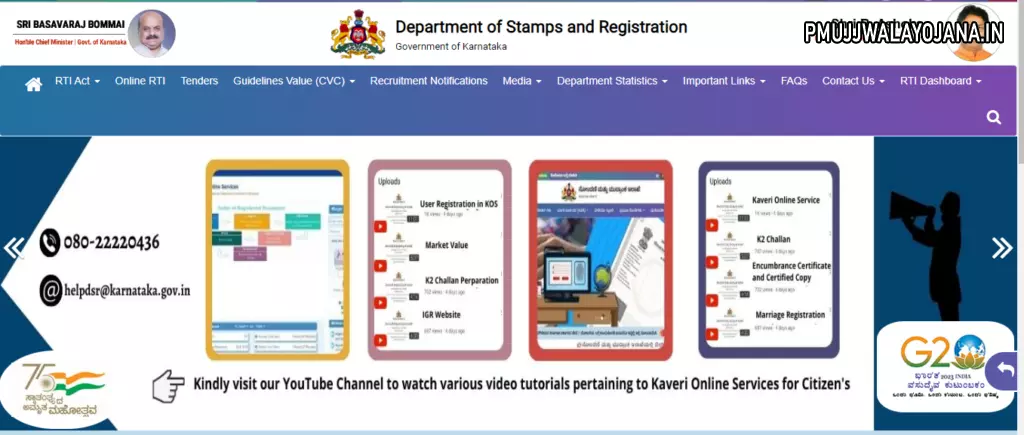

IGR Karnataka is the state authority responsible for property registration and collecting stamp duty and registration fees for property transactions. It operates under the Revenue Minister of Karnataka. You can use services like property registration, stamp duty payment, and checking market value on the Kaveri Online Services Portal. This article covers all you need to know about IGR Karnataka, including registration fees, stamp duty, required documents, and step-by-step instructions for using the IGR Karnataka portal.

About IGR Karnataka 2025

IGR Karnataka takes care of taxes on property transactions and related services in the state. The goal of this initiative is to make property registration quicker and to increase revenue for Karnataka. The official website provides tools to calculate registration fees, register your property, and check market values easily from your home.

Main Points of Karnataka Stamp and Registration

| Name | IGR Karnataka |

| Full Form | Inspector General of Registration |

| Launched by | Government of Karnataka |

| State | Karnataka |

| Website | https://igr.karnataka.gov.in/english |

Main Features of IGR Karnataka Portal

- You can access services anytime from your home using the online portal.

- Some services allow e-signatures for easy verification.

- Step-by-step guides help you understand how to use the portal.

- Registering on the portal is quick and requires basic details like PAN, Aadhaar, name, address, and contact info.

- A live dashboard shows application statuses in real-time to help you track your requests.

- You can download forms and documents like property registration forms directly from the site.

IGR Karnataka Registration Fees and Stamp Duty for 2025

In Karnataka, when you register a property, you need to pay stamp duty and registration fees. Stamp duty ranges from 2% to 5% depending on your property’s price, while registration fees are fixed at 1% of the property value. There’s also a 10% cess and a 2% surcharge on the stamp duty. For example, if your stamp duty is Rs 3 lakh, you will pay an extra Rs 36,000 as cess and surcharge combined.

Documents Needed for Registration with IGR Karnataka

- Aadhaar card

- ID proofs for seller, buyer, and witnesses

- PAN card

- Encumbrance Certificate

- Address proof

- Property card

- Sale deed signed by all parties

- Demand Draft for payment of stamp duty and registration fees

- Power of Attorney (if applicable)

Encumbrance Certificate Fees

| Search for First Year | Rs. 35 |

| For Each Additional Year | Rs. 10 |

Certified Copy Fees

| Copying fee per 100 words | Rs. 5 |

| Single search fee | Rs. 25 |

| Computer-registered documents per page | Rs. 10 |

Hindu Marriage Certificate Registration Charges

| Certified copy of refusal order by Registrar | Rs. 10 |

| Certified copy of Application Form VII | Rs. 10 |

| Certified copy of Marriage Memorandum and Identity Slip | Rs. 10 |

How to Register on IGR Karnataka Portal

- Go to the official IGR Karnataka website.

- On the homepage, click on the Online Services tab, then choose Kaveri Online Services.

- In the login window, click Register as a New User.

- Fill in your details like name, gender, address, Aadhaar, email, mobile number, etc.

- Enter the captcha code and click Register to finish the process.

Steps for Pre-Registration Data Entry on IGR Karnataka Portal

- Go to the official website and click Kaveri Online Services under Online Services.

- Log in with your user ID and password.

- Click the PRDE Process tab, then choose Document Registration.

- Fill in details like document type, date, pages, and parties, then click Save and Continue.

- Enter property and party details such as name, age, gender, and save them.

- Check stamp duty and registration charges, then pay online or at the Sub-Registrar Office.

- Enter witness info and upload documents and payment receipt.

- Book your appointment for property registration after finishing these steps.

Calculate Stamp Duty and Registration Fees Online

- Go to the official IGR Karnataka website.

- Open Kaveri Online Services and log in.

- Choose Stamp Duty and Registration Fee Calculator.

- Select document type like sale deed, gift deed, etc.

- Pick the stamp type and click Show Details.

- Provide property region type and its market value. If you don’t know the market value, use the portal’s calculator.

- Click Calculate to see your fees.

Generate Challan for Payments

- Visit the official IGR Karnataka website.

- Click on Generate Challan.

- Fill your personal details and payment information.

- Enter the captcha and submit.

How to Get a Signed Encumbrance Certificate Copy

- Open the IGR website and go to Kaveri Online Services.

- Log in with your credentials.

- Select Encumbrance Certificate option and enter details like property number, registration period, area, village, district, and more.

- Click Send OTP, enter the OTP received on your phone.

- View the generated PDF, check the details, and submit.

- Pay the fees and print the receipt.

- The certificate may take up to 10 days to process, and you will receive it soon after.

Contact Information for IGR Karnataka

If you have any questions or need help with IGR Karnataka, you can contact them at:

Address:

Sub-Registrar Corporate Office,

Ambedkar Veedhi, Sampangi Rama Nagar,

Bengaluru, Karnataka 560009

Deputy Secretary to Govt. (Land Grants & Land Reforms)

Room No. 526, 5th Floor, Gate-3, M S Building