Are you looking for a simple and affordable insurance plan to protect yourself from accidents? The PMSBY scheme 2025, also known as Pradhan Mantri Suraksha Bima Yojana, is here to help. This government health insurance plan offers coverage for accidental death and disability for Indian residents aged 18 to 70. Let’s look into how this low-cost plan can secure your future.

PMSBY Scheme 2025 – What You Need to Know

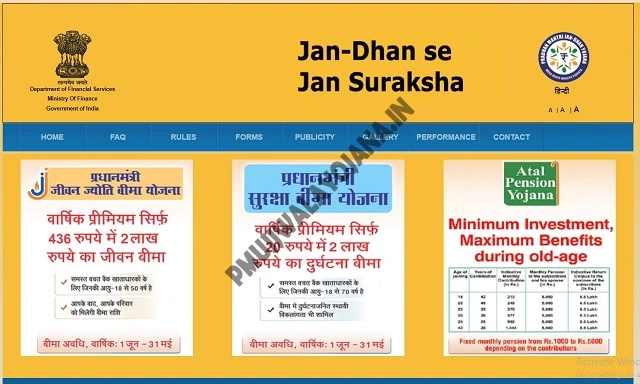

The PMSBY scheme gives you health insurance coverage up to INR 2 lakh for just INR 20 a year. It provides financial support if you suffer death or disability because of an accident. The plan lasts for one year, but you can renew it every year to stay covered. Plus, the premium is automatically deducted from your savings bank account, so it’s hassle-free.

Main Details About PMSBY

| Scheme Name | PMSBY (Pradhan Mantri Suraksha Bima Yojana) |

| Launched By | Government of India |

| Scheme Type | Accidental Health Insurance |

| Beneficiaries | Indian Citizens aged 18 to 70 |

| Official Website | jansuraksha.gov.in |

Who Can Join PMSBY Scheme?

- You should be an Indian resident between 18 and 70 years old.

- You need a savings account in any bank linked to your Aadhaar card.

Main Benefits of PMSBY Scheme

- Accidental Death Cover: Receive INR 2 lakh if you pass away due to an accident.

- Total Disability: Get INR 2 lakh for full disability caused by accidents.

- Partial Disability: Get INR 1 lakh for partial disability due to accidents.

- Affordable Premium: Only INR 20 deducted once a year from your bank account.

- Easy Renewal: Renew your coverage every year on or before 31st May.

How to Apply and Pay Premium

Applying is straightforward! If you have a savings bank account, you can contact your bank or visit the official Jan Suraksha website. The premium of INR 20 is auto-debited from your bank account each year.

Documents Needed

- Aadhaar Card

- Email ID and Mobile Number

- Address proof like Electricity bill

- PAN Card (if applicable)

- Passport size photo

- Birth or Death certificate (if claiming benefits)

How to Claim PMSBY Scheme Benefits

If an accident causes death or disability, you can claim your insurance amount by following these steps:

- Visit the official Jan Suraksha website or your bank branch where you signed up.

- Get the claim application form from the bank or website.

- Fill out the form carefully and attach all required documents like medical reports, FIR, and identity proofs.

- Submit the completed form to your bank or insurance company.

- The insurer will check and settle the claim amount as needed.

Renewal Process for PMSBY Scheme

To keep your insurance active, renew it each year like this:

- Go to the official Jan Suraksha website.

- Click on the ‘Renew’ option.

- Enter the required information and upload the needed documents.

- Submit the application and make sure the premium is deducted before 31st May.

Contact Information

- Helpline Number: 1800-110-001

Frequently Asked Questions (FAQs)

What is the insurance cover under PMSBY?

You get up to INR 2 lakh coverage for accidental death and full disability. For partial disability, INR 1 lakh is paid.

How much premium do I need to pay?

Only INR 20 per year, deducted from your savings account.

Who can apply for PMSBY?

Anyone aged 18 to 70 with a savings bank account can apply.

Keep yourself and your family safe by applying for the PMSBY scheme 2025 today. Don’t miss the chance to get affordable accident insurance with easy claims and renewals. For more details, visit the official Jan Suraksha website.