Pradhan Mantri Vaya Vandana Yojana (PMVVY) was started by the Government of India on 4th May 2017 specially for senior citizens. This pension scheme offers a safe investment with guaranteed returns for elderly people aged 60 years or above. Under this scheme, if you choose monthly pension, you get 8% interest for 10 years; for annual pension, the interest rate is 8.3% for 10 years. Through PMVVY, senior citizens can earn good interest on their investment.

Pradhan Mantri Vaya Vandana Yojana 2025 in Detail

PMVVY is a social security and pension scheme run by LIC on behalf of the Government of India. The maximum investment limit was earlier ₹7.5 lakhs but has now been increased to ₹15 lakhs. The investment window, previously ending on 31st March 2024, has been extended with tentative dates for further period. Today, you will get complete information about the scheme including how to apply, documents required, eligibility, and key guidelines.

About Pradhan Mantri Vaya Vandana Yojana

| Scheme | Pradhan Mantri Vaya Vandana Yojana |

| Launched By | Life Insurance Corporation of India (LIC) |

| Beneficiaries | Senior citizens of India |

| Objective | To provide secure pension to senior citizens |

| Official Website | https://www.licindia.in/Home |

| Year | 2025 |

Key Features of PMVVY Scheme 2025

- Senior citizens can invest a maximum lump sum of ₹15,00,000 to get monthly pension up to ₹10,000.

- Investment under this scheme is exempted from income tax under Section 80C but the pension earned is taxable.

- Monthly pension offers 8% interest while yearly pension pays 8.3% interest for 10 years.

- Pension modes: Monthly, quarterly, half-yearly, or yearly as per investor’s choice.

- No medical exam is needed to join this scheme.

- After 10 years, the pension amount along with the principal investment is returned to the policyholder.

- In case the policyholder dies during the policy term, the invested amount is refunded to the nominee.

PMVVY Purchase Price & Pension Amount

| Pension Mode | Minimum Purchase Price | Pension Amount | Maximum Purchase Price | Pension Amount |

|---|---|---|---|---|

| Annual | ₹1,56,658 | ₹1,200 per annum | ₹14,49,086 | ₹1,11,000 per annum |

| Half-Yearly | ₹1,59,574 | ₹6,000 half yearly | ₹14,76,064 | ₹55,500 half yearly |

| Quarterly | ₹1,61,074 | ₹3,000 per quarter | ₹14,89,933 | ₹27,750 per quarter |

| Monthly | ₹1,62,162 | ₹1,000 per month | ₹15,00,000 | ₹9,250 per month |

Benefits of Pradhan Mantri Vaya Vandana Yojana

- This is an investment scheme, not a tax saving plan.

- Available for Indian citizens aged 60 years and above with investment limit till ₹15 lakhs (till the extended date in 2025).

- Provides pension payment ranging from ₹1,000 to ₹9,250 per month depending on investment.

- Returns are taxable as per prevailing tax rules.

- Exempted from GST, unlike other insurance products.

- Investment does not qualify for deduction under Section 80C.

PMVVY Free Look Period

If you are not satisfied with the scheme terms, you can return the policy within 15 days if purchased offline, or within 30 days if purchased online, after giving a reason. You will get a refund after deducting stamp duty and pension amount if any.

Minimum and Maximum Pension Amount

| Pension Mode | Minimum Pension | Maximum Pension |

|---|---|---|

| Annual | ₹12,000 | ₹1,11,000 |

| Half-Yearly | ₹6,000 | ₹55,500 |

| Quarterly | ₹3,000 | ₹27,750 |

| Monthly | ₹1,000 | ₹9,250 |

Minimum and Maximum Purchase Price

| Pension Mode | Minimum Purchase Price | Maximum Purchase Price |

|---|---|---|

| Annual | ₹1,44,578 | ₹7,22,892 |

| Half-Yearly | ₹1,47,601 | ₹7,38,007 |

| Quarterly | ₹1,49,068 | ₹7,45,342 |

| Monthly | ₹1,50,000 | ₹7,50,000 |

PMVVY Scheme Extension

#Cabinet approved extension of PMVVY up to 31st March 2024 for three more years beyond 31st March 2020, aiming to improve income security and welfare for senior citizens. – K.S. Dhatwalia (@DG_PIB)

Aim of Pradhan Mantri Vaya Vandana Yojana

This scheme aims to provide pension to senior citizens in India by offering interest on their investment. It helps them stay financially independent and reduce dependence in old age. PMVVY promotes financial freedom for elderly people through guaranteed pension.

Interest Rates under PMVVY Scheme 2025

| Pension Option | Fixed Interest Rate |

|---|---|

| Monthly | 7.40% |

| Quarterly | 7.45% |

| Half-Yearly | 7.52% |

| Annual | 7.60% |

Payment Options for PMVVY

- You can pay monthly, quarterly, half-yearly or yearly through NEFT or Aadhaar Enabled Payment System.

- Pension payment modes are monthly, quarterly, half-yearly or annual as per your choice.

Pradhan Mantri Kisan Mandhan Yojana

Maturity Benefits of PMVVY 2025

- If the pensioner survives the full 10 years policy term, pension along with the invested amount is paid back.

- If the pensioner dies before the 10 years term, the invested amount is given to the nominee.

- In case of suicide, the invested amount is refunded.

Surrender Value under PMVVY

If you face financial trouble and wish to exit the scheme early, you can get about 98% of your investment back. If you are unsatisfied with the policy terms, you can return the policy within 15 days (offline purchase) or 30 days (online purchase) to get a refund of premiums paid.

Loan Facility in PMVVY

You can avail a loan up to 75% of the purchase price after completing 3 years of the policy. Loan interest is charged at 10% plus additional charges.

Important Notes about PMVVY

- Available to Indian citizens aged 60 years or more.

- The policy term is 10 years.

- Payment mode is chosen based on pension frequency.

- Death claim amount is paid to legal nominee.

- No medical tests are required.

- Exit before 10 years results in only 9% purchase price as return.

- Loan facility available after 3 years for up to 75% of investment.

Special Features of Pradhan Mantri Vaya Vandana Yojana

- Specifically made for senior citizens aged 60 and above.

- Offers guaranteed pension for 10 years.

- Operated by Life Insurance Corporation of India.

- Fixed interest rates around 7.40% per annum.

- Available both online and offline.

- Scheme period extended up to March 2024 tentatively.

- Pension payouts available in various modes: monthly, quarterly, half-yearly, yearly.

- Principal investment returned at end of 10-year period along with last pension payout.

- Loan facility up to 75% of the invested amount available after 3 years.

- In emergencies, withdrawal up to 98% of investment possible.

- Nominee receives refund of principal if investor dies before maturity.

Key Facts of PMVVY Scheme 2025

- Minimum age to apply is 60 years; no maximum age limit.

- Policy term is always 10 years.

- Maximum investment allowed is ₹15,00,000 as per latest extension.

- Monthly pension can start from ₹1,000 up to ₹9,250 based on investment.

- Pension and principal are protected and secured.

- No GST on this scheme.

Pradhan Mantri Suraksha Bima Yojana

Important Points of PMVVY

| Age | Minimum: 60 years | No Upper Limit |

| Policy Tenure | 10 years | |

| Pension Mode | Monthly, Quarterly, Half-Yearly & Annually | |

| Purchase Price Range | Minimum: ₹1,44,578 to ₹1,50,000 | Maximum: ₹7,22,892 to ₹15,00,000 |

| Pension Amount Range | Minimum: ₹1,000 to ₹12,000 | Maximum: ₹9,250 to ₹1,20,000 |

Eligibility Criteria

- Applicant must be a permanent resident of India.

- Minimum age must be 60 years; no maximum age limit.

- Policy tenure is fixed at 10 years.

Documents Needed for Application

- Aadhaar Card

- PAN Card

- Age proof

- Income proof

- Residence proof

- Bank passbook

- Mobile number

- Passport size photo

How to Apply for PMVVY Scheme 2025?

You can apply online or offline for PMVVY using the following methods:

- Visit the LIC official website.

- On the homepage, find and click the registration option.

- Fill the application form with personal details like name, address, Aadhaar number, etc.

- Upload the necessary documents and submit the form.

- This completes the online registration.

Offline Application Steps

- Visit your nearest LIC branch office.

- Submit all documents and provide your details to the LIC officer.

- The LIC agent will assist you with the application and verification and start your policy.

How to Check Policy Details

- Click the link provided on the official LIC website.

- A new page will open; click the “Open” option under Policy Basic Details.

- A login form will appear; enter your login credentials and click Login.

- Your policy details will be displayed on the screen.

How to Check Loan Details on Policy

- Go to the loan details link on LIC website.

- Click “Open” under Policy Loan Details section.

- Enter your mobile number and MPIN.

- Click on Login to see your loan information.

How to See Payment Details of Policy

- Click the payment details link on LIC website.

- On the home page, select “Open” under Payment Details section.

- Choose login type and enter credentials.

- Click Login to view payment details.

How to Download Pension Payment Details

- Access the pension payment details link.

- Navigate to the Pension Payment Details section.

- Click “Open” and enter your login information.

- You can view and download your pension payment details.

How to View Purchased Policy

- Click on the purchased policy link.

- Click “Open” under Purchased Policy section.

- Enter required login details and click Login.

- Your purchased policy information will be shown.

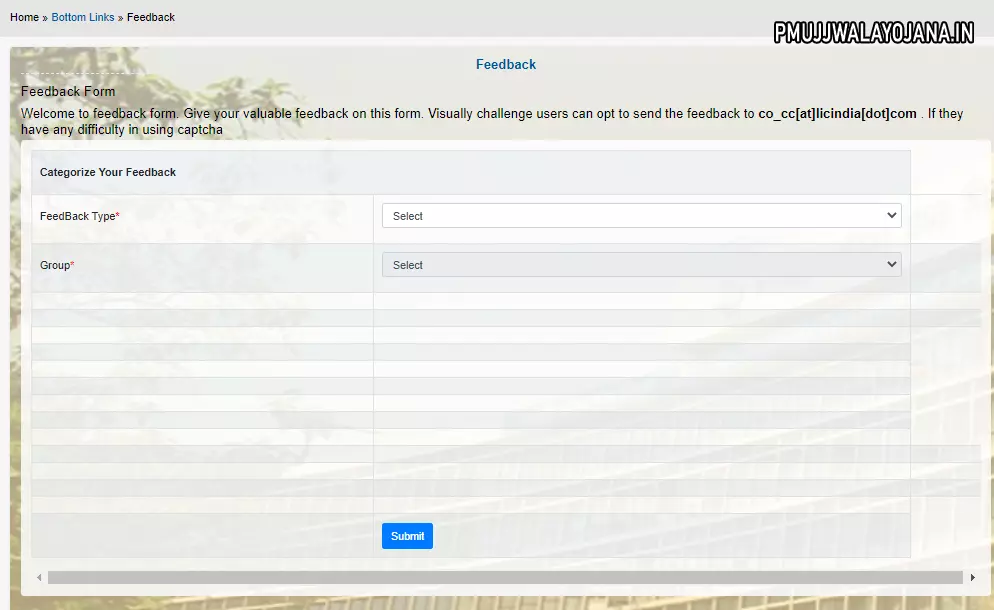

How to Give Feedback

- Visit the LIC official website.

- Click on the Feedback option on the homepage.

- Fill the feedback form selecting type and group.

- Submit your feedback using the Submit button.

Contact Details

- Phone: 022-67819281 or 022-67819290

- Toll-Free: 1800-227-717

- Email: onlinedmc@licindia.com

This scheme is a great way to secure your future with guaranteed pension payments from LIC with good interest rates and flexible payment options. You can choose the pension mode that suits you and rest assured of financial independence in your senior years. If you are 60 or above, consider investing in Pradhan Mantri Vaya Vandana Yojana 2025 to unlock many benefits and peace of mind in old age.