Link PAN with Aadhaar Online – Today, both Aadhaar card and PAN card are very important documents. You need them to get benefits from government schemes and for almost all banking and financial services. To make things easier and prevent fraud, the government has made it compulsory to link your PAN card with your Aadhaar card. The Supreme Court has set the last date to link PAN with Aadhaar as June 30, 2024. If you don’t link your PAN and Aadhaar by then, your PAN card will become inactive. So if you haven’t linked them yet, do it as soon as you can. This article will help you understand how to link your PAN with Aadhaar online, check your link status, and know the benefits and penalties. Please read ahead for all the details.

Check PAN Aadhaar Link Status in 2025

The Central Finance Minister of State has said that out of 61 crore PAN cards in India, around 48 crore are still not linked with Aadhaar. The last date to link PAN with Aadhaar is June 30, 2024. If you don’t complete this before the deadline, your PAN card will be inactivated. This means you won’t be able to open mutual funds, stock accounts, or bank accounts that need PAN card verification.

Linking your PAN with Aadhaar is simple and you can do it from home using your phone or computer. If you’re not sure whether your PAN is linked to Aadhaar or not, you can easily check the status online.

How to Find Your PAN Card Number

About Linking PAN and Aadhaar in 2025

| Article Name | How to Link PAN with Aadhaar |

| Announced By | Supreme Court of India |

| Who Should Link | PAN Card Holders |

| Purpose | To link PAN card with Aadhaar card |

| Year | 2025 |

| Mode | Online |

| Official Website | https://ssup.uidai.gov.in/ |

Last Date to Link PAN and Aadhaar

If you have a PAN card, you should link it with your Aadhaar card by June 30, 2024, as per government rules. If you don’t link before this date, your PAN card will be cancelled. Without a valid PAN card, you cannot complete financial transactions, and you may also have to pay a penalty under Income Tax Section 272B. So, it’s important to link your PAN with Aadhaar as soon as possible.

Penalty for Using Deactivated PAN Card

If you use your PAN card after it’s been deactivated because you didn’t link it with Aadhaar, you may have to pay a fine. The government says anyone using a deactivated PAN card may face a penalty of Rs. 10,000 under Section 272B of the Income Tax Act. To avoid this, the tax department allows a late fee of Rs. 1,000 to link your Aadhaar with PAN after the deadline. But it’s best to link them before the due date to avoid any penalty.

Benefits of Linking PAN with Aadhaar

- It’s now required to link all PAN cards with Aadhaar cards to prevent misuse.

- Linking helps fix problems caused by multiple PAN cards issued in one name.

- You can’t file Income Tax Return without linking your PAN with Aadhaar.

- It helps you get clearer information about the taxes you pay.

- PAN-Aadhaar link reduces tax fraud and helps the government fund development projects.

- It stops people from cheating the government and evading taxes.

- Linking makes it hard to hide income from tax authorities.

- If someone has multiple PAN cards, the government can act against tax evasion.

- The government can track total income and financial activities across regions to improve planning and services.

Importance of PAN Card

- When depositing Rs. 50,000 or more in bank accounts, a PAN card is required.

- Applying for debit or credit cards needs a PAN card.

- Buying or selling property worth up to Rs. 5 lakh requires PAN card documents.

- Deposits over Rs. 50,000 in post offices need PAN card details.

- PAN card may be used while paying bills in hotels or restaurants.

- Buying or selling shares worth Rs. 50,000 or more requires a PAN card.

- PAN card is important for making higher premium payments in life insurance.

How to get a Duplicate PAN Card

How to Link PAN and Aadhaar Using SMS

- Open the SMS app on your mobile phone.

- Type a new message in this format: UIDPAN [space] Aadhaar number [space] PAN number.

- Send the message to 567676 or 56161.

- Your request will be sent to the Unique Identification Authority of India (UIDAI) and your PAN will be linked with Aadhaar.

Steps to Link PAN with Aadhaar Online

- Go to the official Income Tax e-filing website.

- On the homepage, click on the “Link Aadhaar” option.

- A form will appear asking for details like PAN number, Aadhaar number, and the name on your Aadhaar card.

- Agree to the terms by clicking the checkbox to allow UIDAI to verify your info.

- Enter the captcha code shown.

- Click “Link Aadhaar” to submit the form.

- If successful, you’ll get a message confirming your PAN is linked with Aadhaar.

- If your PAN is already linked, it will show that status.

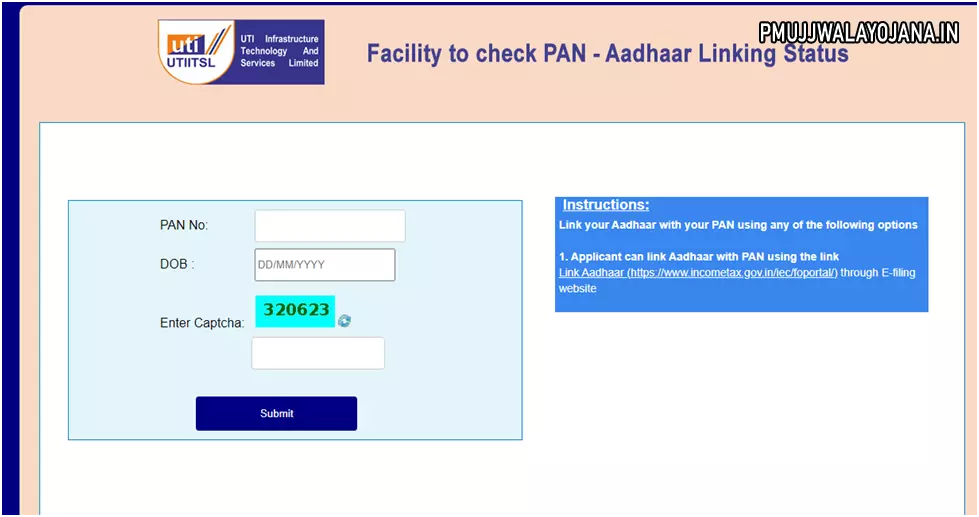

How to Check PAN Aadhaar Link Status Online

- Go to the official UTI website here: UTI PAN Aadhaar Link Status.

- Click on “PAN Aadhaar Linking Status” on the homepage.

- A new page will ask for details.

- Fill in your PAN number, date of birth, and the captcha code.

- Click “Submit.”

- Your PAN Aadhaar link status will be shown on the screen.

By following these steps, you can easily link your PAN card to your Aadhaar card and avoid any problems with financial transactions or tax filing. Make sure you complete the linking soon to follow the government’s rules.