The Government of India has made it very simple for you to check your retirement savings with the National Pension Scheme Calculator 2025. This online tool helps anyone investing in the National Pension Scheme (NPS) find out how much pension they will get without having to visit any office.

You just need to enter your monthly investment, expected yearly return, and your current age. The calculator then shows you the total amount you will have when you retire. It’s quick and easy to use!

Anyone who is a permanent resident of India can use the National Pension Scheme and enjoy its benefits. If you want to know your total investment, maturity amount, or interest earned, just use the official NPS calculator online.

Overview of the National Pension Scheme

The National Pension Scheme, or NPS, is a government plan to help Indians save money safely for their retirement. It helps you build a good amount of money by the time you stop working. The scheme usually offers interest rates between 9% and 12%, which is higher than most bank savings or fixed deposits.

You can invest monthly in NPS and get a good amount after retirement. The plan is open for people aged between 18 and 70, making it a great option for both young and older people looking for a secure future.

Purpose of the National Pension Scheme Calculator

This calculator is made to help you quickly find out how much money you will get when you retire based on your current investments. It saves you time by giving accurate estimates online.

By checking your maturity amount through this tool, you can better plan your savings and retirement goals without any hassle.

Main Features of the National Pension Scheme Calculator

| Scheme Name | National Pension Scheme Calculator |

| Started By | Government of India |

| Launch Year | 2004 |

| Announced By | Prime Minister of India |

| Purpose | Provide investment options for retirement |

| Beneficiaries | Indian citizens |

| Target Group | Citizens wanting to invest for retirement |

| Benefit | Receive money after retirement |

| Eligibility | Permanent resident of India |

| Needed Documents | Aadhaar Card, Bank account |

| Application Method | Online |

| Official Website | https://npstrust.org.in/ |

| Expected Benefits | Good interest rate |

| Contact Number | 1800 2100 080 |

Interest Rate Details

- Interest rate for NPS ranges between 9% and 12% per year.

Minimum and Maximum Investment

- Minimum monthly deposit is ₹1000.

- There is no maximum investment limit set by the Government of India.

Also Read: NPS Vatsalya Scheme

Benefits of National Pension Scheme

- Secure your future by investing for retirement through NPS.

- Higher interest rates compared to regular savings and fixed deposit accounts.

- Low investment risk as the scheme is supported by the Government of India.

- Flexibility to start investing from as low as ₹1000 per month, useful for all income groups.

How to Use the NPS Calculator

Enter your monthly investment, expected annual return rate, and your age. Then, the calculator will show you:

- Total investment so far.

- Interest earned over the years.

- Estimated maturity amount on retirement.

- Minimum annuity investment required.

Formula Used in NPS Calculator

The maturity amount is calculated using this formula:

Future Value (FV) = P [ (1 + r/n)^(nt) 6 1 ] / (r/n)

- P = monthly contribution

- r = annual rate of return

- n = compounding periods per year (usually 12 for monthly)

- t = number of years until retirement

Withdrawal and Maturity Details

- You can withdraw your savings after turning 60 years old.

- Withdrawals before 60 are allowed only after 10 years of participation in NPS. If your total savings are less than ₹2.5 lakh, you may take the full amount as a lump sum.

- In case of death, the full amount goes to your nominee or spouse.

Premature Closure Rules

- You must have saved in NPS for at least 5 years to close the account early.

- If your corpus is ₹2.5 lakh or less, you can withdraw the entire amount at once.

- If the corpus is above ₹2.5 lakh, 80% must buy an annuity, and the remaining 20% can be withdrawn.

- Government employees enrolled under NPS can withdraw anytime.

Advantages of Using the NPS Calculator

- Check your future pension amount quickly and easily.

- Accurate results without any calculation errors.

- Plan your retirement savings based on clear amount estimates.

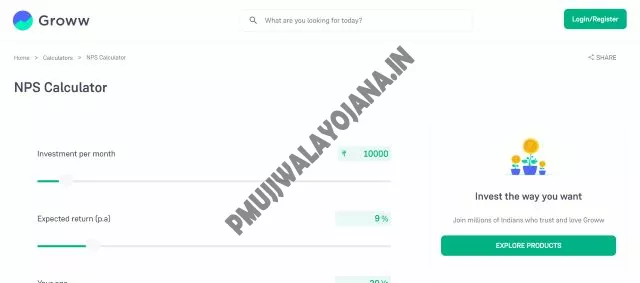

How to Use the National Pension Scheme Calculator – Step by Step

Step 1: Visit the official NPS calculator website at https://groww.in/calculators/nps-calculator.

Step 2: Enter your monthly investment, expected return rate, and your current age in the boxes provided.

Step 3: See your maturity amount, interest earned, total invested amount, and minimum annuity investment displayed instantly.

Contact Information

- Helpline Number: 1800 2100 080

Frequently Asked Questions (FAQs)

What is the current interest rate for the National Pension Scheme?

The interest rate ranges between 9% and 12% per year.

How do I calculate the maturity amount in NPS?

The formula used is Future Value (FV) = P [ (1 + r/n)^(nt) 6 1 ] / (r/n), where P is the monthly contribution, r the annual return rate, n the compounding frequency, and t the years until retirement.

Who can join the National Pension Scheme?

Any Indian citizen aged between 18 and 70 years can join the NPS and benefit from it.

Enjoy planning your retirement with this easy-to-use NPS calculator and make your future financially secure!