LIC New Children Money Back Plan 932 – The resilience of children today will determine the course of the globe. However, the dream won’t come true if they aren’t ready for it. This is why some premium plans are accessible for kids to generally guarantee their future. Particularly well-known for its advantages for developing children is LIC New Children Money Back Plan (932). The stability provided up to age 25 and the provision of a lump sum payment for completing significant tasks are the two reasons why parents and grandparents chose this policy for their cherished children. Read below to get detailed information related to the LIC New Children Money Back Plan like highlights, features, benefits, highlights, Eligibility Criteria, documents required, Exclusions under specific situations, and much more

About LIC New Children Money Back Plan 932

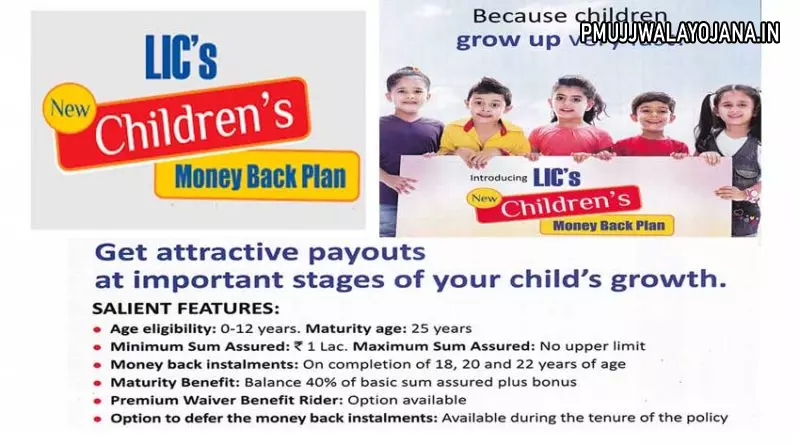

The New Children’s Money Back Plan from LIC is a combination insurance and investment plan that can be utilized to meet a child’s financial needs until they are 25. Being a participating plan, it qualifies for a bonus based on LIC’s performance. However, this plan only offers risk coverage on the child’s life, not the lives of the parent or grandparent. Therefore, it does not guarantee the future of the child in the event of the passing of a parent or grandparent. This is more of an investing strategy with the needs of the child at age 25 in mind.

Details of LIC New Children Money Back Plan

| Plan Name | LIC New Children Money Back Plan |

| Plan type | Participating non-linked money-back scheme |

| Term of Policy | 25 years minus entry age |

| Plan basis | Individual |

| Sum assured | Minimum – Rs 1 lakh Maximum – No upper limit |

| Grace period | 15 days for the monthly payment option 30 days for the other payment modes |

| Premium payment frequency | Monthly, quarterly, half-yearly, or annually |

| Availability of Loan | Through the policy, policyholders can avail of a loan |

| Free look/cooling off period | Within 15 days of obtaining the policy, people have the option to return it |

| Revival | Policies that have expired may be renewed by paying the whole outstanding balance within two years of the first overdue due. |

| Maturity benefits | There will be a maturity benefit equal to the sum assured and any relevant incentives. |

| Policy coverage | maturity benefit, Death benefit, and survival benefit |

Other Plans of LIC

एलआईसी कन्यादान पॉलिसी

LIC New Children Money Back Plan Features

Some of the key features of the LIC New Children Money Back Plan are as follows:

- This program is an unlinked money-back guarantee for growing kids

- One person at a time may be subjected to each strategy

- The whole of the base sum assured at the time of plan purchase, along with any applicable bonuses, will be the maturity benefit.

- The maturity age (25 years) less the entering age will determine the length of the policy. For instance, if the age entered is 8, the term will be 25 – 8 = 17 years.

- The numerous alternatives offered with plans can be used to pay the premiums. In this instance, the premiums might be paid on a monthly, quarterly, half-yearly, or annual basis.

- The policyholder can find loans from this plan using a unique feature.

- After purchasing the plan, you have 15 days from the purchase date to return it.

- The grace period or delayed payments vary according to the frequency of premium payments. The grace period is around 15 days if the payment is made monthly, and it is 30 days for other frequency types.

- The minimum basic sum promised is Rs. 100000, while the maximum basic sum assured has no upper limit.

- By paying off all outstanding premiums at once, there is a chance to reinstate the policy within two years.

- This policy offers three main benefits: the maturity benefit, the death benefit, and the survival benefit.

- The manner of rebates affects the likelihood of receiving a High Sum Assured Rebate. It will be 2% of the tabular premium in the annual mode and 1% of the tabular premium in the half-yearly method. There are no refunds due for any other modes save the quarterly and monthly ones.

- This plan offers Paid-Up value if the premiums and all other recurring payments are made on time for three years. This policy will no longer be regarded as a vacant plan and will instead be reduced to the following plans:

- “Death Paid-up Sum Assured” following the policyholder’s untimely demise. The sum that must be paid will equal the sum of all premiums paid, all amounts owed, and the death benefit.

- The maturity Paid-Up Sum Assured is the amount that will be paid after the maturity and is calculated as follows: (total premiums paid/total amount payable) x (sum assured on maturity + total survival benefits payable under the terms and conditions of that policy) – total survival benefits already paid.

- After paying payments for three full years, the coverage may be surrendered. If so, the surrender value will consist of the percentage value of all premiums paid up to that point, minus any additional premium payments and premium rider values (if any), which are survival benefits that are already owed to the policyholder and are still owed.

- The “Premium Waiver Benefit Rider” option is available to subscribers. Following the demise of the subscriber or the person who is responsible for paying the payments, all premiums will be waived at this point.

LIC New Children Money Back Plan Benefits

Some of the key benefits of the LIC New Children Money Back Plan are as follows:

- Maturity Benefit: The sum assured on maturity, along with the final additional bonus and vested simple revisionary bonuses, will be payable if the life assured survives the policy period while the plan is still in effect. The sum assured on maturity is equal to 40% of the basic sum assured.

- Survival Benefit: If the LIC New Children’s Money Back Plan is in effect, 20% of the sum insured will be paid when the life assured survives every policy anniversary that either coincides with or is followed by the completion of 17, 20, and 22 years of age.

- Participation in Profits: While the policy is in effect, it will share in the company’s profits and be eligible to receive straightforward reversionary incentives based on the company’s performance. The final additional incentive will not be given under paid-up insurance. Likewise, if the policy is not claimed by death or maturity throughout the year, the final additional bonus will be announced within the policy.

- Death Benefit: In the tragic event that the policyholder passes away, the full amount guaranteed at death, including any bonus amounts, will be paid out.

LIC’s New Children’s Money Back Plan Eligibility Criteria

The Eligibility Criteria for LIC’s New Children’s Money Back Plan are as follows:

| Minimum Age for Entry | 0 years (at birth) |

| Maximum Age for Entry | 12 years |

| Age at Maturity | 25 years |

| Payment Modes | Monthly, Quarterly, Half-yearly, Annual, |

Documents Required

- The application or proposal application form must be completed by the policyholder.

- It will be necessary to know the insurance name holder’s whole medical history.

- Along with current address proof, KYC documents are necessary.

- There may be times when policyholders are compelled to undergo a medical checkup. But that relies on both the amount assured and the child’s age.

Exclusions under Specific Situations

The following situations will result in the policy not being cleared:

- If the policyholder dies by suicide within a year of the risk beginning, LIC will only cover 80% of the premiums already paid, excluding any future premiums and service fees. If the admission age is less than 8, this is also not relevant.

- If the policyholder dies by suicide within a year of the revival plan, the Corporation will only make a payment that is greater than 80% of the premiums paid up to the date of death and excludes service taxes and additional premium payments made up to that point.

- If the policy name bearer was younger than 8 years old when the policy was revived or if the policy had already expired without receiving the paid-up amount, this scheme would not be considered.

LIC New Children Money Back Plan Premium Payment

Members who choose this policy must pay the premium for the entire policy term; they have the choice of paying it monthly, quarterly, half-yearly, or annually. The sum assured that a person chooses determines the maximum amount of premium they will ever pay.