AP Stamps and Registration in 2025 – When you buy property in Andhra Pradesh, you need to pay stamp duty and register the property with the AP Land Registration and Property Department. According to Section 17 of the Indian Registration Act 1908, property deeds must be registered within 6 months after the deed is completed. The AP Gram Panchayats Act, 1964 and Andhra Pradesh Municipalities Act, 1965 say that transfer duties must be paid when you register the property deed on IGRS AP. Here, you get a full update on Stamps and Registration in Andhra Pradesh 2025 and how it works.

Understanding AP Stamps and Registration

Like all other Indian states, in Andhra Pradesh buying any property requires paying stamp duty and registering the property. The Andhra Pradesh Property and Land Registration Department handles all the processes related to stamp duty here. After buying, both the buyer and seller must visit the sub-registrar’s office in the property area with two witnesses to officially record the purchase. Besides collecting stamp duty payments, the AP Property and Land Registry offers many online services to make things easier for you.

New government rules say you can register property anywhere in the district. So, you can go to the nearest Sub-Registrar Office (SRO) to your home or workplace for registering papers and paying stamp duty. Remember, two witnesses are needed for registration. Every day about 5,000 to 6,000 properties get registered, and annually around 17 to 18 million properties in Andhra Pradesh complete their registrations.

See all services on AP Seva Portal

AP Stamps and Registration Online Portal

You can visit registration.ap.gov.in for details on AP stamp duty and deed registration. To register land or property, you can submit some documents online but the buyer, seller, and two witnesses need to be present at the sub-registrar office where the property is located.

The AP registration office also lets you access land records and register deeds online. Use these services to check and get your IGRS AP deed details easily.

AP Land Records

Registration Charges for AP Property

| Documents | Registration Fee |

| Sale deed | 1% |

| Agreement of sale cum general power of attorney | Rs 2,000 |

| Development agreement cum general power of attorney | 0.5% (max Rs 20,000) |

| Power of attorney to sell / construct / develop / transfer immovable property | 0.5% (min Rs 1,000, max Rs 20,000) |

| License deed | 0.1% |

| Conveyance deed | 0.5% |

| Lease deed / Rental agreement | 0.1% |

| Mortgage | 0.1% |

How to Pay Stamp Duty in Andhra Pradesh

You can pay stamp duty in AP in different ways. You can buy stamp paper at the registration office or use a franking machine. Payment can be made by cash, money order, debit or credit card at the office. For franking, you pay fees at centers with franking machines.

You can find a list of places to buy stamp paper or franking supplies on the official IGRS AP website. Just pick your registration district from the drop-down menu for exact locations.

Webland AP

Paying Stamp Duty Online via SHCIL in Andhra Pradesh

Andhra Pradesh works with SHCIL (Stock Holding Corporation of India Ltd) for online stamp duty payment. SHCIL manages India’s e-stamping and is authorized by RBI. To pay stamp duty online:

- Go to the SHCIL official website.

- Select Andhra Pradesh on the homepage.

- Log in with your username and password.

- Enter the property details and pay using net banking, NEFT, or debit/credit card.

- You can also download lists of SHCIL branches and Sub-Registrar offices in Andhra Pradesh.

Documents Needed for AP Stamp and Registration

- Photos of buyer and seller

- ID proofs like Voter ID, Aadhaar card, or Passport

- Original sale deed

- Property registration card from Municipal Survey Department

Steps for Registering Property in Andhra Pradesh

- Check the property price.

- Compare circle rate with actual price. Stamp duty applies on the higher value. Buy non-judicial stamp papers accordingly.

- Take all papers to the sub-registrar office. They will prepare a check slip.

- The registrar does E-KYC and takes fingerprints of the people signing, verified via Aadhaar.

- Pay stamp duty, registration fees, and any other costs.

- The registrar prints and registers the documents, gets thumb impressions, and hands over the registered document.

- Registered documents are scanned and uploaded to a server accessible through the online portal.

- If verification fails, you need to correct and resubmit your application.

AP Stamp Duty Refund Rules

If you want a refund of stamp duty in Andhra Pradesh, you can apply within 6 months. The office refunds up to 90% of the stamp duty (10% is deducted). To apply, send your request with challan and original bank receipt to your District Collector/Sub-Collector/Deputy Collector/RDO/Tahsildar. After verification, you’ll get a certificate for the refund balance.

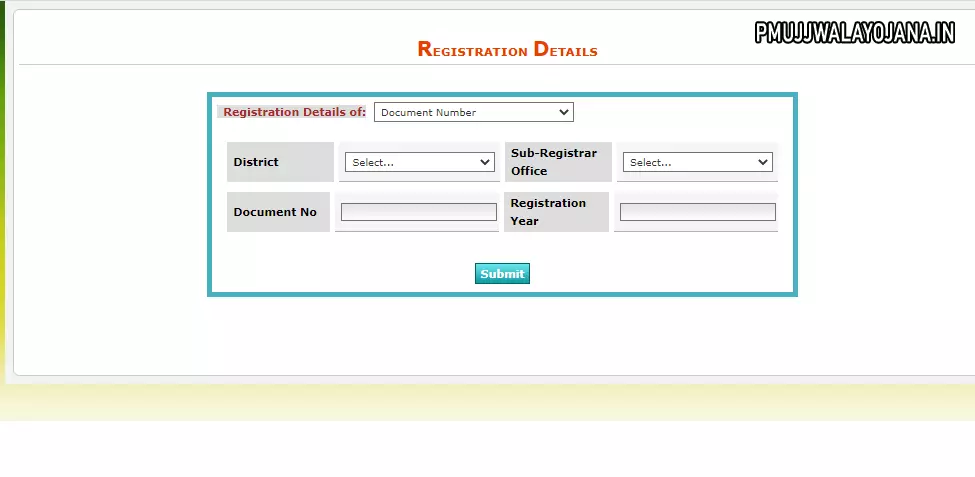

How to Check AP Land Registration Details Online

- Visit the official AP Stamps and Registration website.

- On the page, under “Services”, click on “Document Details” to access land registration information.

- On the new page, you can search by document number, layout plot, or apartments for registration details.

- Select “Document Number” from the drop-down menu to search by document number.

- Choose your district and then sub-registrar office.

- Enter the document number and the year of registration, then click “Submit”.