If you are a government employee in Assam planning to buy your own house, the Apun Ghar Loan Scheme 2025 is here to help you. This scheme offers loans to Assam state employees to buy their first home with easy terms and lower interest rates.

Overview of the Apun Ghar Loan Scheme

The Apun Ghar Loan Scheme started in 2016-17 to support Assam state employees in owning homes. So far, the Assam government has provided loans worth 5663 crores through this scheme. It offers financial support with loans and subsidies, making it easier for employees to buy their first house.

This scheme is only for Assam government employees who want to buy their first house. If you have already taken housing loans under other schemes, this one won’t apply to you.

Purpose of the Apun Ghar Loan Scheme

This scheme aims to help Assam government employees improve their living standard by offering affordable home loans. The interest rates are lower than regular banks, making repayments easier. It benefits those who might find it difficult to afford a home otherwise.

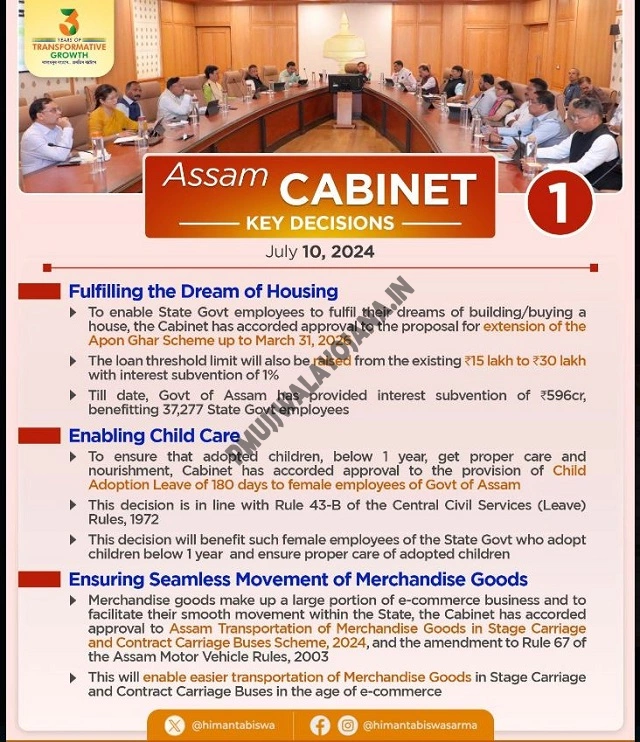

In the #AssamCabinet meeting held recently,

7The Apun Ghar Scheme was extended for State Govt employees

7Other employee benefits were also discussed

Himanta Biswa Sarma (@himantabiswa) July 10, 2024

Main Details of the Apun Ghar Loan Scheme

| Scheme Name | Apun Ghar Loan Scheme |

| Launched by | Government of Assam |

| Scheme Objective | Provide housing loans to Assam state government employees |

| Who can benefit? | Assam state government employees |

| Official Website | Assam Apun Ghar Loan Portal |

Who Is Eligible for the Apun Ghar Loan Scheme?

- You must be a permanent resident of Assam.

- You should be a government employee in Assam.

- Your family income should not exceed INR 20 lakh per year.

- You must take a housing loan above INR 5 lakh from Scheduled Commercial Banks, Regional Rural Banks, or Assam Cooperative Apex Bank within Assam.

- The loan must be sanctioned on or after April 1, 2019.

- This should be your family’s first house.

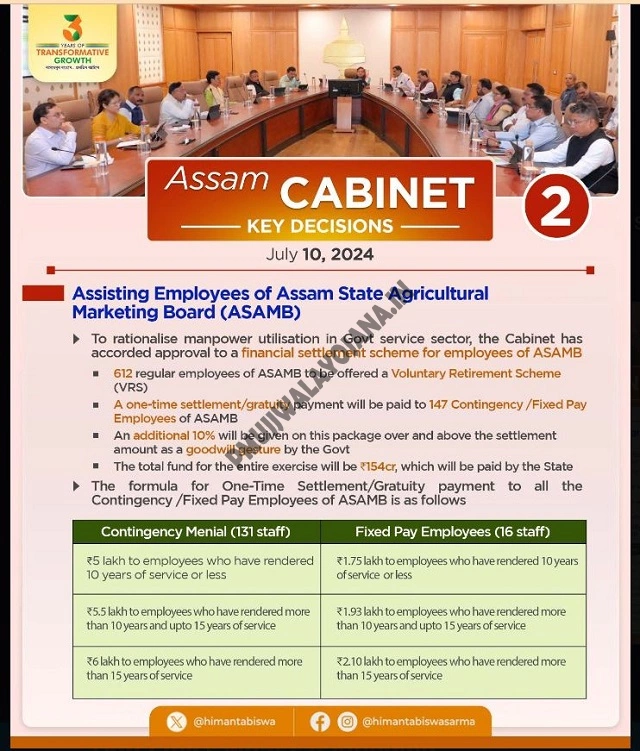

Assam Cabinet Key Decisions

Assam Cabinet Key Decisions

Documents You Need

- Aadhar Card

- Email ID

- Mobile Number

- Electricity Bill (as address proof)

- Address Proof

- PAN Card

Loan Amount and Interest Rates

- Under the updated Apun Ghar Loan Scheme 2025, loans up to INR 30 lakh are available for Assam government employees.

- Government employees get an interest subsidy of 3.5% on home loans up to INR 15 lakh for a loan term of 20 years.

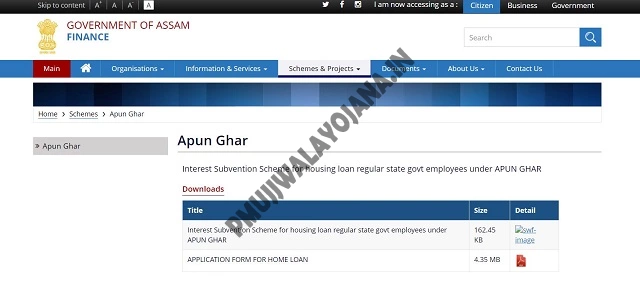

Assam Apun Ghar Loan Scheme

Assam Apun Ghar Loan Scheme

Benefits of the Apun Ghar Loan Scheme

- You get easy access to loans made specifically for Assam government employees.

- The scheme makes owning your first house more affordable with lower interest rates and government subsidies.

- The financial support reduces your worries about home buying expenses.

How to Apply for the Apun Ghar Loan Scheme 2025

Follow these simple steps to apply:

Step 1: Visit the official Apun Ghar Loan Portal and find the application form for the scheme.

Apun Ghar Loan Scheme Portal

Apun Ghar Loan Scheme Portal

Step 2: Click on the APPLICATION FORM FOR HOME LOAN link to download the form.

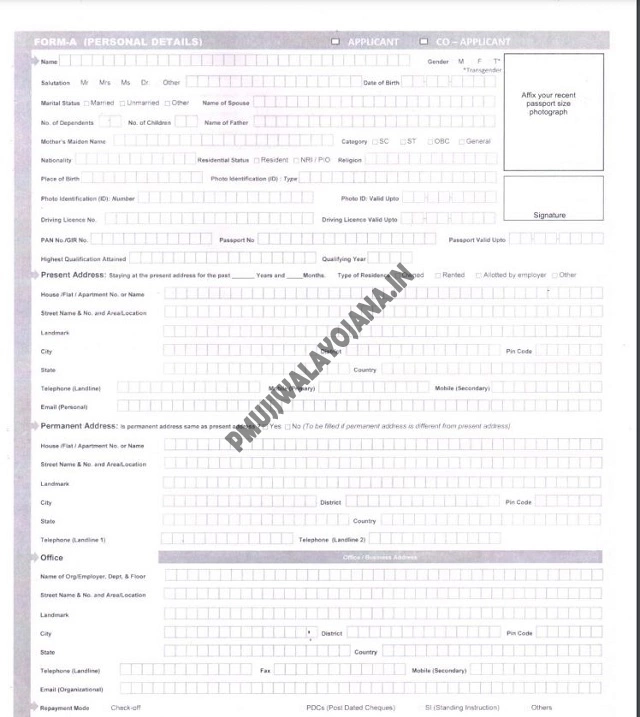

Registration Form

Registration Form

Step 3: Print the application form and fill in all the required details.

Step 4: Attach all the necessary documents mentioned earlier with your application.

Step 5: Submit your filled application to the concerned government officer.

Details to Fill in the Application Form

- Name

- Gender

- Date of Birth

- PAN Number

- Email ID

- Mobile Number

- Address

- IFSC Code of Loan Branch

- Bank Name

- Branch Name

- Account Number

- Loan Amount Sanctioned

- Date of Loan Sanction

- Property Address

Frequently Asked Questions (FAQs)

Which state runs the Apun Ghar Loan Scheme 2025?

The Assam state government runs the Apun Ghar Loan Scheme.

Who can benefit from this scheme?

All Assam state government employees can apply and benefit from this housing loan scheme.

What is the maximum loan amount under the Apun Ghar Loan Scheme 2025?

The maximum loan amount is INR 30 lakh for qualified applicants.

If you are an Assam government employee wanting to own your first home, the Apun Ghar Loan Scheme 2025 is a great option to get financial support with easier loan terms and lower interest. Check your eligibility and apply through the official portal!