Employees Provident Fund (EPF) is a well-known savings scheme managed by the Employees’ Provident Fund Organization (EPFO), under the Government of India. It helps salaried individuals save money regularly to build a retirement fund. This guide explains EPF in simple terms, including its benefits, contribution rates, eligibility, and how you can check your EPF balance in 2025.

Overview of EPF

EPF, or Employees’ Provident Fund, started in 1952. It is a retirement savings plan where both you and your employer contribute a fixed monthly amount until you retire. Usually, 12% of your basic salary plus dearness allowance is deposited by you and your employer. Part of the employer’s contribution, 8.33%, goes into the Employees’ Pension Scheme (EPS). EPF is not only a good way to save but also offers tax benefits and better interest than many other saving plans.

Main Details of Employees Provident Fund

| Name | EPF |

| Full Name | Employees’ Provident Fund |

| Launched By | Employees’ Provident Fund Organization |

| Beneficiaries | Salaried Employees |

| Official Website | https://www.epfindia.gov.in/site_en/index.php |

Main Objectives of EPF

- To give each employee a single EPF account for all jobs.

- To make sure companies follow EPFO rules properly.

- To make it easy for employees and employers to follow the rules.

- To provide online access to all members’ accounts.

- To improve online services and make the system more reliable.

- To reduce claim settlement time from 20 days to 3 days.

- To encourage voluntary participation in EPF.

Explore Post Office Saving Schemes

Advantages of Employees’ Provident Fund

- Helps you plan and save money for the long term.

- Small monthly contributions grow into a large amount over time.

- No need to invest a big sum at once.

- Financial help is available in emergencies.

- Supports maintaining a steady lifestyle and saving for retirement.

About Employees’ Provident Fund Organization (EPFO)

EPFO is a government organization started in 1951 under the Ministry of Labour and Employment. Its role is to help employees save money for retirement. It provides services to both Indian and some foreign employees covered under bilateral agreements.

Universal Account Number (UAN)

Every EPF member gets a 12-digit Universal Account Number (UAN). This number stays the same even if you change your job. Your previous employer’s member ID and your new employer’s member ID both link to this UAN. Activating your UAN lets you access all EPF services online, like checking balance or withdrawing funds.

EPF Interest Rate for 2025

The current EPF interest rate for the financial year 2024-25 is 8.10%. Interest is calculated yearly on the sum deposited by you and your employer.

File your EPFO e-nomination online

Contribution Rates to EPF

Here’s how the employer’s contributions are split:

| Category | Contribution Percentage (%) |

| Employees Provident Fund | 3.67 |

| Employee’s Deposit Linked Insurance Scheme (EDLIS) | 0.50 |

| Employees’ Pension Scheme (EPS) | 8.33 |

| EDLIS Admin Charges | 0.01 |

| EPF Admin Charges | 1.10 |

Different EPF Forms and What They’re For

| Form | Purpose |

| Form 31 | Used for EPF withdrawal advances and loans. |

| Form 10D | To claim monthly pension. |

| Form 10C | Claim benefits from EPF and EPS contributions. |

| Form 13 | Transfer your PF amount from old to new employer account. |

| Form 19 | For final EPF settlement. |

| Form 20 | Withdraw PF amount if the account holder passes away. |

| Form 51F | Nominee claim under Employee’s Deposit Linked Insurance. |

Who Can Join the EPF Scheme?

- Employees earning less than Rs. 15,000 per month must open an EPF account.

- Companies with fewer than 20 employees can join EPF voluntarily.

- Companies with more than 20 employees must register for EPF.

- EPF benefits are available throughout India except Jammu and Kashmir.

- Employees earning more than Rs. 15,000 per month can join EPF with approval from Assistant PF Commissioner.

How You Can Check Your EPF Balance

Here are some easy ways to check your EPF balance:

- EPFO Website: Log in using your UAN and password at the EPFO member portal to view your balance.

- Missed Call Service: Give a missed call from your registered number to 011-22901406 to get balance info.

- SMS Service: Send an SMS to 7738299899 with your UAN to receive your EPF balance.

- UMANG App: Download the UMANG app on your phone to check your EPF balance and file claims.

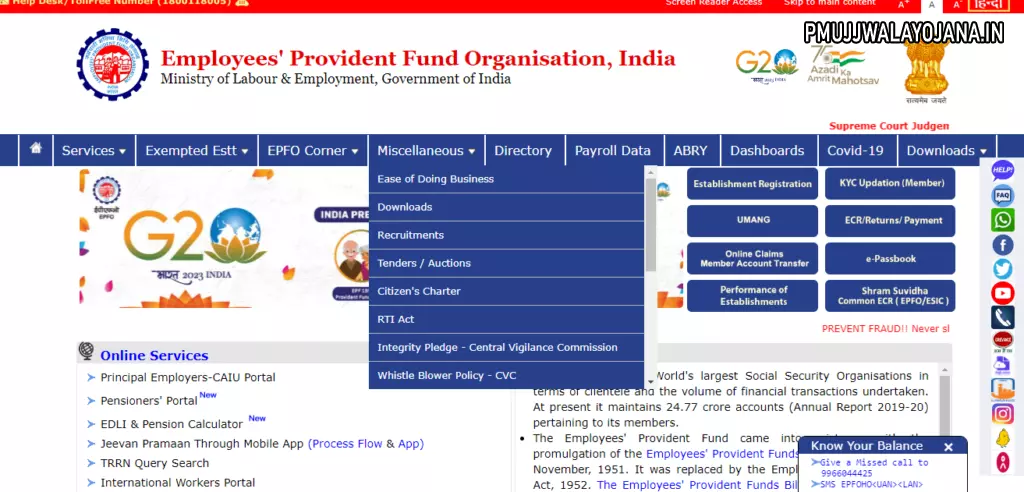

How Employers Can Register for EPF

- Visit the EPFO official website.

- Click on ‘Establishment Registration’ tab.

- Read and accept the instructions and terms.

- Fill in the registration form with required details.

- Activate your email and mobile verification links sent to your registered contacts.

- Upload all necessary documents to complete registration.

How to Transfer Your EPF Account

- Go to the EPF member portal.

- Register by filling out the form with necessary details.

- Visit Online Transfer Claim Portal.

- Request to transfer your EPF balance.

- Submit your details for transfer and get it approved by your employer(s).

- After submission, you will get a tracking ID on your mobile.

- Use this ID to track your transfer status online.

Your EPF Passbook

The EPF passbook helps you see monthly contributions and interest details. You can download or print it from the EPFO portal after activating your UAN.

Rules for EPF Withdrawal

You can withdraw full or part of your EPF money, but only in specific cases like:

- After retirement.

- If unemployed for more than two months.

- When changing jobs, but being unemployed for over two months.

When Can You Withdraw EPF Partially?

You can withdraw part of your EPF for:

- Weddings.

- Buying land or building a house.

- Higher education.

- Home renovation.

- Paying home loans.