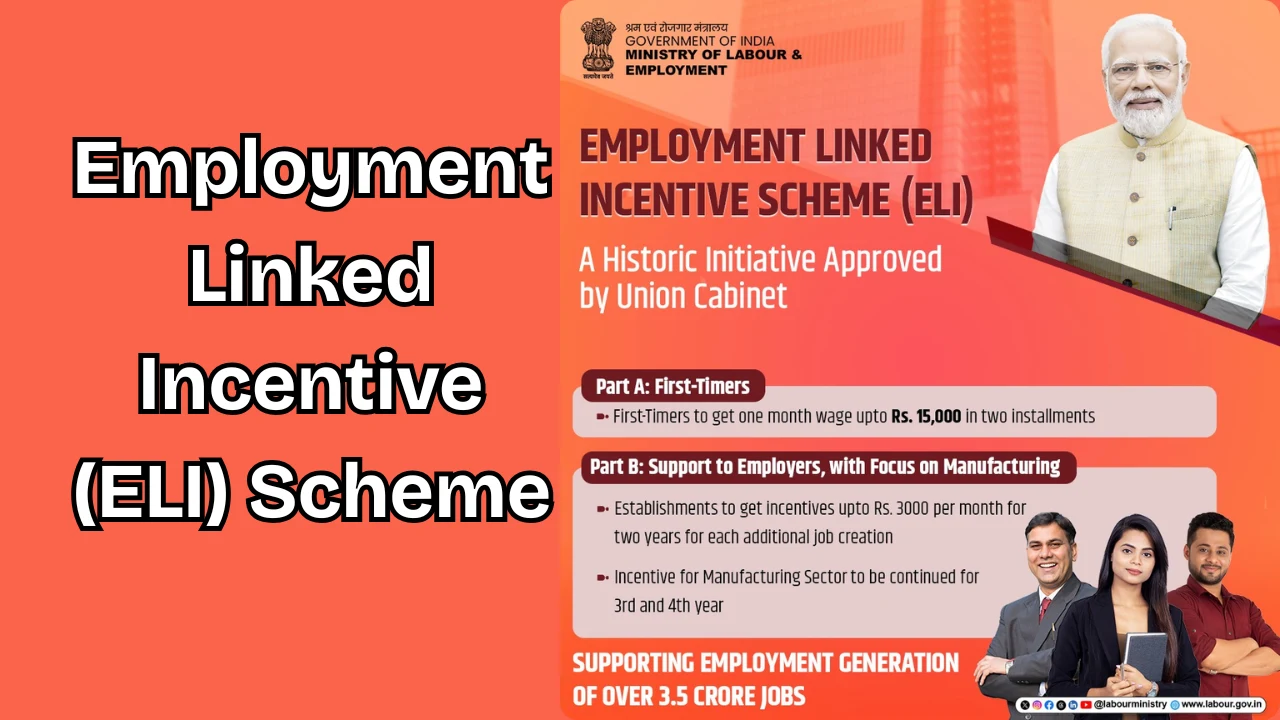

Employment Linked Incentive Scheme 2025 – On 1st July 2025, the Central Government started a new plan called the ELI Scheme. This plan helps more people get good jobs and earn money regularly. It also gives money help to both workers and companies. If you are starting your first job or if you are a company hiring new workers, this scheme is made for you.

With this scheme, the government aimed to generating over 3.5 crore jobs in two years. The scheme, with a total outlay of ₹99,446 crore (nearly ₹1 lakh crore), will support job creation, enhance employability, and expand social security coverage across sectors, with a special push for manufacturing.

Also Read – PM Vidhyalaxmi Scheme

What is Employment Linked Incentive Scheme?

Employment Linked Incentive (ELI) Scheme is made to support employment generation across all sectors in India, with special attention to the manufacturing sector. This scheme has two main parts – one part gives benefits to new employees, and the second part supports employers who hire new people and keep them in jobs for a long time.

The goal is to create over 3.5 crore new jobs across the country. Out of this, around 1.92 crore people will be first-time employees. The government will spend a total of ₹99,446 crore to run this scheme successfully and help as many people as possible.

Employment Linked Incentive Scheme – Eligibility

For Employee

- One -month EPF wage up to ₹15,000 in two parts is payable after 6 months and 2nd installment will be payable after 12 months of service and completion

- Employers get up to ₹3,000/month per new employee for 2 years.

- Money is sent directly to employer’s PAN-linked account via Direct Benefit Transfer (DBT).

- A part of the incentive will be kept in a deposit/savings account, helping you learn to save money for the future.

For Companies (Employer)

- You must be a registered employer with EPFO

- You must hire new employees

- At least 2 new employees if you have less than 50 workers

- At least 5 new employees if you have 50 or more workers

- New employees must be kept for at least 6 months

- Monthly salary of new employees must be ₹1,00,000 or less

Employment Linked Incentive Scheme – Benefits

- One -month EPF wage up to ₹15,000 in two parts is payable after 6 months

- 2nd installment will be payable after 12 months of service and completion of a financial literacy programme by the employee.

How Does the Scheme Work?

STEP 1: For First-Time Employees (Part A)

If you are joining a job for the first time and are registered with EPFO, you will receive a one-time incentive. You can get up to ₹15,000 in two parts. The first part is given after you complete 6 months of work, and the second part is given after 12 months along with a small training on financial literacy.

To help you build savings, a part of this money will be kept safely in a savings account and you can withdraw it later. This part of the scheme will help around 1.92 crore first-time employees like you get support in the beginning of their career.

STEP 2: For Employers Hiring New Workers (Part B)

If you are an employer, you will get money support from the government for hiring new workers. This is for all sectors, but manufacturing companies will get more benefits for a longer time. You must hire and keep at least 2 new workers (if your company has less than 50 workers) or 5 new workers (if you have 50 or more employees) for at least 6 months.

For every new worker you hire and retain for 6 months, you will get the following incentives every month for 2 years:

The incentive structure will be as under:

| EPF Wage Slabs of Additional Employee | Benefit to the Employer (per additional employment per month) |

| Up to ₹10,000* | Up to ₹1,000 |

| More than ₹10,000 and up to ₹20,000 | ₹2,000 |

| More than ₹20,000 (up to salary of ₹1 Lakh/month) | ₹3,000 |

For companies in the manufacturing sector, these payments will continue for 3rd and 4th year as well. This step is taken to boost job creation and growth in factories and industrial work.

The payment will be made using Direct Benefit Transfer (DBT). If you are a new employee, your money will be sent to your Aadhaar-linked bank account using Aadhar Bridge Payment System (ABPS). For employers, the money will be sent to the PAN-linked bank account.