Stamp Duty and Registration Charges in West Bengal – The West Bengal state government has recently extended the rebate on stamp duty and circular rates, now valid until March 2025, to keep the momentum alive in the state’s real estate sector. This decision has been welcomed by home buyers and real estate developers alike. The continued rebate on stamp duty is considered a boon for residents of the city, especially during the festive season. Below, find detailed information about the Stamp Duty and Registration Charges in West Bengal, covering key highlights, features, and benefits, area-wise stamp duty rates, charges for different property documents, and more.

Stamp Duty and Registration Charges in West Bengal 2025

When purchasing property in West Bengal, it is essential to be aware of the state’s registration fees and stamp duty. The responsibility of paying these charges falls on the buyer. To facilitate the process, the West Bengal administration has enabled online payment of registration and stamp duty fees. With the current discounts on stamp duty, buying a property has become more affordable for prospective homeowners, significantly reducing their overall expenses since stamp duty constitutes a large portion of property acquisition costs.

Key Highlights of WB Stamp Duty and Registration Charges

| Name | Stamp Duty and Registration Charges |

| Introduced by | West Bengal State Government |

| State | West Bengal |

| Official Website | wbregistration.gov.in |

Features and Advantages of Stamp Duty in West Bengal

Here are some important features and benefits of stamp duty in West Bengal:

- Stamp duty is applicable at varying rates based on the type of property transfer.

- Stamp duty rates are lower for properties located in rural areas compared to urban areas.

- For properties valued at up to 1 crore rupees, the stamp duty rate is lower than for those valued above this amount.

- West Bengal does not offer gender-based discounts for property ownership.

- In rural areas, stamp duty and registration charges are 3% for properties valued at 1 crore rupees.

- In urban areas, these charges rise to 4% for equivalent property values.

- For properties valued at 2 crore rupees, the stamp fee is 4% in rural areas and 5% in urban locations.

Banglarbhumi West Bengal Land Record

Stamp Duty and Registration Charges in West Bengal

The stamp duty and registration charges for different property transactions in West Bengal are outlined in the following table:

| Property Location | Stamp Duty for Properties Over 25 Lakhs | Stamp Duty for Properties 25 Lakhs and Below | Registration Fee |

| Municipal Corporation Area | 7% | 6% | 1% |

| Corporation Areas (Kolkata/Howrah) | 7% | 6% | 1% |

| Other Areas | 6% | 5% | 1% |

Area-wise Stamp Duty and Registration Charges in West Bengal

Here’s a breakdown of area-wise stamp duty and registration charges:

| Property Area | Value Over 40 Lakhs | Value Under 25 Lakhs | Charges for Females | Registration Rates |

| Kolkata | 5% | 4% | Same | 1% |

| Durgapur | 5% | 4% | Same | 1% |

| Howrah | 5% | 4% | Same | 1% |

| Siliguri | 5% | 4% | Same | 1% |

| Kharagpur | 5% | 4% | Same | 1% |

West Bengal Lakshmi Bhandar Scheme

Stamp Duty and Registration Charges on Various Property Deeds

The following table details stamp duty and registration fees for different types of property deeds in West Bengal:

| Property Document | Stamp Duty | Registration Fee |

| Transfer of lease for family members | 0.5% of market value | Same as transfer deed |

| Transfer of lease property in other cases | Same as transfer deed based on market value | Same as transfer deed |

| Gift deed (not family members) | Same as transfer deed based on market value | Same as transfer deed |

| Gift deed to family members | 0.5% of market value | Same as transfer deed |

| Power of attorney for properties between 60 Lakhs & 1 Crore | 10,000 Rupees | Nil |

| Power of attorney for properties below 30 Lakhs | 5,000 Rupees | Nil |

| Power of attorney for properties between 30 Lakhs & 60 Lakhs | 7,000 Rupees | Nil |

| Power of attorney for properties above 3 Crore | 75,000 Rupees | Nil |

| Power of attorney for properties between 1 & 1.5 Crores | 20,000 Rupees | Nil |

| Power of attorney for properties between 1.5 & 3 Crores | 40,000 Rupees | Nil |

| Sale agreement (60 Lakhs to 1 Crore) | 10,000 Rupees | 7 Rupees |

| Sale agreement (less than 30 Lakhs) | 5,000 Rupees | 7 Rupees |

| Sale agreement (30 Lakhs to 60 Lakhs) | 7,000 Rupees | 7 Rupees |

| Sale agreement (over 3 Crore) | 75,000 Rupees | 7 Rupees |

| Sale agreement (between 1 & 1.5 Crores) | 20,000 Rupees | 7 Rupees |

| Sale agreement (between 1.5 & 3 Crores) | 40,000 Rupees | 7 Rupees |

| Partnership deed (up to 50,000 Rupees) | 100 Rupees | 7 Rupees |

| Partnership deed (up to 500 Rupees) | 20 Rupees | 7 Rupees |

| Partnership deed (over 50,000 Rupees) | 150 Rupees | 7 Rupees |

| Partnership deed (up to 10,000 Rupees) | 50 Rupees | 7 Rupees |

How to Calculate Stamp Duty and Registration Fees in West Bengal

To calculate stamp duty and registration charges in West Bengal, follow these steps:

- Open the official website of the Directorate of Registration and Stamp Revenue, West Bengal at https://wbregistration.gov.in/

- The homepage will appear on your screen.

- Navigate to the E-services tab and select the MV, SD & RF Calculator.

- A dialog box with several options will appear.

- Choose the Stamp Duty and Registration Fee option.

- The Stamp Duty and Registration Fee Calculator will open.

- Enter required details like:

- Transaction Major

- Transaction Minor

- Local Body

- Market Value

- Complete the captcha verification.

- Finally, click on the Display button to see the calculated stamp duty and registration charges.

How to Pay Stamp Duty and Registration Charges in West Bengal

To pay stamp duty and registration charges in West Bengal, follow these steps:

- Visit the official website of the Directorate of Registration and Stamp Revenue, West Bengal at https://wbregistration.gov.in/.

- The homepage will be displayed.

- Go to the E-services tab and click on the E-payment and Refund option.

- A dialog box with options will appear.

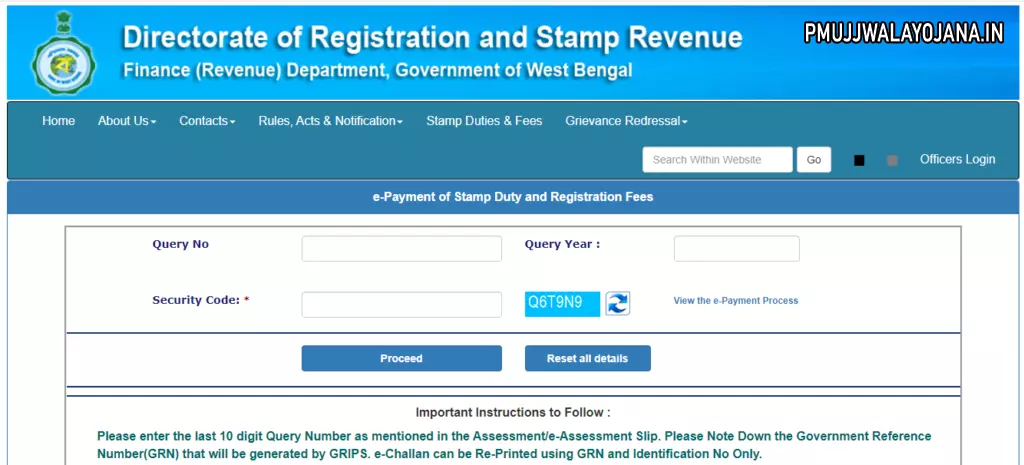

- Select the e-Payment of Stamp Duty & Registration Fees option.

- A new page will load on the screen.

- Input the Query No and Query Year.

- Fill in the captcha and click on the proceed button.

- A new page will open.

- Enter all required details including name, bank account number, bank name, branch name, phone number, type of bank account, IFS code, and MICR code.

- Click on Proceed for ePayment.

- A new page with payment details and total amount will appear.

- Click the confirm and proceed button to complete your online payment.

- A success message will confirm your payment.

- Finally, click the download button to save your receipt or challan for future reference.

How to Claim a Refund for Paid Stamp Duty and Registration Charges

To apply for a refund of paid stamp duty and registration charges, follow these steps:

- Go to the official website of the Directorate of Registration and Stamp Revenue, West Bengal at https://wbregistration.gov.in/.

- Click on the E-services tab and choose the E-payment and Refund option.

- A dialog box will pop up with options.

- Choose Application for Refund of e-payment.

- A new page will display.

- Input your query number, query year, and GRN number.

- Click on the Show Payment button to initiate the refund process.

<liThe homepage will load.

.