India has many government schemes to help poor and disadvantaged citizens. One important scheme is the Pradhan Mantri Jan Dhan Yojana, started by Prime Minister Narendra Modi. This scheme is for poor people who don’t have a bank account yet. Through Jan Dhan Yojana, the government wants to reach all poor citizens and give them easy banking services and direct financial support through a Jan Dhan Account. Anyone in India can open their Jan Dhan Account under this scheme.

PM Jan Dhan Account in 2025

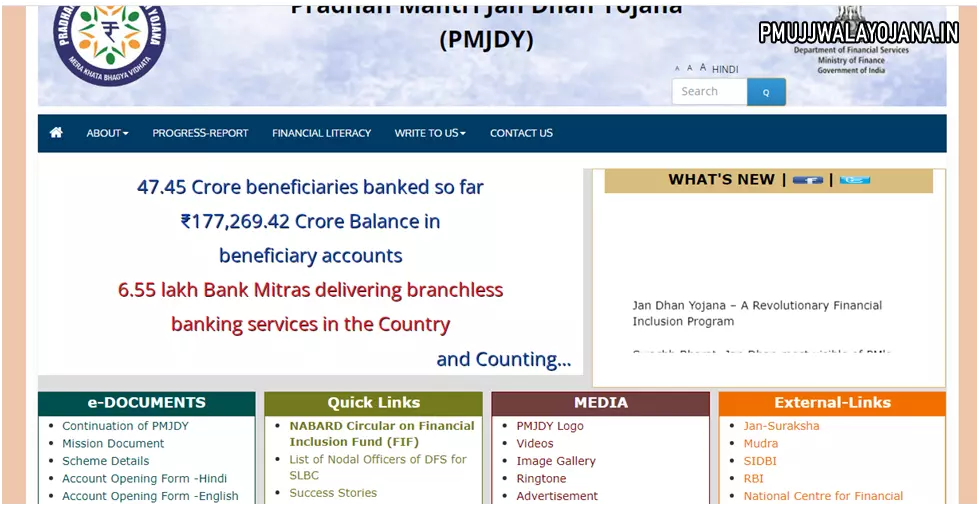

Launched on August 15, 2014, the Pradhan Mantri Jan Dhan Yojana was started for Indian citizens without bank accounts. Its main goal is to connect poor people with banking so money and other benefits from government schemes can be sent directly to them. The scheme makes banking simple by allowing zero balance accounts. So far, over 40 crore accounts have been opened under this scheme.

This scheme helps people who have no banking information to join the banking system. All savings accounts under Jan Dhan Yojana come with facilities like debit cards and overdraft options, making it easier for poor families to use financial services.

Details of Pradhan Mantri Jan Dhan Account

| Scheme Name | PM Jan Dhan Account |

| Started By | Prime Minister Narendra Modi |

| Launch Date | 15 August 2014 |

| Beneficiaries | All Indian citizens without any bank account |

| Aim | To connect poor sections with banking services |

| Year | 2025 |

| Official Website | https://www.pmjdy.gov.in/ |

Rs 10,000 Support for Jan Dhan Account Holders

Millions of Jan Dhan accounts have been opened but many account holders don’t know all the benefits. The government offers Rs 10,000 to Jan Dhan account holders. To get this, you need to apply at your bank branch. You don’t need to keep any minimum balance. A free debit card is also provided. There is an overdraft facility where you can borrow up to Rs 10,000 by applying through your bank.

Bank Services with Jan Dhan Account

- No monthly limit on the number or value of transactions.

- Four free withdrawals per month from ATMs or bank counters.

- Other services like RTGS, NEFT, clearing transfers, and debit cards are available.

- Charges apply for more than 4 withdrawals per month.

- Account holders get a free basic RuPay card.

Benefits and Features of PM Jan Dhan Account

- Interest is paid on the balance in the savings account.

- No need to maintain any minimum balance.

- Cheque book facility is available if you keep a minimum balance.

- Overdraft facility available after keeping the account in good standing for six months.

- Accidental insurance cover of Rs 1 lakh via RuPay card.

- The family gets Rs 30,000 in case of accidental death of the account holder.

- Insurance and pension services are available under the scheme.

- Overdraft option of Rs 5,000 is usually given to women in the family, which can go up to Rs 10,000.

- Poor people can easily access government schemes through this account.

Who Can Open a Jan Dhan Account?

- You must be an Indian resident.

- You should not have any other savings bank account.

- The minimum age to open an account is 10 years.

Documents Required for Jan Dhan Account

- Aadhaar Card

- PAN Card

- Ration Card

- Driving License

- Voter ID Card

- Mobile Number

- Passport Size Photo

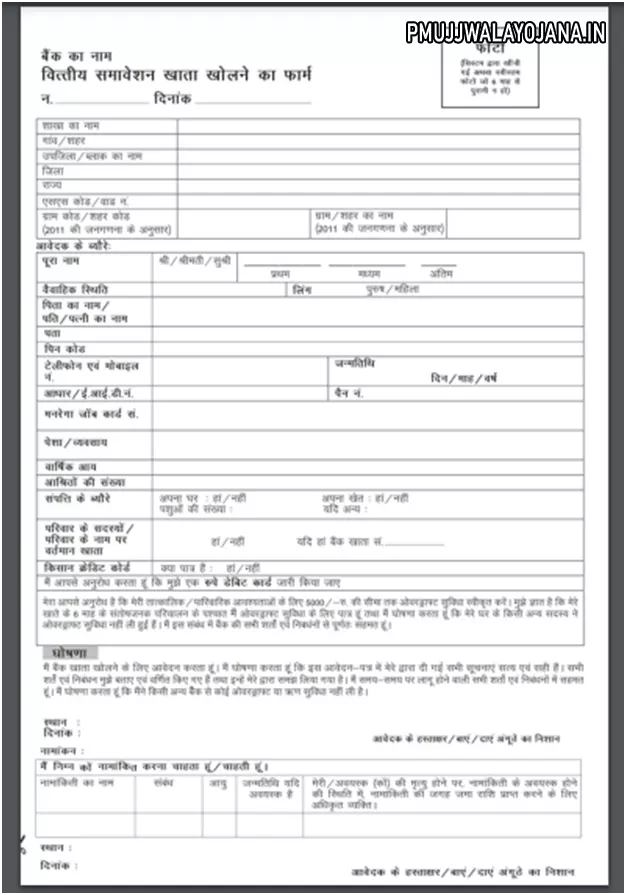

How to Open Jan Dhan Account Online

- Go to the official website of Pradhan Mantri Jan Dhan Yojana: https://www.pmjdy.gov.in/

- On the homepage, choose the option to open the account form in either Hindi or English.

- Select your preferred language and download the account opening form.

- Fill in all required details carefully in the form.

- Attach the necessary documents with the form.

- Submit the form at your nearest bank branch.

- After submission, your bank account will be opened under the Jan Dhan scheme.

How to Open Jan Dhan Account Offline

- Visit your nearest bank branch where Jan Dhan accounts are opened.

- Ask the bank staff for information about the Jan Dhan scheme.

- Collect the account opening form from the bank.

- Fill the form with all required information.

- Attach copies of the necessary documents.

- Submit the form at the bank.

- After your account is opened, you will get a passbook from the bank.

- You can use the passbook for all banking transactions.