Farmers in Telangana are getting great help with the Telangana Crop Loan Waiver 2025 scheme. The government, led by Chief Minister A Revanth Reddy, plans to waive crop loans up to Rs 2 lakh in one go. This decision is aimed at reducing farmers’ financial stress and improving their lives.

Overview of Telangana Crop Loan Waiver Scheme 2025

The Telangana Crop Loan Waiver Scheme has already supported over 11 lakh farmers and is now entering its second phase. This phase is expected to start soon, with the government aiming to clear farmers’ outstanding loans by August 15, 2024. The scheme focuses on waiving short-term agricultural loans up to Rs 2 lakh, especially for farmers who are finding it hard to repay their loans.

New Guidelines for Telangana Crop Loan Waiver

A government order (GO Rt. No 567) provides clear rules for the loan waiver:

- Maximum loan waiver of Rs 2 lakh per farmer family.

- Eligibility based on food security card data from the Civil Supplies Department.

- Loan tenure considered: from December 12, 2018, to December 9, 2023.

- Only short-term loans are waived; loans from district cooperative banks, rural banks, and scheduled commercial banks are excluded.

These rules make sure the help reaches real farmers struggling with their crop loans.

Main Details about Telangana Crop Loan Waiver Status

| Scheme Name | Telangana Crop Loan Waiver Status |

| Launched By | Government of Telangana |

| Managing Department | Department of Agriculture, Telangana |

| Who Benefits? | Farmers of Telangana |

| Goal | To waive crop loans |

| Check Application | Online |

| Official Website | clw.telangana.gov.in |

Eligibility Criteria for Loan Waiver

- Applicants must be permanent residents of Telangana.

- Farming should be their main occupation.

- Loan should have been taken between December 11, 2018, and December 9, 2023.

- Only short-term loans qualify for the waiver.

Documents Needed for Loan Waiver

- Passport size photograph

- Aadhaar card

- Valid identity card

- Residence certificate

- PAN card

- Age certificate

- Loan certificate

- Bank passbook

- Loan account passbook

- Mobile number and email ID

Check Telangana Crop Loan Waiver Status Online

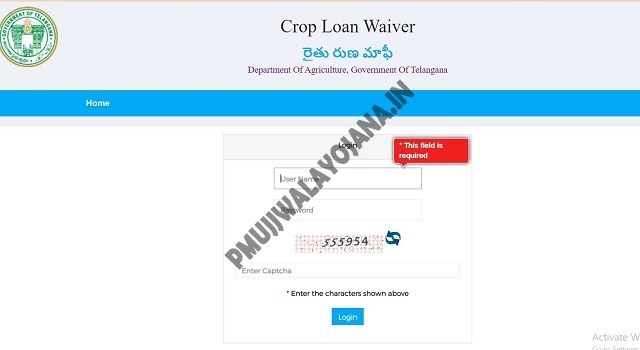

On Official Crop Loan Waiver Portal

- Visit https://clw.telangana.gov.in/Login.aspx.

- Click on the ‘Payment Status’ option on the homepage.

- Enter your details and click ‘Send OTP’.

- Enter the OTP you receive and click ‘Submit’. Your loan waiver status will be shown right away.

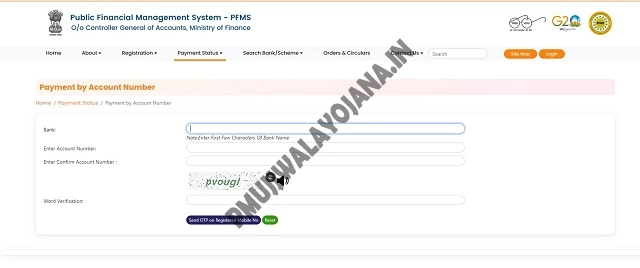

On Public Financial Management System (PFMS) Website

- Go to the PFMS website: https://pfms.nic.in/SitePages/KnowYourPayment_Dw_NewNew.aspx.

- Select ‘Payment Status’ on the homepage.

- Enter your details and submit to see your payment status.

How to Check Telangana Crop Loan Waiver Status Offline

- Visit the bank where you took the loan.

- Ask the bank employee to check your account passbook for any loan waiver entries.

- This will show if the loan waiver amount has been credited to your account.

Details You Can See On Loan Waiver Status Dashboard

- Your name as the applicant

- Bank account details

- Personal information

- Bank name

- Status of loan waiver

- Pending actions or approvals

Benefits of Telangana Crop Loan Waiver 2025

- Farmers get relief from crop loans up to Rs 2 lakh, which helps them financially.

- You can easily track your loan waiver status online through official websites.

- The government’s support aims to improve farmers’ quality of life and ease their debts.

Important FAQ about Crop Loan Waiver Scheme

Who started this Telangana Crop Loan Waiver scheme?

This scheme was started by the Telangana Congress government under Chief Minister A Revanth Reddy.

What is the maximum loan waiver amount?

Up to Rs 2 lakh per farmer family is waived as per the government order.

How can farmers check their loan waiver status?

Farmers can check their status online at the official crop loan website or the PFMS site, or visit their loan bank branch to check offline.

We hope this information helps you understand the Telangana Crop Loan Waiver 2025 scheme better. Keep checking the official sites regularly to stay updated on your loan waiver status.