Aatmnirbhar Haryana Loan Scheme 2025 is here to support small business owners in Haryana by offering loans. Under this scheme, eligible people can get a loan of ₹15,000 at a low interest rate to start their own business. Around 3 lakh poor individuals in the state will benefit from loans at just 2% interest. You can apply online by visiting the official website atmanirbhar.haryana.gov.in. This article covers everything you need to know about the scheme including how to apply, benefits, and eligibility, so keep reading for a clear understanding.

Details about Aatmnirbhar Haryana Loan Scheme 2025

Earlier, loans under the Haryana DRI Yojana were given at 4% interest, but now under the Aatmnirbhar Haryana Scheme, loans are available at just 2% interest. The state government provides a 2% subsidy to cover the remaining interest. Because of the COVID-19 lockdown till the end of May 2020, many small businesses faced problems. To help them recover, the Haryana government introduced this ₹15,000 loan scheme. If you want to use this scheme, you need to apply through the official process.

Aatmnirbhar Bharat Employment Scheme

The Haryana government will provide loans of up to ₹15,000 at only 2% interest to 3 lakh poor small business owners to help them start their businesses. pic.twitter.com/rddNaISTFK — CMO Haryana (@cmohry) May 21, 2020

Objective of Aatmnirbhar Haryana ₹15,000 Loan Scheme

Because of the lockdown, small businesses had a hard time, which affected their income badly. With this in mind, the government started this scheme to help local entrepreneurs. The Haryana government offers ₹15,000 loans to support people in starting their small businesses. This loan at 2% interest will help around 3 lakh poor people in Haryana. The money will be sent straight to the bank accounts of the beneficiaries, so having a bank account is important.

Haryana Youth Employment Promotion Scheme

Main Highlights of Aatmnirbhar Haryana Loan Scheme

| Scheme Name | Aatmnirbhar Haryana Loan Scheme |

| Launched By | Chief Minister Manohar Lal Khattar |

| Beneficiaries | Poor small business owners in Haryana |

| Purpose | Providing loans for business |

Main Facts about Aatmnirbhar Haryana Loan Scheme

- Under the DRI Yojana, the Haryana government provides loans of ₹15,000 to small business owners.

- The scheme aims to increase income for poor families in the state.

- About 3 lakh poor people can start their businesses at a low interest rate of just 2%.

- DRI loans originally had 4% interest, but under this scheme you pay only 2%, and the government covers the rest.

- The loan amount will be directly transferred to the beneficiary’s bank account.

Pradhan Mantri Mudra Loan Scheme

Other Announcements by Haryana Government

- Education Loan Interest Waiver for Three Months: The Haryana government will pay the interest for three months on education loans for students who finished their studies this year or last year but are unable to start jobs or businesses due to COVID-19. Around 36,000 students will benefit from this with a budget of ₹40 crore.

- 2% Interest Subsidy on Shishu Mudra Loan: The government will cover 2% interest on Shishu loans up to ₹50,000 under the central government’s Mudra scheme. No collateral is needed, and the benefit will reach about 5 lakh people in Haryana.

Eligibility Criteria for DRI Loan

- Applicant must be a permanent resident of Haryana.

- For rural applicants, family annual income should be up to ₹18,000; for urban, up to ₹24,000.

- Applicant should not have received help under any government subsidy scheme.

- The beneficiary should not have another source of finance while holding an active DRI loan.

- Applicant must not own more than 1 acre irrigated or 2.5 acres non-irrigated land.

- SC/ST applicants are eligible regardless of land ownership if other criteria are met.

- Applicant should not be a defaulter on previous loans.

Eligibility for Shishu Loan under Mudra

- Applicant must be a resident of Haryana.

- Applicants can be individuals, proprietors, partnership firms, LLPs, private or public limited companies, or other legal entities.

- Micro and small non-agriculture enterprises involved in manufacturing, trading, or services are eligible as per MSMED Act, 2006.

- Applicants should not default on previous loans.

Eligibility for Education Loan

- Applicant must be a resident of Haryana.

- This applies to students who can’t pay EMI or interest due to COVID-19 between April 2024 and June 2024.

- Applicants should not be defaulters on previous loans.

Documents Needed for Aatmnirbhar Haryana Loan Scheme

- Permanent resident proof of Haryana

- Aadhaar Card

- Bank account details

- Residence proof

- Identity proof

- Mobile number

- Passport size photograph

How to Apply for Aatmnirbhar Haryana Loan Scheme?

If you want to take advantage of this loan scheme, you can apply online by following these steps. You can apply for DRI loans, Shishu loans under Mudra, or education loans based on your need.

Applying for DRI Loan

- Go to the official Aatmnirbhar Haryana website.

- On the home page, click on the option Apply for Bank Loan.

- You will see a form; select the loan type as DRI Loan.

- Choose your bank, district, and branch.

- Read the eligibility criteria and check the box confirming you meet the conditions.

- Click the proceed button.

- Enter your Aadhaar number for verification and complete the OTP validation to submit your application.

Applying for Shishu Loan under Mudra

- Visit the official website and click Bank Loan.

- On the next page, select Shishu Loan under Mudra Yojana in loan type.

- Select your bank, district, and branch.

- Read and confirm the eligibility criteria.

- Click proceed, enter Aadhaar, verify with OTP to complete the application.

Applying for Education Loan

- Visit the official website and click Bank Loan.

- Select Education Loan as the loan type.

- Choose your district, bank branch, etc.

- Read eligibility criteria and confirm by checking the box.

- Click proceed, enter Aadhaar number, verify OTP to finish application.

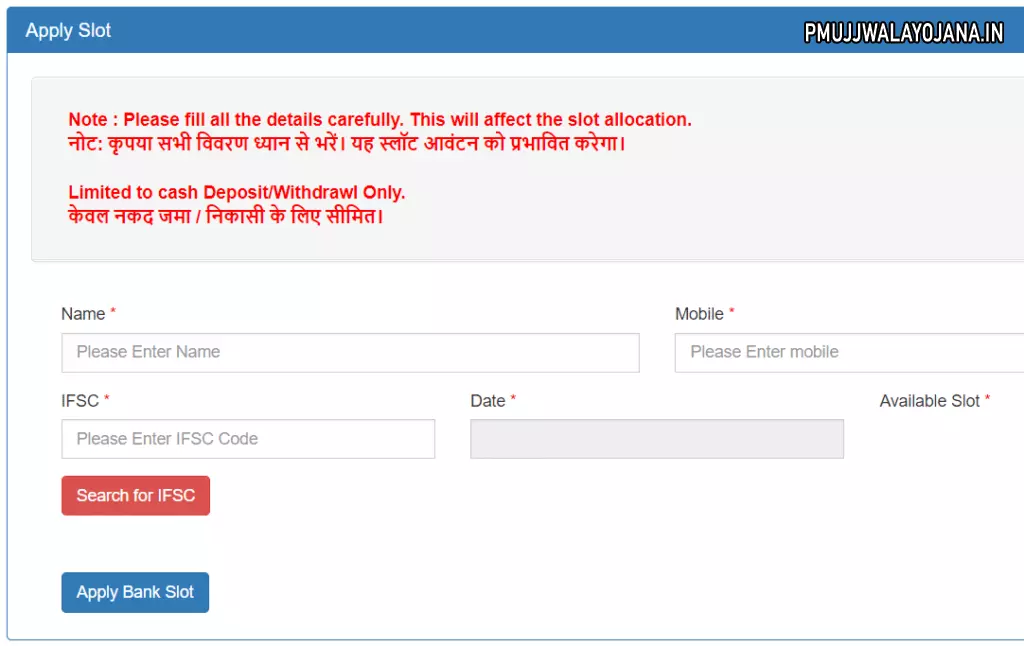

How to Book Your Bank Slot

- Visit the official Aatmnirbhar Haryana website.

- Click on Book Bank Slot option.

- Fill in your name, mobile number, IFSC code, and other details, then click Apply Slot.

- Until 28 August 2024, 8968 bank slots have been booked through the portal.

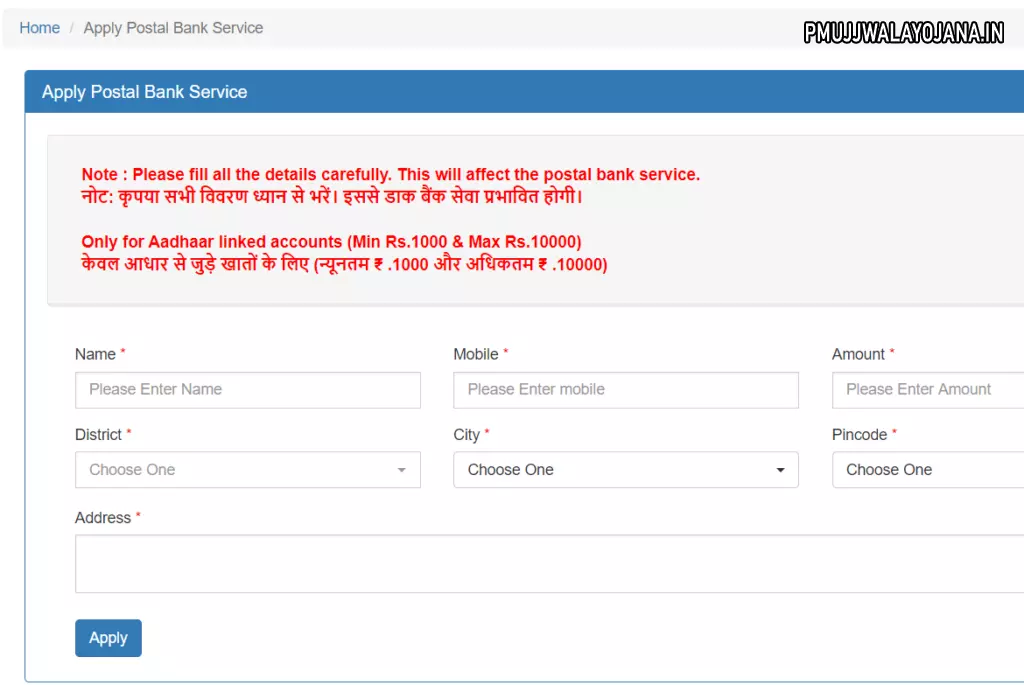

How to Use Postal Banking Service Online

- Go to the official website, and on the home page, click on Postal Bank Service.

- Fill in details like name, mobile, amount, district, city, pincode, and address.

- After filling the form, click on Apply to get access to postal banking service.

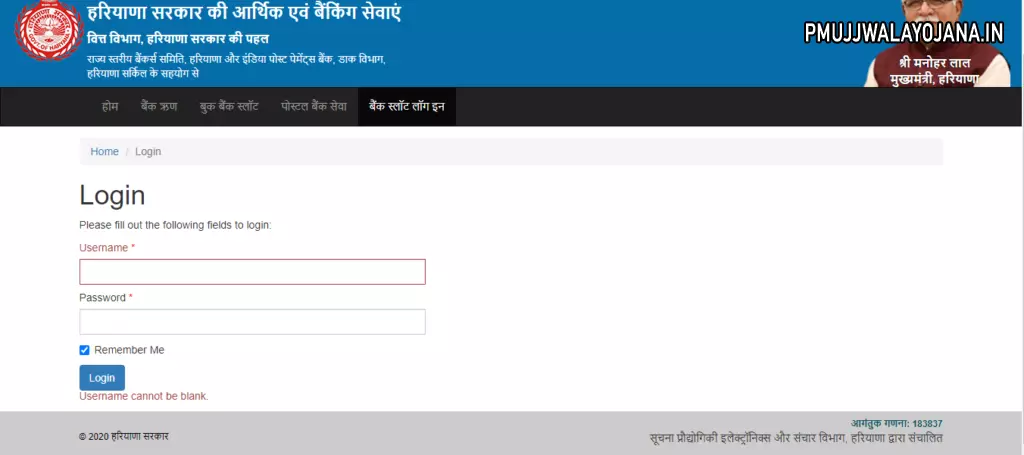

How to Login to Bank Slot

- Visit the official website, then click on Bank Slot Login on the home page.

- Enter your username, password, and captcha code on the login form.

- Click the login button to access your account.

Through this scheme, Haryana’s small business owners and students facing tough times can get support with low-interest loans. Make sure you meet all the eligibility requirements and submit your application correctly on the official portal for the best chance to get benefits.