India’s Credit Guarantee Scheme for MSME 2025 is made to help small and micro businesses get easy loans to buy machinery. This lets you grow your business without needing to provide collateral or third-party guarantees.

Overview of the Credit Guarantee Scheme for MSME

Launched by the Government of India during the 2024-25 Union Budget, this scheme gives financial help to small and micro enterprises. It lets you buy new machines without the pressure of giving collateral. This means you can focus more on growing your business with the latest technology.

Also Read: Mudra Loan Scheme 2.0

Main Goal of the Credit Guarantee Scheme

The main goal is to help small businesses get loans easily to upgrade their machines. The government offers a guarantee fund up to INR 100 crore per applicant, which means more financial help for your business.

To manage the scheme, borrowers pay a guarantee fee at the start and a yearly fee based on the loan balance. This helps you handle your loan payments better.

This scheme aims to improve the lifestyle and social standing of small business owners across India.

Main Facts About the Credit Guarantee Scheme for MSME

| Scheme Name | Credit Guarantee Scheme for MSME |

| Launched By | Government of India |

| Purpose | Financial Support for MSME |

| Who Can Apply | Small and Micro Business Owners |

| Official Website | https://www.cgtmse.in |

Who Can Apply?

- You should be a permanent resident of India.

- You must own a small or micro business.

Main Benefits of the Credit Guarantee Scheme

- The government provides a credit guarantee fund of up to INR 100 crore per MSME owner.

- You can buy the latest machines for your business without worrying about providing collateral.

- Your small or micro-enterprise can grow faster with this financial help.

Also Read: NPS Vatsalya Scheme

Documents You Need to Apply

- Aadhar Card

- Ration Card

- Mobile Number

- Electricity Bill

- Address Proof

- PAN Card

How to Apply Online for the Credit Guarantee Scheme for MSME

Step 1: Go to the official CGTMSE website and find the application form.

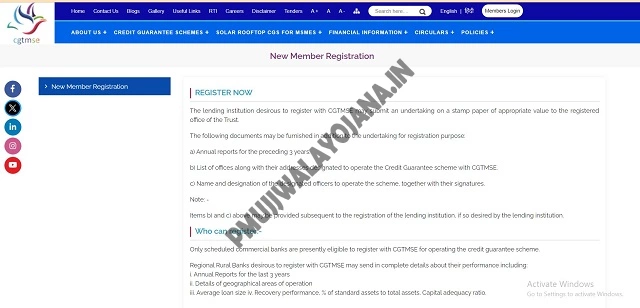

Step 2: Click on New Member Registration on the homepage.

Step 3: Fill out the form with your details and upload the required documents.

Step 4: Check the information and click submit to finish your application.

How to Apply Offline for the Credit Guarantee Scheme for MSME

Step 1: Visit the nearest bank branch or regional office.

Step 2: Talk to the bank official and get the application form.

Step 3: Fill in all details and attach the required documents.

Step 4: Review and give the form to the official.

Contact Details

- Phone Numbers: (022) 6722 1553, 6722 1438, 6722 1483

Common Questions

When was the Credit Guarantee Scheme for MSME 2025 announced?

It was announced during the Union Budget presentation for 2024-25.

What is the maximum credit guarantee offered?

The government guarantees up to INR 100 crore per MSME owner.

Why was the Credit Guarantee Scheme for MSME 2025 started?

To help small and micro enterprises buy new machines without worrying about money problems, so they can grow their business easily.