AP YSR Bheema Scheme – The Andhra Pradesh government continues to roll out schemes aimed at supporting its citizens. One such initiative is the YSR Bheema Scheme, designed to provide accident-related insurance to the families of economically disadvantaged and unorganized workers in the state. This article will detail key information about the YSR Bheema Scheme, including its objectives, benefits, features, eligibility criteria, and how to apply. If you’re keen to learn all about it, please read through to the end.

YSR Bheema Scheme 2025

The YSR Bheema Scheme offers financial security to low-income families in Andhra Pradesh in cases of accidental death or permanent disability. In such events, the insurance amount is compensated to the nominee of the beneficiary. Approximately 1.14 crore residents of the state stand to benefit from this initiative, with a total budget of Rs 510 crore allocated for its execution.

Beneficiaries can receive insurance coverage ranging from Rs 1.5 lakh to Rs 5 lakh, which will be credited directly to the bank account of the deceased’s family within 15 days of the claim being made. Additionally, an immediate financial relief amount of Rs 10,000 will also be provided by the Andhra Pradesh government. Participants are required to pay a nominal premium of just Rs 15 annually.

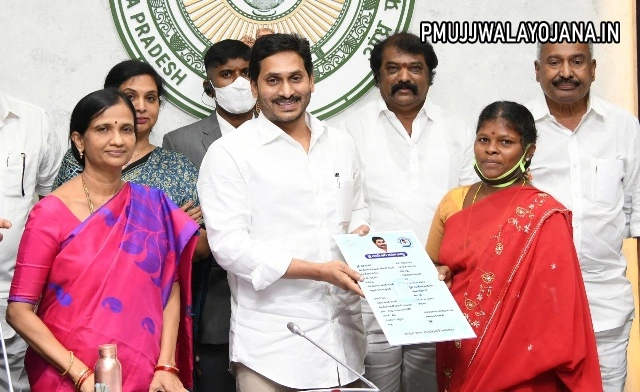

On the initiative of CM YS Jagan, the ‘YSR Bheema’ scheme has been launched to secure the livelihood of families. The state government covers the entire premium cost. Approximately 1.41 crore families holding ration cards will benefit from this scheme. pic.twitter.com/aaA9uGUsJW — CMO Andhra Pradesh (@AndhraPradeshCM) October 21, 2020

Objective of YSR Bheema

The primary aim of the YSR Bheema Scheme is to provide insurance coverage to destitute families and unorganized workers in Andhra Pradesh. The financial compensation is intended to support the beneficiaries’ families during a tough time, ensuring that they have a financial safety net in cases of tragic accidents.

Highlights of YSR Bheema Scheme

| Name of Scheme | YSR Bheema Scheme |

| Launched by | Government of Andhra Pradesh |

| Beneficiaries | Citizens of Andhra Pradesh |

| Objective | To provide insurance cover |

| Premium Amount | Rs 15 per annum |

| Year | 2025 |

Benefits and Features of YSR Bheema Scheme

- The scheme provides accident insurance to families of poor and unorganized workers.

- The nominee receives the insurance amount in case of the beneficiary’s death.

- Approximately 1.14 crore citizens of Andhra Pradesh will benefit from this scheme.

- Rs 510 crore has been allocated for effective implementation.

- Insurance cover ranges from Rs 1.5 lakh to Rs 5 lakh, deposited directly into the beneficiary’s family bank account.

- Claims are settled within 15 days.

- Immediate financial relief of Rs 10,000 is available to beneficiaries’ family members.

- The annual premium is only Rs 15.

- Beneficiaries will receive an identity card with a unique ID number and policy number.

- Claim payments will be made directly to the bank account via bank transfer.

- For assistance, beneficiaries can reach out to PD DRDA for issues concerning enrollment or claims.

Insurance Coverage Under YSR Bheema Scheme

- Individuals aged 18 to 50 years will have an insurance coverage of Rs 5 lakh for accidental death and total permanent disability.

- Individuals aged 51 to 70 years will have an insurance coverage of Rs 3 lakh for accidental death and total permanent disability.

- Coverage of Rs 2 lakh is provided in case of natural death for individuals aged 18 to 50 years.

- For partial permanent disability caused by an accident, individuals aged 18 to 70 years will have a coverage of Rs 1.5 lakh.

Note: The claim amount is deposited into the nominee’s bank account within 15 days of submitting the claim.

Nominees for YSR Bheema Scheme

Nominees for the YSR Bheema Scheme can include:

- The spouse of the beneficiary

- Son aged 21 years or younger

- Unmarried daughter

- Widowed daughter

- Dependent parents

- Widowed daughter-in-law or her children

Note: Beneficiaries will receive an identity card that includes both a unique identification number and policy number.

Eligibility Criteria and Required Documents

- Applicants must be permanent residents of Andhra Pradesh.

- Applicants should possess a white ration card.

- Ration card.

- Aadhar card.

- Residence certificate.

- Income certificate.

- Recent passport-sized photograph.

- Bank account details.

- Mobile number.

Application Procedure for YSR Bheema Scheme

No registration is needed to apply for the YSR Bheema Scheme. Volunteers will conduct door-to-door surveys to identify white ration cardholders. The information gathered will then be verified by the welfare secretary. Selected beneficiaries will be guided to open a bank account, and they will need to pay the annual premium of Rs 15. For further details, visit the official website.