Macfos IPO Allotment Status – The Macfos IPO is set to launch on February 17 and will conclude on February 21. The price range for this initial public offering has been established at Rs. 96 to Rs. 102. The final pricing will be influenced by the demand and supply dynamics in the market. Investors can check their Macfos IPO Allotment Status online through the BSE website and the IPO Registrar Bigshare Pvt Ltd. Additionally, they can also log into their bank and Demat accounts for updates. Below, we provide essential details regarding the Macfos IPO Allotment Status, including highlights, timelines, pricing, and steps for checking the allotment status on various platforms.

Macfos IPO Allotment Status 2025

Investors will be informed about the Macfos IPO allotment status on February 24, 2025. Those who did not receive shares will have their applications refunded by February 27, 2025. The IPO showed significant interest from investors, with a total subscription rate of 193.27 times. The allocation for different categories has been set at 35% for retail investors, 15% for Non-Institutional Investors (NII), and 50% for Qualified Institutional Buyers (QIB). However, given the high demand, securing an allocation in Macfos will be quite challenging for many retail investors.

Macfos IPO Allotment Status Details

| Name | Macfos IPO Allotment Status |

| Year | 2025 |

| IPO Opening | Feb 17, 2025 |

| IPO Closing | Feb 21, 2025 |

| IPO allotment status | February 24, 2025 |

| Unsuccessful applications refund | February 27, 2025 |

| IPO Price | Rs. 102 |

| Face Value | Rs. 10 |

Macfos IPO Allotment Schedule

| Bid/Offer Opens On | 17 Feb 2025 |

| Bid/Offer Closes On | 21 Feb 2025 |

| Finalization of Basis of Allotment | 24 Feb 2025 |

| Refund Initiation Date | 27 Feb 2025 |

| Credit of Equity Shares | 28 Feb 2025 |

| Listing Date | 1 Mar 2025 |

IPO Pricing Band for Macfos

The price range for the Macfos IPO is set between Rs. 96 and Rs. 102. This pricing will be influenced by the demand at the time of the public offering. The upper end of the price band is Rs. 102, equating to a face value of Rs. 10 per share. This IPO will be listed on the Bombay Stock Exchange. For further information, you can explore the company’s prospectus, which includes crucial data and financial insights.

IPO Lot Size for Macfos

The minimum lot size for the Macfos IPO is 1200 shares. It’s essential to understand that to apply for the IPO, investors must apply for at least one lot size, which consists of 1200 shares. Shares will not be allotted in any fractional amount, as allocations are strictly based on these lot sizes.

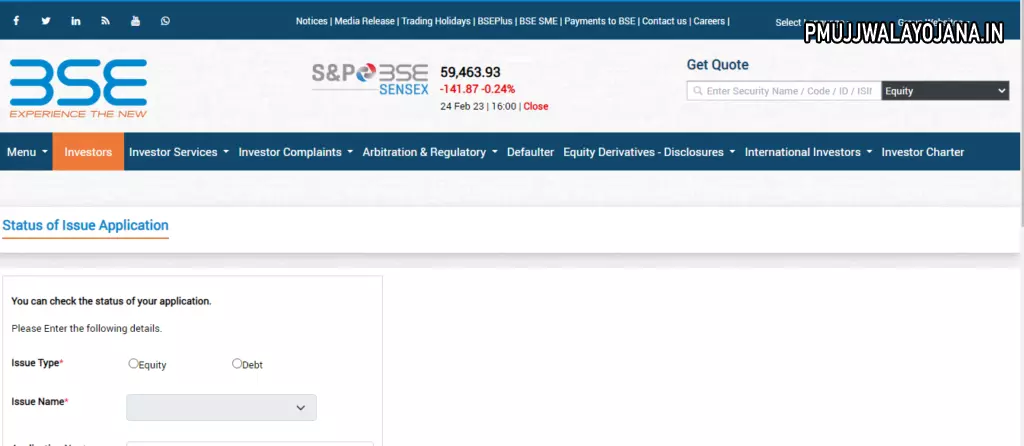

How to Check Macfos IPO Allotment Status on BSE

To check your allotment status on the BSE, please follow these steps:

- Visit the official BSE website.

- Once on the homepage, look for the option labeled “Status of Issue Application”.

- Fill in the requested details:

- Select “Equity” as the Issue Type.

- Choose “Macfos” as the Issue Name.

- Enter your Application Number or PAN card number.

- Fill in the captcha code and click the “Search” button.

How to Check Macfos IPO Allotment Status on Bigshare Pvt Ltd

For checking your allotment status on Bigshare Pvt Ltd, follow these steps:

- Go to the Bigshare Pvt Ltd official website: https://www.bigshareonline.com/ipo_Allotment.html

- On the homepage, choose “Macfos” as the IPO Name.

- Select the Type as either PAN Number, Application Number, or Beneficiary ID.

- Enter the required number and then click the “Search” button.

Current Update of Macfos IPO Allotment Subscription Status

| Category | Day 1 | Day 2 | Day 3 |

| QIB: | 0.01x | 2.60x | 21.60x |

| RII: | 18.52x | 93.42x | 268.45x |

| NII: | 5.94x | 55.49x | 659.99x |

| EMP: | 0.0x | 0.0x | 0.0x |

| Total: | 7.02x | 40.26x | 193.27x |