PAN Card Number – किसी भी तरह का अकाउंट खुलवाने के लिए पैन कार्ड नंबर देना आवश्यक होता है। फिर चाहे आपको बैंक अकाउंट खुलवाना हो या डिमैट अकाउंट या ट्रेडिंग अकाउंट। इसके अलावा महंगी प्रॉपर्टी खरीदने और महंगी ज्वैलरी के लिए भी पैन कार्ड डिटेल्स देनी होती है। बिना पैन कार्ड के ऐप कोई भी लेनदेन नहीं कर सकते और ना ही अपना इनकम टैक्स रिटर्न भर सकते हैंं। लेकिन अगर आप अपना पैन कार्ड नंबर भूल गए हैं या आपने अपना पैन कार्ड कहीं खो दिया है। तो आपको परेशान होने की जरूरत नहीं है। आप हमारे इस आर्टिकल के माध्यम से अपना पैन कार्ड नंबर पता कर सकते हैंं। आज हम आपको इस आर्टिकल के माध्यम से पैन कार्ड नंबर कैसे पता करें से संबंधित जानकारी उपलब्ध कराएंगे। इसलिए आपको यह आर्टिकल विस्तारपूर्वक अंत तक पढ़ना होगा।

How to Know PAN Card Number Details

PAN कार्ड एक महत्वपूर्ण दस्तावेज होता है। जो आपको एक विशिष्ट पहचान संख्या के रूप में भारत सरकार के आयकर विभाग द्वारा जारी किया जाता है। किसी भी प्रकार के लेनदेन के लिए आपके पास पैन कार्ड होना अनिवार्य है। PAN Card के माध्यम से आप वित्तीय लेनदेन और विभिन्न प्रकार की सरकारी सुविधाओं का लाभ उठा सकते हैंं। इसके अलावा पैन कार्ड के माध्यम से आप किसी भी बैंक में जाकर आसानी से लोन के लिए आवेदन कर सकते हैंं। बैंक अकाउंट खुलवाने से लेकर 50,000 रुपए से अधिक लेन-देन पर आपको पैन कार्ड से संबंधित जानकारी देनी आवश्यक होती है।

पैन कार्ड नंबर डिटेल्स हेल्पलाइन नंबर से जाने

आयकर विभाग की टोल फ्री हेल्पलाइन नंबर सेवा 18001801961 से संपर्क करके आप अपने पैन कार्ड नंबर डिटेल्स के बारे में जानकारी पता कर सकते हैंं। हेल्पलाइन नंबर से आप नीचे बताई गई प्रक्रिया के माध्यम से पैन कार्ड नंबर जान सकते हैंं।

- सबसे पहले आपको अपने फोन में टोल फ्री हेल्पलाइन नंबर 18001801961 कोड डायल करना होगा।

- नंबर डायल करने के बाद आपको भाषा के बारे में पूछा जाएगा। आपको अपनी आवश्यकतानुसार भाषा का चयन करना होगा।

- हिंदी के लिए आपको 1 चुनना होगा।

- और अंग्रेजी के लिए 2 चुनना होगा।

- भाषा का चयन करने के बाद आपके सामने बहुत से ऑप्शन आ जाएंगे जैसे पैन कार्ड डिटेल्स, आयकर रिटर्न, कर भुगतान आदि की जानकारी आपको दिखाई देगी।

- आपको पैन कार्ड की जानकारी प्राप्त करने हेतु 1 नंबर को दबाना होगा।

- जैसे ही आप 1 नंबर दबाते हैं आपके पैन कार्ड से संबंधित डिटेल्स आपके मोबाइल पर SMS के माध्यम से आ जाएगी।

- इस प्रकार आप हेल्पलाइन नंबर की सहायता से अपने पैन कार्ड की जानकारी प्राप्त कर सकते हैंं।

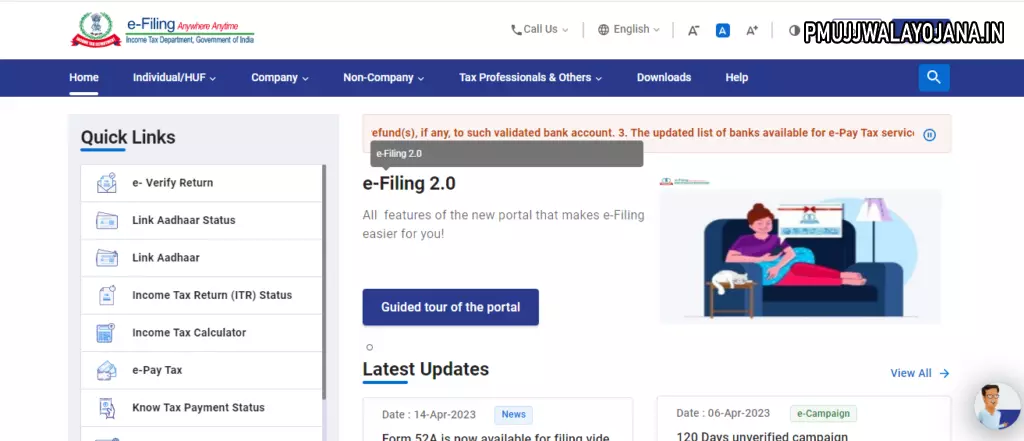

e-Filing पोर्टल से PAN Card Number कैसे पता करें?

यदि आपने अपना पैन कार्ड नंबर आधार कार्ड के साथ लिंक किया है तो आप आसानी से घर बैठे ही अपने पैन कार्ड नंबर को जान सकते हैंं। e-Filing पोर्टल के माध्यम से आप नीचे बताई गई प्रक्रिया को अपनाकर अपने पैन कार्ड नंबर को जान सकते हैंं। जो कि कुछ इस प्रकार है।

- सबसे पहले आपको अपना PAN Card Number पता करने के लिए आयकर विभाग की e-filing वेबसाइटपर जाना होगा।

- वेबसाइट पर जाने के बाद आपके सामने वेबसाइट का होम पेज खुल जाएगा।

- होम पेज पर आपको Quick Links के सेक्शन में Instant E-PAN के ऑप्शन पर क्लिक करना होगा।

- क्लिक करते ही आपके सामने नया पेज खुल जाएगा।

- अब आपको इस पेज पर Check Status/Download PAN के तहत दिए गए Continue के ऑप्शन पर क्लिक करना होगा।

- इसके बाद आपके सामने एक नया पेज खुल जाएगा। इस पेज पर आपको अपना 12 अंको का आधार नंबर दर्ज करना होगा।

- आधार नंबर दर्ज करने के बाद आपको Continue के ऑप्शन पर क्लिक करना होगा।

- जैसे ही आप क्लिक करेंगे आपके आधार लिंक मोबाइल नंबर पर ओटीपी आएगा। जिसे आपको ओटीपी बॉक्स में दर्ज कर वेरीफाई करना होगा।

- ओटीपी वेरीफाई करने के बाद View PAN Card और Download PAN Card का ऑप्शन मिलेगा।

- आप अपनी इच्छा अनुसार अपने पैन कार्ड नंबर को देख भी सकते हैंं और चाहे तो Download के ऑप्शन पर क्लिक करके PAN Card को पीडीएफ फाइल के रूप में डाउनलोड भी कर सकते हैं।

- इस प्रकार आप आसानी से इनकम टैक्स e-Filing पोर्टल के माध्यम से अपना पैन कार्ड नंबर जान सकते हैंं।

Net Banking की सहायता से कैसे पता करें PAN Card Number

अगर आप बैंक की नेट बैंकिंग सेवा का उपयोग करते हैं और आपका पैन कार्ड आपके बैंक अकाउंट से लिंक है तो आप आसानी से अपना पैन कार्ड नंबर पता कर सकते हैंं। हम आपको SBI की नेट बैंकिंग का उदाहरण देकर पैन कार्ड नंबर कैसे पता करें से संबंधित जानकारी उपलब्ध कराएंगे। तो आइए जानते हैं कि नेट बैंकिंग की सहायता से कैसे जाने पैन कार्ड नंबर –

- सबसे पहले आपको जिस भी बैंक में आपका खाता है उस बैंक की आधिकारिक वेबसाइट पर जाना होगा।

- उदाहरण स्वरूप आपको SBI की ऑनलाइन नेट बैंकिंग से संबंधित अधिकारी वेबसाइट पर जाना होगा।

- इसके बाद आपके सामने वेबसाइट का होम पेज खुल जाएगा।

- होम पेज पर आपको Personal Banking के अंतर्गत Login के ऑप्शन पर क्लिक करना होगा।

- क्लिक करते ही आपके सामने लॉगिन फॉर्म खुल जाएगा।

- अब आपको लॉगिन फॉर्म में बैंक द्वारा दी गई यूजर आईडी और पासवर्ड को दर्ज करना होगा।

- इसके बाद आपको कैप्चर कोड दर्ज कर Login के ऑप्शन पर क्लिक करना होगा।

- लॉगिन के ऑप्शन पर क्लिक करते ही आपके मोबाइल नंबर पर एक OTP आएगा। जिसे आपको ओटीपी बॉक्स में दर्ज कर Submit के ऑप्शन पर क्लिक करना होगा।

- OTP वेरीफाई होने के बाद आपको अपने अकाउंट में View Nomination PAN Details का ऑप्शन दिखाई देगा आपको उस पर क्लिक करना होगा।

- क्लिक करते ही आपके सामने आपका पैन कार्ड नंबर आ जाएगा।

- इस प्रकार आप नेट बैंकिंग की सहायता से अपने पैन कार्ड नंबर को पता कर सकते हैंं।

सैलरी स्लिप की सहायता से पैन कार्ड नंबर कैसे पता करें?

यदि आप किसी कंपनी में काम करते हैं तो आपको हर महीने उस कंपनी द्वारा सैलरी स्लिप मिलती होगी। आपकी सैलरी स्लिप में आपका पैन नंबर दर्ज होता है। सामान्यतः बड़ी कंपनियां अपने कर्मचारियों को सैलरी स्लिप ऑनलाइन भी उपलब्ध कराती है। जब कभी भी किसी भी कंपनी में कर्मचारी की नियुक्ति की जाती है तो नियुक्ति के समय उस कर्मचारी से संबंधित सभी जानकारी को प्राप्त किया जाता है। सभी जानकारी के साथ कर्मचारी का पैन नंबर भी मांगा जाता है। आप अपनी सैलरी स्लिप की सहायता से अपना पैन कार्ड नंबर पता कर सकते हैंं।

Form 16 की सहायता से PAN Card Number जाने

अगर आपका TDS कटा है। तो आपको टीडीएस काटने वाले बैंक के संस्था द्वारा एक टीडीएस सर्टिफिकेट दिया गया होगा। जिस पर आपका PAN नंबर भी दर्ज होगा। TDS भरने वाले व्यक्ति को बैंक के द्वारा फॉर्म 16 या फॉर्म 16A के रूप में प्राप्त होता है। आपको बता दें कि सैलरी पर TDS काटे जाने पर Form 16 दिया जाता है। इसके अलावा किसी अन्य प्रकार की आमदनी जैसे ब्याज, किराया, कमीशन आदि काटे जाने पर फॉर्म 16A जारी किया जाता है। यदि आप अपने पैन कार्ड से संबंधित जानकारी प्राप्त करना चाहते हैं तो आप अपने फॉर्म 16 के माध्यम से प्राप्त कर सकते हैंं।

पैन आधार कार्ड से लिंक कैसे करें

Income Tax Return फाइल की सहायता से जाने PAN कार्ड नंबर

यदि आप आयकर दाता है और आपने अपना इनकम टैक्स रिटर्न भरा होगा जिसकी कॉपी आपके पास अवश्य होगी। आपके इस Income Tax Return में आपका पैन कार्ड नंबर दर्ज होता है। इसकी सहायता से आप अपना पैन कार्ड नंबर पता कर सकते हैंं। आपको बता दें कि आयकर विभाग के नियमों के अनुसार जो भी व्यक्ति इनकम टैक्स भरता है उसके पास पैन कार्ड होना अनिवार्य होता है।