Indira Gandhi Shehri Credit Card Yojana 2025 is a scheme started by the Rajasthan government to support small traders, street vendors, and young workers affected by the coronavirus pandemic. If you qualify, you can get an interest-free loan of up to ₹50,000 to help restart your business and get through financial problems.

Overview of Indira Gandhi Shehri Credit Card Yojana 2025

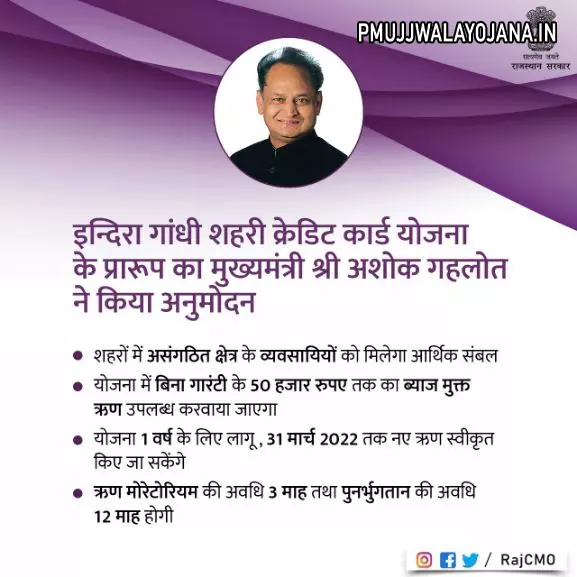

This scheme was started by Rajasthan’s Chief Minister Ashok Gehlot to provide loans to unemployed small traders and service workers in urban areas affected by COVID-19 lockdowns. It offers an interest-free loan up to ₹50,000 without any guarantee to help people overcome money problems caused by the pandemic. The scheme runs for one year, and you can apply online until March 31, 2024.

Main Details of Indira Gandhi Shehri Credit Card Yojana 2025

| Scheme Name | Indira Gandhi Shehri Credit Card Yojana |

| Started By | Rajasthan Government |

| Beneficiaries | Urban residents of Rajasthan |

| Purpose | To provide loans up to ₹50,000 |

| Application Mode | Online and offline |

| Loan Interest | Interest-free |

| Loan Repayment | 12 monthly installments after 3 months moratorium |

| Application Last Date | 31 March 2024 |

| State | Rajasthan |

How the Scheme Works

Urban Local Bodies (ULB) set up a screening committee led by municipal officers together with representatives from District Industry Centres and banks. This committee checks and approves loan applications. If you’re approved, you’ll get the loan amount through designated web portals and mobile apps. Scheduled caste, scheduled tribe, and other backward class citizens in urban areas are supported by the scheme body Anuja Corporation.

People in Charge

- District Collector: Main officer for running and monitoring the scheme.

- Sub-Divisional Officers: Check and verify beneficiaries in their areas.

Who Can Get Help from This Scheme?

- Hairdressers

- Rickshaw pullers

- Potters

- Leather workers

- Electricians

- Tailors

- Laundry workers

- Painters

- Other small urban service workers

Main Goals of Indira Gandhi Shehri Credit Card Yojana 2025

The scheme supports unemployed youth and informal sector workers affected by lockdowns by giving them financial help to restart their businesses. It also promotes self-employment opportunities in urban areas and helps lower unemployment and money problems among Rajasthan’s urban poor.

Benefits and Features

- ₹50,000 interest-free loan available for eligible people.

- No collateral or guarantee required.

- Repayment starts after 3 months, spread over 12 monthly installments.

- Apply online before 31 March 2024 via official portals or eMitra kiosks.

- No processing or service fees.

- About 5 lakh beneficiaries will be served, on a first come, first served basis.

- You can withdraw the loan amount via debit or credit card in full or in parts.

- All scheme expenses are paid by the state government.

Important Points

- Only urban residents of Rajasthan are eligible.

- Age must be between 18 and 40 years.

- Applicant’s monthly income should be ₹15,000 or less.

- Family monthly income should be ₹50,000 or less.

- Must have certificate or ID card from urban bodies.

- Local authorities will help with loan repayment.

How to Apply for Indira Gandhi Shehri Credit Card Yojana 2025

- Go to the official web portal or use eMitra kiosks to apply.

- Fill in your details and upload documents like Aadhaar card, residence proof, income certificate, age proof, photo ID, mobile number, and passport size photo.

- Local committees will review your application.

- Approval takes about 25 working days after submission.

- After approval, you’ll get a credit card to withdraw the loan amount.

Repayment Information

- Loan must be paid back in 12 equal monthly installments.

- You can repay through cash, online payment, or UPI.

Loan Institutions and Credit Guarantee

- Loans are given through scheduled commercial banks, regional rural banks, small finance banks, cooperative banks, and non-banking financial companies.

- All loans have credit guarantee coverage from Credit Guarantee Fund Trust for Micro and Small Enterprises.

- Credit guarantee fee and GST charges apply on loans.

Documents You Need

- Aadhaar Card

- Residence Proof

- Income Certificate

- Identity Proof

- Age Proof

- Mobile Number

- Passport Size Photo

The Indira Gandhi Shehri Credit Card Yojana 2025 is a great chance to restart small urban businesses hit hard by the pandemic. If you meet the eligibility, be sure to apply online before the last date to get this interest-free loan and support your livelihood.