Pradhan Mantri Fasal Bima Yojana List किसान भाईयों के लिए एक बहुत अच्छी योजना है। इस योजना का मुख्य उद्देश्य है किसानों को बीमा कवर देना। यानी जब उनकी फसल खराब हो जाती है, तो सरकार उन्हें पैसे देती है। इससे किसान को काफी मदद मिलती है।

सरकार ने प्रधानमंत्री फसल बीमा योजना को पहले की दो योजनाओं की जगह शुरू किया है। ये दो योजनाएं थीं – नेशनल एग्री इंश्योरेंस स्कीम और मॉडिफाई एग्री इंश्योरेंस स्कीम। इन योजनाओं में कई कमियां थीं। पुरानी योजनाओं में सबसे बड़ी समस्या थी उनकी लंबी दावा प्रक्रिया। इसका मतलब है कि जब फसल खराब होती थी, तो किसानों को पैसे पाने में बहुत समय लगता था। इस वजह से उन्हें बहुत दिक्कतों का सामना करना पड़ता था।

इसीलिए प्रधानमंत्री फसल बीमा योजना को शुरू किया गया। यह योजना किसानों के लिए आसान और फायदेमंद है। अगर आप भी एक किसान हैं और इस फसल बीमा योजना का लाभ उठाना चाहते हैं, तो आपको यह लेख ध्यान से पढ़ना चाहिए।

PM Fasal Bima Yojana 2024

देश प्रधानमंत्री नरेंद्र मोदी जी के द्वारा किसानों के हित के लिए प्रधानमंत्री फसल बीमा योजना का शुभारंभ किया गया है। इस योजना का शुभारंभ 13 मई 2016 को मध्यप्रदेश के सेहोर किया गया था। PMFBY के अंतर्गत यदि किसी किसानों की फसल खराब हो जाती है तो ऐसी स्थिति में किसानों को बीमा कवर देने का प्रावधान किया गया है। प्रत्येक किसान की आर्थिक स्थिति को ध्यान में रखते हुए प्रीमियम राशि को काफी कम रखा गया है। केंद्र सरकार द्वारा इस योजना की शुरुआत से लेकर अब तक 36 करोड़ किसानों को बीमा कवर प्रदान किया जा चुका है।

अभी तक इस Pradhan Mantri Fasal Bima Yojana के द्वारा किसानों को 1.8 लाख करोड़ रूपए की बीमा क्लेम राशि प्रदान की जा चुकी है। इस योजना का लक्ष्य अधिक से अधिक किसानों को लाभ पहुंचाना है। ताकि प्राकृतिक आपदा के कारण हुए नुकसान की भरपाई की जा सके। जल्द ही सरकार द्वारा किसानों को फसल बीमा पॉलिसी देने के लिए घर-घर मित्रा अभियान शुरू किया जाएगा ताकि बिना किसी परेशानी के ज्यादा से ज्यादा किसानों को इस योजना का लाभ मिल सके।

प्रधानमंत्री कृषि सिंचाई योजना

Latest Update:-बर्बाद फसल पर मिलेगा मुआवजा 31 जुलाई से पहले कर लें आवेदन

मानसून के चलते कई राज्यों में बारिश का सिलसिला जारी है। अधिक बारिश के कारण कृषि प्रधान राज्य पंजाब और हरियाणा को भारी जलजमाव की स्थिति का सामना करना पड़ रहा है। ऐसे में किसानों के लिए प्रधानमंत्री फसल बीमा योजना एक बेहद ही अच्छा ऑप्शन है। प्रधानमंत्री फसल बीमा योजना के तहत किसान को फसल के साथ व्यक्तिगत नुकसान भी हुआ है तो उसे इस योजना का लाभ मिलेगा। प्राकृतिक आपदाओं के चलते किसानों की फसल बर्बाद होने पर ही बीमा कंपनियों द्वारा भरपाई की जाती है। इस दौर में जलवायु संकट में किसान फसलों का बीमा जरूर करा लें। इस योजना के माध्यम से फसल खराब होने की स्थिति में किसान मुआवजे का हकदार बन जाएगा। सरकार द्वारा खरीफ फसलों का बीमा के लिए आवेदन मांगे गए है। किसान प्रधानमंत्री फसल बीमा योजना के तहत 31 जुलाई तक पोर्टल पर जाकर अपनी फसल का बीमा करा सकते हैंं। और इसका लाभ प्राप्त कर सकते हैंं। इसके अलावा किसान जनसेवा पर भी जाकर आवेदन कर सकते हैंं।

Summary Pradhan Mantri Fasal Bima Yojana List

| योजना का नाम | Pradhan Mantri Fasal Bima Yojana |

| शुरू की गई | प्रधानमंत्री नरेंद्र मोदी द्वारा |

| योजना की शुरुआत | 13 मई 2016 को |

| मंत्रालय | कृषि एवं किसान कल्याण मंत्रालय |

| लाभार्थी | देश के किसान |

| उद्देश्य | किसानों को फसल संबंधित नुकसान की भरपाई करना |

| अधिकतम क्लेम राशि | 2 लाख रूपए |

| आवेदन करने की प्रक्रिया | ऑनलाइन/ऑफलाइन |

| अधिकारिक वेबसाइट | https://pmfby.gov.in |

Pradhan Mantri Fasal Bima Yojana का उद्देश्य

प्रधानमंत्री नरेंद्र मोदी द्वारा प्रधानमंत्री फसल बीमा योजना को शुरू करने का मुख्य उद्देश्य प्राकृतिक आपदा से हुए फसल नुकसान पर पीड़ित किसानों को वित्तीय सहायता प्रदान करना है ताकि किसानों को नवीन और आधुनिक कृषि पद्धति को अपनाने के लिए प्रोत्साहित किया जा सके और किसानों की आय को स्थिर और उनकी खेती में निरंतरता सुनिश्चित हो सके। इस योजना के तहत सरकार द्वारा किसानों को फसलों के नुकसान पर अलग-अलग धनराशि प्रदान की जाती है। देश के किसान इस योजना के तहत आवेदन कर लाभ प्राप्त कर सकते हैंं।

प्रधानमंत्री किसान संपदा योजना

72 घंटे पहले देनी होती है जानकारी

प्रधानमंत्री फसल बीमा योजना के तहत प्राकृतिक आपदा से फसल नुकसान होने पर किसानों की जिम्मेदारी है कि वह कृषि विभाग को 72 घंटे के अंदर फसल खराब होने की जानकारी से सूचित करें। इसके अलावा किसान को एक लिखित शिकायत जिला प्रशासन एग्रीकल्चर डिपार्टमेंट में देनी होती है। और अपनी फसल नुकसान का पूरा ब्यौरा लिख कर देना होता है। शिकायत मिलते ही जिला प्रशासन एग्रीकल्चर डिपार्टमेंट द्वारा कार्यवाही की जाएगी। इसके लिए सूचना बीमा कंपनी को तुरंत जानकारी दी जाती है। जिसके बाद बीमा कंपनी द्वारा सूचना मिलने पर किसान को बीमा कवर दिलाने की कार्यवाही शुरू हो होती है।

PM Fasal Bima Yojana के अंतर्गत मिलने वाली क्लेम राशि

प्रधानमंत्री फसल बीमा योजना का लाभ प्राप्त करने के लिए किसानों को नुकसान का क्लेम करना पड़ता है। प्राकृतिक आपदा से फसल नुकसान होने पर या दूसरा फसल कम होने पर किसान बीमा का क्लेम कर सकता है। फसलों के लिए प्रधानमंत्री फसल बीमा योजना के तहत अलग-अलग धनराशि तय की गई है। कपास की फसल के लिए 36,282 रुपए अधिकतम प्रति एकड़ के हिसाब से क्लेम राशि दी जाती है। धान की फसल के लिए 37,484 रुपए, बाजरा की फसल के लिए 17,639 रुपए इसके अलावा मक्का की फसल के लिए 18,742 रुपए और मूंग की फसल के लिए 16,497 रुपए की बीमा क्लेम राशि प्रदान की जाती है। यह क्लेम राशि सर्वे में फसल क्षति की पुष्टि होने के बाद किसानों के बैंक खाते में भेज दी जाती है।

प्रधानमंत्री फसल बीमा योजना के मुख्य बिंदु

- Pradhan Mantri Fasal Bima Yojana के तहत प्राकृतिक आपदा के कारण फसलों का नुकसान होने पर किसानों को बीमा कवर राशि दी जाती है।

- इस योजना के अंतर्गत किसानों से रबी की फसल के लिए 1.5%, खरीफ की फसल के लिए 2% और वाणिज्यिक एवं बागवानी फसलों के लिए 5% प्रीमियम लिया जाता है।

- किसानों द्वारा स्वयं से फसल बीमा करवाने पर बहुत कम प्रीमियम लिया जाता है।

- अधिकतम सरकार द्वारा प्रीमियम भरा जाता है ताकि कोई भी किसान बीमा कवर प्राप्त करने से वंचित ना रहे जाए और जिससे आपदा में हुए नुकसान की भरपाई आसानी से हो सके।

- फसल काटने के बाद यदि 14 दिन तक फसल खेत में है और उस दौरान को याद आ जाती है तो ऐसी स्थिति में किसान को दावा राशि प्राप्त हो सकेगी।

- PMFBY में टेक्नोलॉजी का भरपूर उपयोग किया जाता है ताकि सेटल करने के समय कम उपयोग किया जा सके।

- एग्रीकल्चर इंडिया इंश्योरेंस कंपनी द्वारा प्रधानमंत्री फसल बीमा योजना को नियंत्रित किया जाता है।

- इस योजना के तहत बजट 2016-17 में किसानों को 5550 करोड़ रुपए का आवंटन किया गया था।

- इस योजना की शुरुआत से अब तक 36 करोड़ किसानों का बीमा किया जा चुका है।

PM Fasal Bima Yojana में कौन–कौन सी फसलें शामिल की गई है।

- खाद्य फसलें (अनाज-धान, गेहूं, बाजरा इत्यादि)

- वार्षिक वाणिज्यिक (कपास, जूट, गन्ना इत्यादि)

- दलहन (अरहर, चना, मटर और मसूर सोयाबीन, मूंग, उरद और लोबिया इत्यादि)

- तिलहन (तिल, सरसों, अरंडी, बिनौला, मूँगफली, सोयाबीन, सूरजमुखी, तोरिया, कुसम, अलसी, नाइजरसीड्स इत्यादि)

- बागवानी फसलें (केला, अंगूर, आलू, प्याज, कसावा, इलायची, अदरक, हल्दी सेब, आम, संतरा, अमरूद, लीची, पपीता, अनन्नास, चीकू, टमाटर, मटर, फूलगोभी)

प्रधानमंत्री फसल बीमा योजना हेतु ऑनलाइन रजिस्ट्रेशन कैसे करें?

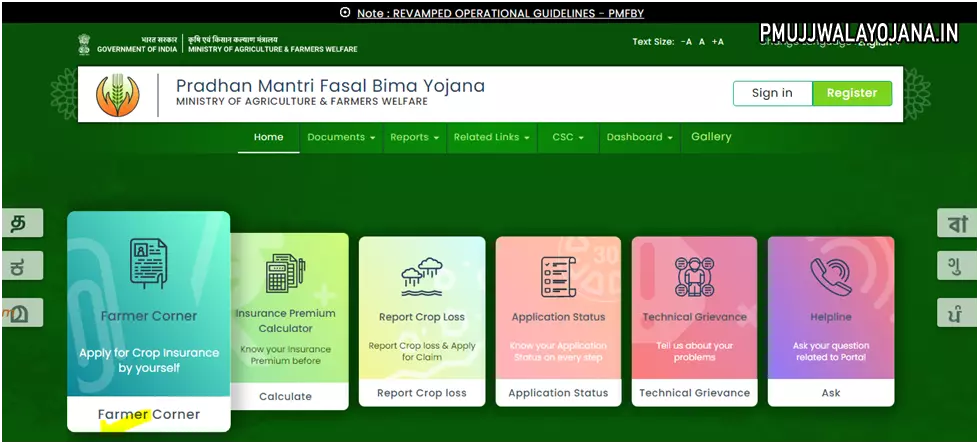

- सबसे पहले आपको Pradhan Mantri Fasal Bima Yojana की आधिकारिक वेबसाइट पर जाना होगा।

- इसके बाद आपके सामने वेबसाइट का होम पेज खुल जाएगा।

- होम पेज पर आपको Farmer Corner Apply for Crop Insurance yourself के ऑप्शन पर क्लिक करना होगा।

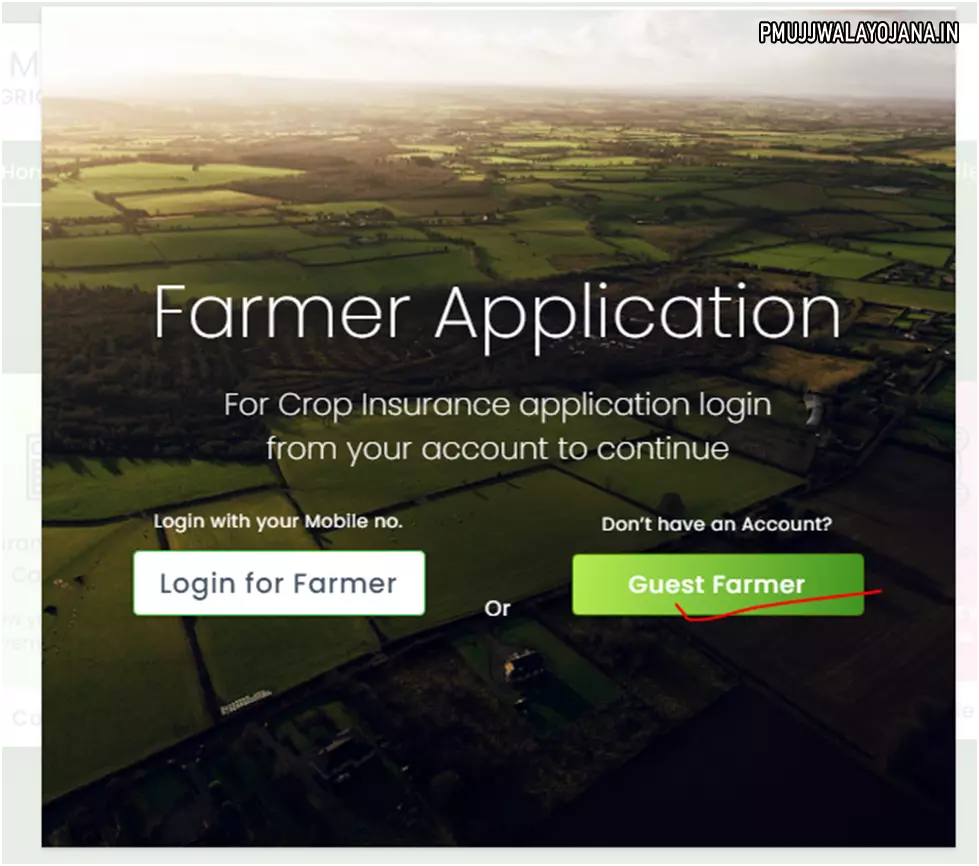

- इसके बाद आपके सामने Farmer Application पेज खुल जाएगा।

- जिस पर आपको Guest Farmer के ऑप्शन पर क्लिक करना होगा।

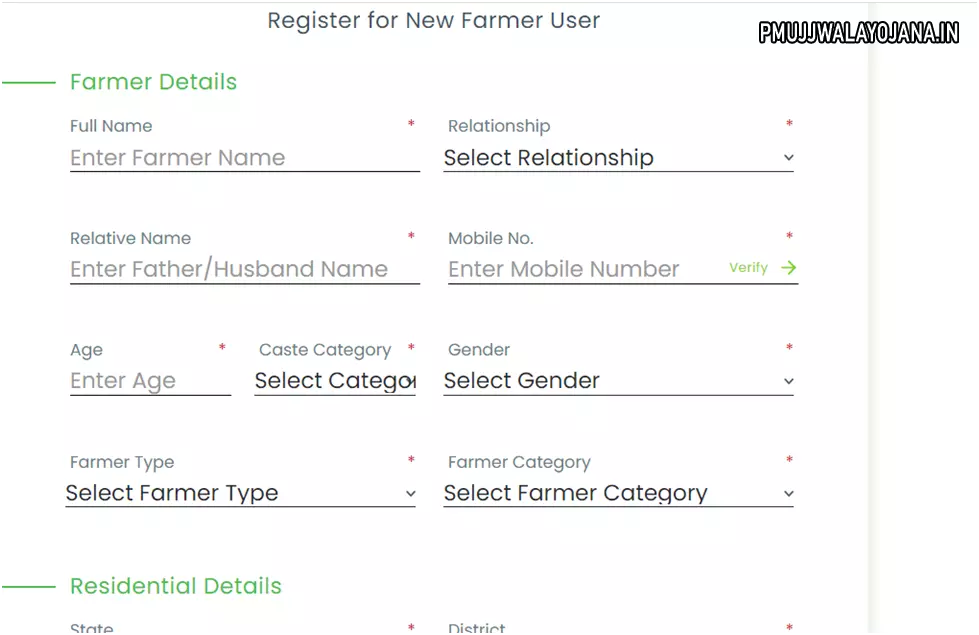

- क्लिक करते ही आपके सामने रजिस्ट्रेशन फॉर्म खुल जाएगा।

- अब आपको इस फॉर्म में मांगी गई सभी आवश्यक जानकारी को ध्यानपूर्वक दर्ज करना होगा। जैसे-

- Farmer Details,

- Residential Details,

- Farmer ID,

- Account Details

- सभी जानकारी दर्ज करने के बाद आपको नीचे दिया गया कैप्चा कोड दर्ज करना होगा।

- इसके बाद आपको Submit के ऑप्शन पर क्लिक करना होगा।

- इस प्रकार आपके आवेदन करने की प्रक्रिया पूरी हो जाएगी।

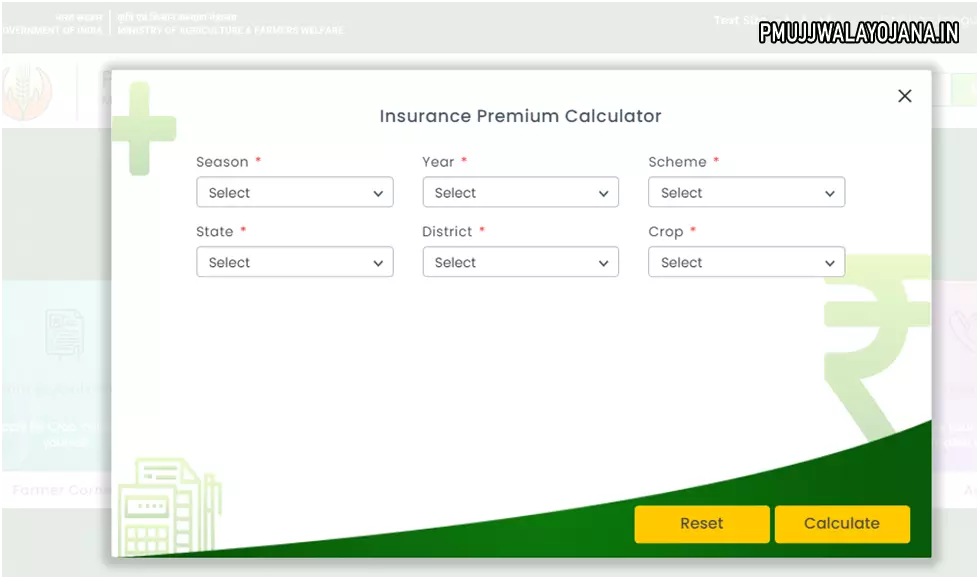

PMFBY में फसल की बीमा राशि और प्रीमियम कैसे जाने?

- सबसे पहले आपको प्रधानमंत्री फसल बीमा योजना की आधिकारिक वेबसाइट पर जाना होगा।

- उसके बाद आपके सामने वेबसाइट कम होम पेज खुल जाएगा।

- होम पेज पर आपको Insurance Premium Calculator के ऑप्शन पर क्लिक करना होगा।

- क्लिक करते ही आपके सामने नया पेज खुल जाएगा।

- इस पेज पर आपको प्रीमियम कैलकुलेट की सभी जानकारी को दर्ज करना होगा।

- जैसे फसल का सीजन (रबी/खरीफ), वर्ष, स्कीम का नाम, अपने राज्य का नाम, जिला और फसल आदि का चयन करना होगा।

- इसके बाद आपको अपने खेत का क्षेत्रफल हेक्टेयर में दर्ज करना होगा।

- सभी जानकारी दर्ज करने के बाद आपको Calculate के ऑप्शन पर क्लिक करना होगा।

- जैसे ही आप क्लिक करेंगे आपके सामने आपकी फसल बीमा राशि और उसके प्रीमियम की जानकारी आ जाएगी।

- इस प्रकार आप आसानी से प्रधानमंत्री फसल बीमा योजना में फसल की बीमा राशि प्रीमियम आसानी से चेक कर सकते हैंं।

प्रधानमंत्री फसल बीमा योजना के लिए ऑफलाइन आवेदन करने की प्रक्रिया

अगर कोई किसान स्वयं द्वारा बनाया गया नहीं कर सकते हैंं तो वह ऑफलाइन प्रक्रिया के माध्यम से फसल बीमा के लिए आवेदन कर सकते हैंं। ऑफलाइन आवेदन करने की प्रक्रिया नीचे दी गई है जिसे अपनाकर आप आसानी से ऑफलाइन आवेदन कर सकते हैंं।

- ऑफलाइन आवेदन करने के लिए सबसे पहले आपको अपने नजदीकी बैंक जाना होगा।

- वहां जाकर आपको प्रधानमंत्री फसल बीमा योजना के लिए आवेदन फॉर्म प्राप्त करना होगा।

- इसके बाद आपका आवेदन फॉर्म में पूछी गई सभी आवश्यक जानकारी को ध्यान पूर्वक दर्ज करना होगा।

- सभी जानकारी दर्ज करने के बाद आपको फॉर्म में मांगे गए जरूरी दस्तावेजों को संलग्न करना होगा।

- इसके बाद आपको यह आवेदन फॉर्म वापस बैंक में ही जमा कर देना होगा।

- आवेदन फॉर्म जमा करने के बाद आपको आवेदन की पर्ची दी जाएगी जिसे आपको अपने पास भविष्य के लिए सुरक्षित रखनी होगी।

- इस प्रकार आपकी ऑफलाइन आवेदन करने की प्रक्रिया पूरी हो जाएगी।

- इसके अलावा आप चाहे तो अपने नजदीकी जन सेवा केंद्र पर जाकर या बीमा कंपनी मैं भी ऑफलाइन फसल बीमा के लिए आवेदन कर सकते हैंं।

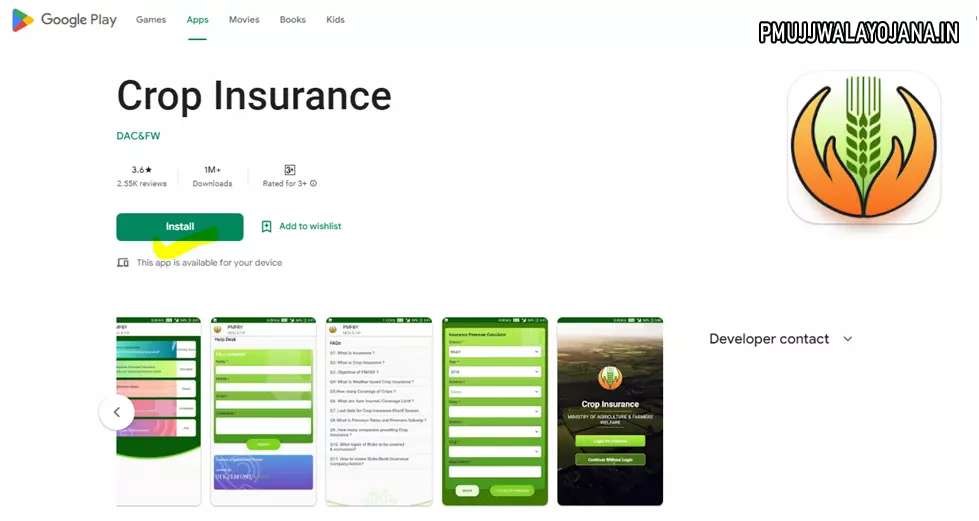

PM Fasal Bima Yojana मोबाइल ऐप कैसे डाउनलोड करें?

प्रधानमंत्री फसल बीमा योजना के संचालन के लिए केंद्र सरकार द्वारा Crop Insurance के नाम से मोबाइल ऐप को लांच किया गया है। इस ऐप के माध्यम से किसान आसानी से रजिस्ट्रेशन, फसल बीमा प्रीमियम राशि की जानकारी, फसल के नुकसान का क्लेम आदि सभी प्रकार की सेवाएं प्राप्त कर सकते हैंं। Crop Insurance App को डाउनलोड करने की प्रक्रिया निम्न प्रकार है।

- सबसे पहले आपको अपने मोबाइल फोन के प्ले स्टोर पर जाना होगा।

- इसके बाद आपको सर्च बॉक्स में Crop Insurance लिखकर सर्च करना होगा।

- इसके बाद आपके सामने काफी सारे सर्च रिजल्ट आ जाएगी आपको यहां पर आधिकारिक ऐप का चयन करना होगा।

- अब आपको Install के ऑप्शन पर क्लिक करना होगा।

- क्लिक करते ही कुछ समय बाद आपके मोबाइल पर ऐप डाउनलोड हो जाएगा।

- ऐप डाउनलोड होने के बाद आप फसल बीमा संबंधित सभी प्रकार की जानकारी आसानी से प्राप्त कर सकेंगे।