Karnataka Karasamadhana Scheme 2025 is a plan by the Karnataka government to help you clear old tax dues from before GST started without going to court. It gives a special chance to pay your pending taxes and get full relief from penalties and interest if you pay by December 31, 2025. Keep reading to know how to apply, who can benefit, and important dates for this scheme.

About Karnataka Karasamadhana Scheme 2025

This scheme was introduced by the Karnataka government through Order No. FD 07 CSL 2024 dated July 18, 2024, in Bengaluru. Its goal is to collect pre-GST tax dues quickly and avoid long legal disputes. If you pay your full tax dues before December 31, 2025, you will get a complete waiver on penalties and interest. It also includes cases where assessments, appeals, or revisions have been done or will be done by October 31, 2024, even if only penalties and interest remain.

If you get a notice about any outstanding dues, you need to pay the tax within 15 days or by January 15, 2025 (whichever is earlier) to enjoy the scheme benefits. If you miss the deadline, you won’t get the scheme’s benefits. This helps the government settle tax issues quickly and motivates taxpayers to clear dues without going to court.

Main Highlights of Karnataka Karasamadhana Scheme

| Name | Karnataka Karasamadhana Scheme |

| Launched by | Government of Karnataka |

| State | Karnataka |

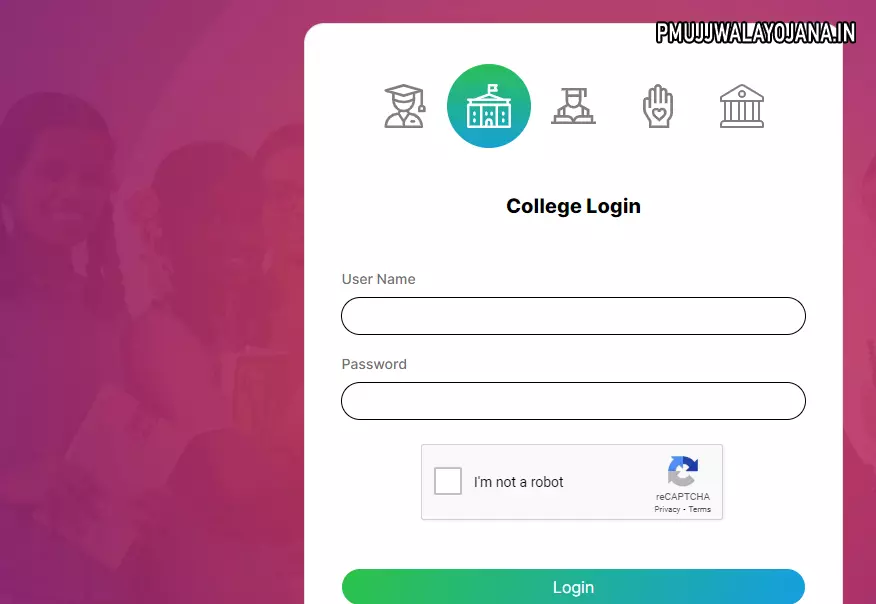

| Official Website | vat.kar.nic.in |

Purpose of Karnataka Karasamadhana Scheme

With more online transactions and trading, some taxpayers delay paying their taxes and face penalties, which affects the economy. This scheme was started to settle old tax disputes from before GST began and help recover dues easily without court involvement.

Main Features

- 100% waiver on penalties and interest for assessments, revisions, and appeals completed or to be completed by October 31, 2024, under KST, KVAT, and CST Acts.

- Also applies where only penalties and interest remain but tax is cleared.

- Penalty waiver for not submitting audited accounts if tax dues are fully cleared.

Benefits of the Scheme

- Extended deadlines allow more people to use it.

- Those who missed earlier chances can apply now.

- Complete waiver on penalty and interest helps dealers save money.

Who Can Apply?

- Dealers, individuals, or proprietors who pay all back taxes by December 31, 2025.

- Those with only penalty and interest due from orders completed or to be completed by October 31, 2024.

- Applicants must withdraw any ongoing appeals or petitions related to pending tax dues.

- Cannot apply if the state has filed appeals in higher courts or if revision started before October 31, 2024.

Important Conditions

- Unregistered dealers can also be included under certain rules and must use number “2900” if no registration exists.

- Cases sent back for reassessment by authorities can also benefit.

Eligibility Requirements

- Not eligible if covered under section 10 A of GST.

- Applicants must print payment confirmation as proof and submit it to the tax department.

Documents Needed

- Aadhar Card

- PAN Card

- Business Card

- Proof of Residence

- Mobile Number and Email ID

How to Apply for Karnataka Karasamadhana Scheme

- Application: Submit an online application separately for each assessment year using the prescribed format before December 31, 2025.

- Verification: Authorities will review your application and inform you within 15 days if there are any remaining dues.

- Payment: Pay any balance dues within 15 days of notice or by January 15, 2025, whichever is earlier.

- Withdraw Appeals: You must declare withdrawal of any related appeals or court cases.

- Order Issued: After confirming eligibility and payment, officials will issue the waiver order for penalty and interest.

This scheme provides a simple way to clear your old tax problems easily and save money on penalties. If you have any pending tax dues from before GST started, this is a good chance to settle them without hassle. Visit the official link vat.kar.nic.in to start or learn more.

Karnataka Ration Card DBT Status

Gruha Lakshmi Scheme Karnataka