Electric Vehicle Manufacturing Subsidy Scheme is a new support plan started by the central government of India to boost electric vehicle (EV) production in the country. The scheme helps both global and Indian EV makers by giving them subsidies and benefits if they set up their factories in India. This way, more electric vehicles can be made in India, prices can go down, and we can move towards a cleaner future.

If you are a company that wants to make electric vehicles, this is a great opportunity for you. You can apply online through a simple and clear process. You will also get support from the government like lower import taxes, online registration help, and many more benefits. This scheme will also bring more jobs to India and promote the ‘Make in India’ and ‘Aatmanirbhar Bharat’ missions.

Also Read – PM-WANI Scheme

Details of the Electric Vehicle Manufacturing Subsidy Scheme

| Parameter | Details |

| Name of the Scheme | Electric Vehicle Manufacturing Subsidy Scheme |

| Launched By | Government of India |

| Purpose | To promote EV production and attract global companies |

| Beneficiaries | Electric vehicle manufacturers |

| Important Dates | – Start Date: 24th June 2025 (from 10:30 AM) – End Date: 21st October 2025 (till 6:00 PM) |

| Required Investment | Minimum ₹4,150 crore |

| Import Duty Benefit | Only 15% on high-end electric cars for 5 years |

| Eligibility | All global and Indian EV manufacturers |

| Documents Required | Aadhaar Card, Bank account details |

| Application Process | Online |

| Official Website | https://spmepci.heavyindustries.gov.in/ |

| Contact Email | smec[at]ifciltd[dot]com |

How to Register for the Electric Vehicle Manufacturing Subsidy Scheme 2025

To register under this scheme, follow these easy steps:

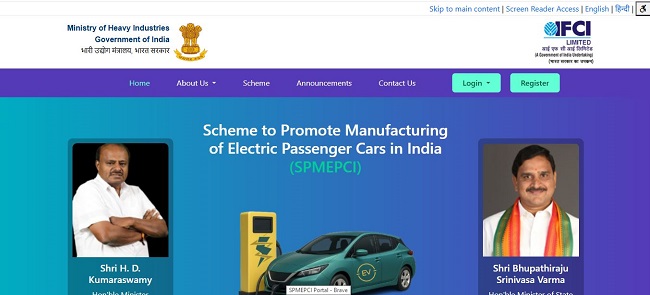

STEP 1: Go to the official portal of the scheme on the IFCI website.

STEP 2: At the homepage, Click on the “register” button shown on the homepage.

STEP 3: Fill in your company name, authorized person details, upload necessary documents, and complete OTP verification.

STEP 4: After entering all the details, click on “submit” to complete the registration.

Eligibility Criteria:

- You must be an Electric Vehicle Manufacturer

- You must commit to invest at least ₹4,150 crore in India

- The policy framework includes duty reductions of up to 15 percent on imported electric vehicles, with eligibility extending to up to 8,000 electric cars annually priced from Rs 30 lakh.

Benefits of the Electric Vehicle Manufacturing Subsidy Scheme:

- Lower import duty of 15% on high-end EVs for approved companies

- Encourages more global companies to set up EV plants in India

- Reduces cost of electric vehicles in the country

- Helps in lowering pollution and improving environment

- Brings more jobs to the automobile and EV sectors

- Supports India’s clean energy and net zero goals

EV Manufacturing Subsidy Scheme Features

- Make in India Focus: Strong push for local manufacturing

- 5-Year Tax Benefit: Lower customs duty allowed for 5 years

- Eco-Friendly Production: Helps India meet its green targets

- Job Opportunities: Creates employment in EV-related industries

Need Help?

If you need help or have questions, you can contact the official email: smec[at]ifciltd[dot]com

FAQs

Who runs the Electric Vehicle Manufacturing Subsidy Scheme?

The Ministry of Heavy Industries, Government of India, is the main department behind this scheme.

Who can apply?

All electric vehicle manufacturers, whether global or Indian, can apply if they are ready to invest ₹4,150 crore or more in India.

What is the benefit of this scheme?

You will get a subsidy benefit like lower import duty and help from the government to set up your factory.