Understanding e-RUPI Digital Payment – The Government of India, led by Prime Minister Mr. Narendra Modi, is continually launching digital initiatives that have led to a digital revolution across the nation. With increased awareness among citizens about digital payment methods, the overall standard of living has improved. In this article, we will explore the e-RUPI Digital Payment system, detailing its purpose, advantages, functioning, how to download the app, and more. For complete insights into the e-RUPI digital payment platform, read on until the end.

What is e-RUPI?

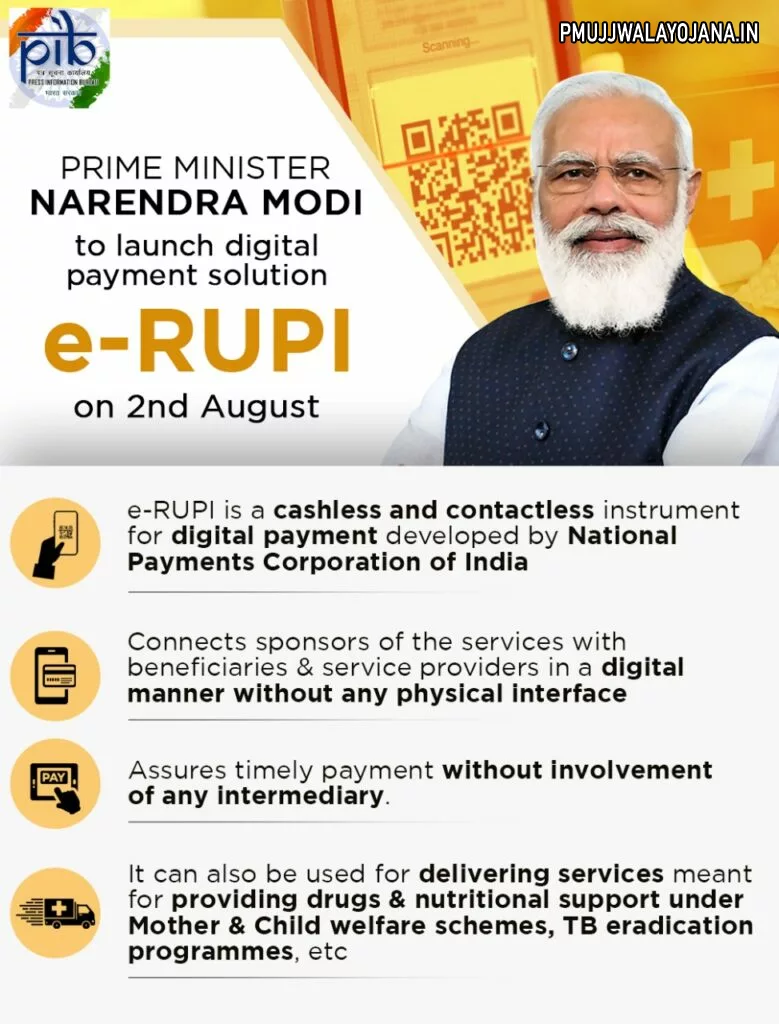

On August 2, 2024, Prime Minister Modi announced the launch of e-RUPI, a cashless, contactless digital payment platform. This platform uses QR codes or SMS-based e-vouchers sent directly to users’ mobile phones. Importantly, these vouchers can be redeemed without needing any digital payment app, internet banking, or debit/credit card. Developed by the National Payments Corporation of India (NPCI) on its UPI platform, e-RUPI was designed in collaboration with various government departments, aiming to bridge service providers and beneficiaries in a completely digital way without physical interaction.

Overview of e-RUPI Digital Payment

| Name Of The Article | e-RUPI Digital Payment |

| Launched By | Government Of India |

| Target Audience | Citizens Of India |

| Goal | Provide a Cashless and Contactless Payment Instrument |

| Official Website | NPCI |

| Year | 2025 |

Applications of the e-RUPI Digital Payment Platform

The e-RUPI system ensures that payments are made to service providers only after a transaction is completed. This platform operates on a prepaid basis, eliminating the need for intermediaries to facilitate payments. It can be utilized for public welfare schemes that provide essential services, including healthcare and nutritional support, such as the Mother and Child Welfare Schemes and the TB Eradication Program, alongside private sector employee welfare initiatives. This digital voucher system assures secure delivery of essential services and supports the development of welfare programs across sectors.

Voucher Issuing Process

The e-RUPI digital payment system has been created by NPCI on its UPI platform. It involves banks as the issuing authorities of the vouchers. Corporates or government bodies need to contact their partner banks, providing details of the beneficiary and the purpose of the payment. The beneficiary will receive a voucher linked to their mobile number through the bank. This initiative aims to simplify payment processes and improve living standards.

How to Open a Jan Dhan Account

PM @narendramodi to launch #eRUPI today at 4:30 pm

Here’s everything you need to know about e-RUPI

Watch on PIB’s

YouTube: https://t.co/fC4K3Q10TJ @PMOIndia @UPI_NPCI pic.twitter.com/aB6HioZSg9 — PIB India (@PIB_India) August 2, 2024

About the National Payments Corporation of India

The National Payments Corporation of India (NPCI) oversees the functioning of retail payment and settlement systems in the country. Established by the Reserve Bank of India and the Indian Banks’ Association, NPCI operates under the Payment and Settlement Systems Act of 2017 to create a robust infrastructure for digital payments in India. It functions as a non-profit under Section 8 of the Companies Act, 2013 and aims to innovate payment methods through the latest technology. The organization encompasses multiple banks including the State Bank of India, Punjab National Bank, and ICICI Bank, among others.

Launch of e-RUPI Digital Payment Platform

The e-RUPI digital platform was introduced via video conferencing on August 2, 2024. During this event, Prime Minister Modi and the Chief Executive Chairman of the National Health Authority highlighted the platform’s capabilities. The initial application of e-RUPI was demonstrated at a private vaccination center in Mumbai.

Objectives of e-RUPI Digital Payment

The primary objective of the e-RUPI platform is to create a cashless and contactless payment mechanism. This system allows users to make secure payments without the necessity of cards or digital banking apps. Beneficiaries receive vouchers via QR codes or SMS, ensuring their payments are timely and secure without intermediaries.

Participating Banks in e-RUPI

| Bank Name | Issuer Status | Acquirer Status | Acquiring App |

| Union Bank of India | Yes | No | N/A |

| State Bank of India | Yes | Yes | YONO SBI Merchant |

| Punjab National Bank | Yes | Yes | PNB Merchant Pay |

| Kotak Jain Bank | Yes | No | N/A |

| Indian Bank | Yes | No | N/A |

| IndusInd Bank | Yes | No | N/A |

| ICICI Bank | Yes | Yes | Bharat Pe and PineLabs |

| HDFC Bank | Yes | Yes | HDFC Business App |

| Canara Bank | Yes | No | N/A |

| Bank of Baroda | Yes | Yes | BHIM Baroda Merchant Pay |

| Axis Bank | Yes | Yes | Bharat Pe |

Features of e-RUPI Digital Payment

- e-RUPI is launched on August 2, 2024.

- This platform is a cashless and contactless payment instrument.

- Payments are processed via QR codes or SMS-based e-vouchers.

- Users receive vouchers directly on their mobile devices.

- No digital payment app, internet banking or card is necessary for redemptions.

- Developed by NPCI on the UPI platform.

- Partners include the Department of Financial Services, Ministry of Health, and National Health Authority.

- Direct connections will be facilitated between service sponsors and beneficiaries with a digital interface.

- Payments are based on completed transactions.

- e-RUPI operates on a prepaid basis without requiring intermediaries.

- Applicable to welfare schemes providing essential services.

Advantages of e-RUPI

| For Consumers | Payment processes are contactless, involving minimal steps without requiring a digital app or bank account, ensuring privacy. |

| For Hospitals | With prepayment vouchers, hospitals simplify payments and avoid cash handling, using verification codes for security. |

| For Corporates | Enhances employee welfare initiatives, enabling safe and efficient voucher tracking while reducing transaction costs. |

Other Services Offered by NPCI

NPCI operates India’s retail payment systems, providing several key services:

Unified Payments Interface (UPI)

Through UPI, users can link multiple bank accounts to one application.

RuPay

A domestic card payment network allowing secure transactions at ATMs, POS, and e-commerce sites across India.

Bharat Interface for Money (BHIM)

This app enables quick payments via UPI and allows users to collect payments using a mobile number.

National Automated Clearing House (NACH)

Facilitates repetitive electronic transaction processing across various sectors.

Immediate Payment Service (IMPS)

Allows interbank fund transfers around the clock through various channels.

National Electronic Toll Collection (NETC)

Offers electronic toll payment solutions nationwide.

BHIM Aadhaar

Allows merchants to receive payments through Aadhaar authentication.

Aadhaar Enabled Payment System (AePS)

Facilitates transactions at POS using Aadhaar for secure payments.

National Financial Switch (NFS)

Connects a network of ATMs ensuring operational reliability.

Cheque Truncation System (CTS)

Enables electronic clearance of cheques saving time and effort.

Highlights from the Chief Executive Chairman of the National Health Authority

The Chief Executive Chairman praised the e-RUPI initiative, emphasizing its importance comparable to BHIM UPI. He noted its purpose-specific features, allowing organizations to issue vouchers instead of cash, directly benefiting different sectors like health, nutrition, and education.

- This system is real-time and paperless, enhancing operational efficiencies.

- Beneficiaries can only utilize vouchers for their assigned purposes.

Key Statements from Prime Minister Narendra Modi

- He highlighted e-RUPI as a pivotal move towards digital governance.

- The initiative aims for transparency, efficiency, and targeted distribution of funds.

- Modi noted that digital technology plays an essential role in uplifting citizens’ quality of life.

- During its launch, he encouraged NGOs to use e-RUPI to support beneficiaries in need.

- For now, the focus is primarily on health sector benefits.

Finding Live Hospitals on e-RUPI

To view the list of hospitals accepting e-RUPI, follow these steps:

- Visit the official NPCI website.

- On the homepage, click “What We Do.”

- Navigate to “UPI” and select “e-RUPI Live Partners.”

- Click on Live Hospitals on e-RUPI to access the PDF file with updated information.

Downloading the e-RUPI Digital Payment Mobile App

- Open the Google Play Store or Apple App Store on your device.

- Search for “e-RUPI Digital Payment”.

- Select the first option from the list and click install.

- The e-RUPI app will be downloaded to your device.

Steps to Redeem an e-RUPI Voucher

- Present the e-RUPI QR code or SMS at the service center.

- The service provider scans the QR code or enters the SMS.

- An OTP will be sent to the beneficiary’s mobile.

- Share this OTP with the seller, who will enter it to process the payment.

Contacting the Department

To reach NPCI, visit their official website, click on “Get in Touch,” fill in your details, and submit the form to contact them.

NPCI Office Contact Details

You can find NPCI office information by visiting their official website and scrolling down the “Get in Touch” section for comprehensive contact details.

Helpline Number

For further queries regarding e-RUPI digital payment, contact NPCI’s helpline at 18001201740. This article provides extensive insights into e-RUPI, ensuring all relevant details are covered for better understanding.