Pashu Kisan Credit Card is a helpful scheme started by the Haryana government to support farmers involved in animal husbandry. This plan aims to double farmers’ income by offering easy loans to take care of their animals. If you are a livestock farmer in Haryana, this article will guide you through everything about the Pashu Kisan Credit Card Yojana – what it is, benefits, eligibility, documents needed, and how to apply online in 2025.

About Pashu Kisan Credit Card Yojana 2025

The Pashu Kisan Credit Card scheme was started by Haryana’s Animal Husbandry and Agriculture Minister JP Dalal. With this scheme, farmers can get loans for their livestock. For example, a farmer with cows can get a loan of ₹40,783, and for buffaloes, the loan amount is ₹60,249. The loan is given in 6 equal installments, which the farmer has to repay at 4% interest per year. Interest starts from the date of the first installment.

Farmers need to get a Pashu Kisan Credit Card to get these benefits. This credit card works like a bank debit card and helps farmers access their loan amount easily.

Main Details of Pashu Kisan Credit Card Yojana

| Scheme Name | Pashu Kisan Credit Card |

| Launched By | Haryana Government |

| Beneficiaries | Livestock Farmers in Haryana |

| Objective | Grow animal farming business in the state |

| Official Website | Click here |

| Year | 2025 |

Interest Rate and Loan Amount under Pashu Kisan Credit Card

In Haryana, about 16 lakh families own dairy animals. All these livestock are being tagged for better management. Under this scheme, farmers will get loans at an interest rate of only 4%, which is lower than the usual 7% offered by banks. Also, the central government provides a 3% interest subsidy. Farmers can take a maximum loan up to ₹3,00,000.

| Animal | Loan Amount |

|---|---|

| Cow | ₹40,783 |

| Buffalo | ₹60,249 |

| Sheep/Goat | ₹4,063 |

| Layer Chicken | ₹720 |

Purpose of Pashu Kisan Credit Card 2025

Many farmers keep animals along with crop farming. Sometimes, they need to sell animals during money problems or face difficulties treating sick animals due to lack of funds. This scheme helps farmers by giving them loans so they can take proper care of their livestock. It will also help grow the animal husbandry business and modernize farming in the state.

Who Can Benefit from Pashu Kisan Credit Card?

| Area | Beneficiaries |

|---|---|

| Fish Farming | Self-help groups, individual farmers, partners, groups, tenant farmers, sharecroppers, women groups, joint liability groups |

| Marine Fishing | Self-help groups, farmers, women groups, joint liability groups |

| Poultry Farming | Individual or joint borrowers, joint liability groups, self-help groups (farmers of goats, sheep, poultry, pigs, rabbits, birds etc.) |

| Dairy | Individual or joint borrowers, joint liability groups, self-help groups (farmers owning or leasing sheds) |

Top Banks Offering Pashu Kisan Credit Card Loan

- State Bank of India

- Punjab National Bank

- HDFC Bank

- Axis Bank

- Bank of Baroda

- ICICI Bank

Loan Amounts for Different Animals

- Cows: ₹40,783

- Buffaloes: ₹60,249

- Sheep and Goats: ₹4,063

- Poultry Farming: ₹720

Benefits of Pashu Kisan Credit Card Yojana 2025

- Farmers can get loans without giving any security.

- The credit card works like a regular bank debit card.

- Loan amount per buffalo is ₹60,249 and per cow ₹40,783.

- Loan up to ₹1.60 lakh is available without collateral security.

- Loans are offered at 7% interest with a 3% subsidy if paid on time.

- For loans over ₹3 lakh, the interest rate is 12%.

- Interest payment is done yearly for further installments.

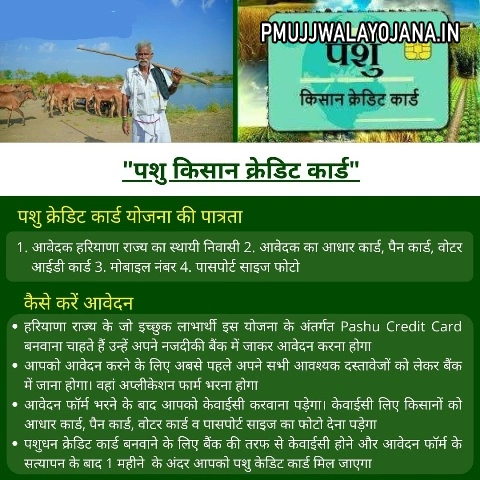

Documents Needed to Apply for Pashu Kisan Credit Card

- Permanent resident of Haryana state

- Animal health certificate

- Insurance certificate of the animal (only insured animals are eligible)

- Applicant must be medically fit

- Aadhar Card, PAN Card, Voter ID Card

- Mobile number

- Passport size photo

How to Apply for Pashu Kisan Credit Card in 2025?

- Visit your nearby bank branch that offers the scheme.

- Carry all required documents with you.

- Ask for the application form and fill it carefully.

- Attach photocopies of all documents with the form and submit it to the bank official.

- After checking, you will get the Pashu Kisan Credit Card within 1 month.

Pashu Kisan Credit Card Yojana 2025 is a great chance for animal farmers in Haryana to get financial support easily and improve their livestock business. Make sure you have all documents ready and apply soon at the nearest bank.