UP MSME Loan Mela 2025: Friends, if you are running a micro, small, or medium enterprise in Uttar Pradesh, this article is for you. The UP government, led by Chief Minister Yogi Adityanath, has launched the MSME Sathi Loan App along with an online loan mela for 2025. With this scheme, MSME entrepreneurs in Uttar Pradesh can apply online to get loans up to ₹2000 crore. We’ll walk you through the benefits, eligibility criteria, required documents, and how to apply online for the UP MSME Loan Mela.

UP MSME Loan Mela 2025 Details

This scheme supports entrepreneurs involved in micro, small, and medium industries. The Uttar Pradesh government plans to provide financial help worth ₹2000 crore to 36,000 MSME business owners. This support aims to boost economic growth and create jobs in the MSME sector across the state.

Micro, small and medium enterprises play a big role in the state’s economy. These businesses form the backbone of many communities and generate a large number of jobs.

Main Highlights of UP MSME Loan Mela 2025

| Scheme Name | UP MSME Loan Mela |

| Announced By | Chief Minister Yogi Adityanath |

| State | Uttar Pradesh |

| Application Mode | Online |

| Start Date | 14 May 2025 |

| End Date | 20 May 2025 |

| Beneficiaries | MSME Sector Entrepreneurs |

| Total Budget | ₹2000 Crore |

| Official Website | http://diupmsme.upsdc.gov.in/ |

About Uttar Pradesh MSME Loan Mela

The UP government has launched the MSME Sathi portal and mobile app to help the MSME sector grow. So far, over 56,000 entrepreneurs have benefited with loans worth ₹2000 crore distributed quickly. If you haven’t registered yet, it’s best to do so soon to get this loan support.

Main Types of MSME

- Micro Enterprises: Businesses with investment up to ₹1 crore and turnover up to ₹5 crore.

- Small Enterprises: Businesses with investment up to ₹10 crore and turnover up to ₹50 crore.

- Medium Enterprises: Businesses with investment up to ₹20 crore and turnover up to ₹100 crore.

Overview of UP MSME Loan Mela

Under the Atmanirbhar Bharat Campaign, CM Yogi Adityanath supports the MSME sector with this online loan mela available at diupmsme.upsdc.gov.in. This loan mela focuses on promoting local products and helping MSMEs become global brands. The program gives a strong boost to micro, small, and medium enterprises in Uttar Pradesh, helping the state’s economy grow faster.

Finance Minister Nirmala Sitharaman announced a ₹3 lakh crore package for MSMEs at the center, and UP government will provide ₹2000 crore loans to about 36,000 entrepreneurs from 14 May to 20 May 2025.

Main Objective of UP MSME Loan Mela

The COVID-19 pandemic caused many businesses to struggle during lockdowns. To support MSMEs in Uttar Pradesh, this loan mela aims to offer financial help so they can grow and create jobs in the state.

MSME Delayed Payment Monitoring System

- The Ministry has taken steps to handle delayed payments.

- Buyers can be reported online to the state MSME Forums (MSEFC).

- The MSEFC councils will look into complaints about delayed payments.

- Payments, including interest, will be processed as per rules after investigation.

Other UP Loan Schemes

- Mudra Scheme

- Pradhan Mantri Employment Generation Programme

- Vishwakarma Shram Samman Yojana

- Mukhyamantri Yuva Swarojgar Yojana

- One District One Product Scheme

Documents Needed for UP MSME Loan Mela

- Aadhaar Card

- PAN Card

- Registered Mobile Number

- Email ID

- Bank Passbook Copy

- Bank Account Number

Main Benefits of MSME Sathi UP Online Loan Mela 2025

- Support for business growth for all MSME entrepreneurs.

- Loan money is transferred quickly to bank accounts.

- Local businesses get a good chance to grow as imports slowed during the pandemic.

Eligibility for UP MSME Loan Mela 2025

- Business must be registered properly and running for a long time.

- Minimum turnover as per set criteria must be declared.

- Trusts, NGOs, and charitable institutions cannot apply for loans.

- Business must not be blacklisted.

This eligibility will be confirmed by the government. Updates will be shared once official details are available.

Loan Schemes under UP MSME Loan Mela 2025

- Mukhyamantri Yuva Swarojgar Yojana: Gives loans up to ₹25 lakh for industrial units and up to ₹10 lakh for the service sector to help young people.

- One District One Product Margin Money Scheme: Provides 20% funding up to ₹50 lakh per applicant aged 18-40 years, who is a UP resident.

- Vishwakarma Shram Samman Yojana: Offers 6-day training for craftsmen like potters, weavers, carpenters, blacksmiths, and barbers with 250 trained every year.

- One District One Product Training & Toolkit Scheme: Offers skill development through Recognition of Prior Learning (RPL) with certification and a daily stipend of ₹200 for 10 days training for unskilled workers.

How to Apply Online for UP MSME Loan Mela 2025 via MSME Sathi App

- Visit the official website http://diupmsme.upsdc.gov.in/.

- Go to the login section and click on “New User Registration”.

- Fill in the online registration form carefully and upload the required documents.

- Click submit and wait for a confirmation message on your registered mobile or email.

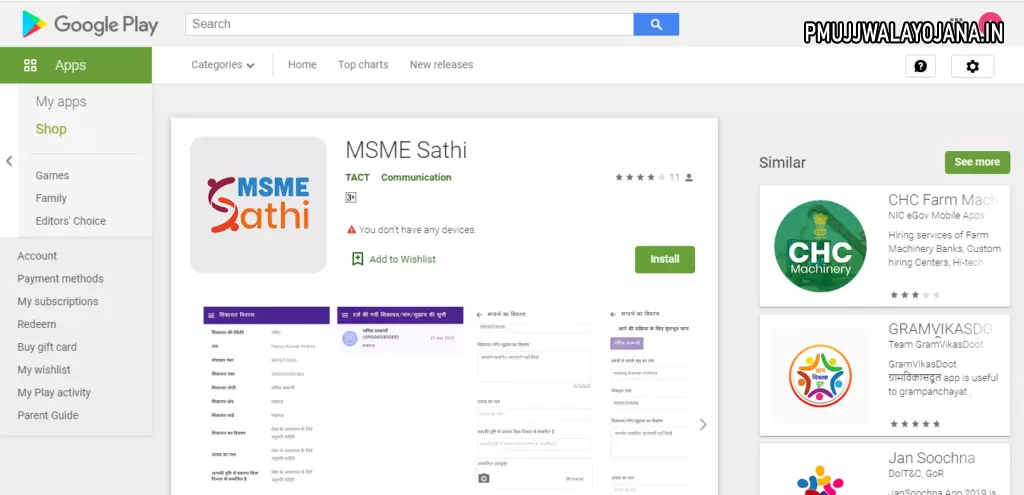

- You can also download the MSME Sathi Mobile App from Google Play Store and apply through the app.

Main Features of MSME Sathi Mobile App

The MSME Sathi App, launched by the Uttar Pradesh government, helps entrepreneurs to raise complaints, share suggestions, and get support for various MSME activities. Using this app, you can register complaints and track their status easily.

How to Download MSME Sathi Loan App

- Open Google Play Store on your Android phone.

- Search for “MSME Sathi App”.

- Download and install the app.

Steps to Register a Complaint via MSME Sathi App

- Open the app on your phone.

- Click the menu and choose “Complaint Details”.

- Enter reference details and upload the needed documents.

- Select the complaint category and submit.

How to Register and Track Reference via Official Website

- Go to the official MSME Sathi website.

- Click on “Online Registration” then “Submit Reference”.

- Login using your username, password, and captcha.

- Enter the requested information and submit.

- To check the status, select “Reference Status” and enter your reference number.

- You will see the status displayed on the screen.

How to Submit Suggestions

- Visit the MSME Sathi official website.

- Click on “Online Registration” then “Give Your Suggestion”.

- Login and fill out the form.

- Submit your suggestion for government consideration.

How to Check Suggestion Status

- Open the MSME Sathi official website.

- Go to “Online Registration” and click “Suggestion Status”.

- After login, enter your reference number to view your suggestion status.

If you run a micro, small, or medium enterprise in Uttar Pradesh, applying for the UP MSME Loan Mela 2025 is a great chance to get financial support and grow your business. Be sure to visit the official site and apply before the deadline.