Atal Pension Yojana (APY) helps people, especially those working in the unorganized sector, save money for their retirement. If you are between 18 and 40 years old and do not pay income tax, this scheme is a simple way to plan your future pension.

This scheme encourages you to contribute small amounts regularly. When you turn 60, you receive a guaranteed monthly pension to support your life. This plan is excellent if you don’t have a formal pension from your job.

Overview of Atal Pension Yojana (APY)

Here are the main points about the Atal Pension Yojana:

- Started by the Government of India in May 2015.

- Focuses on workers in the unorganized sector who do not have regular pension plans.

- Managed by the Pension Fund Regulatory and Development Authority (PFRDA).

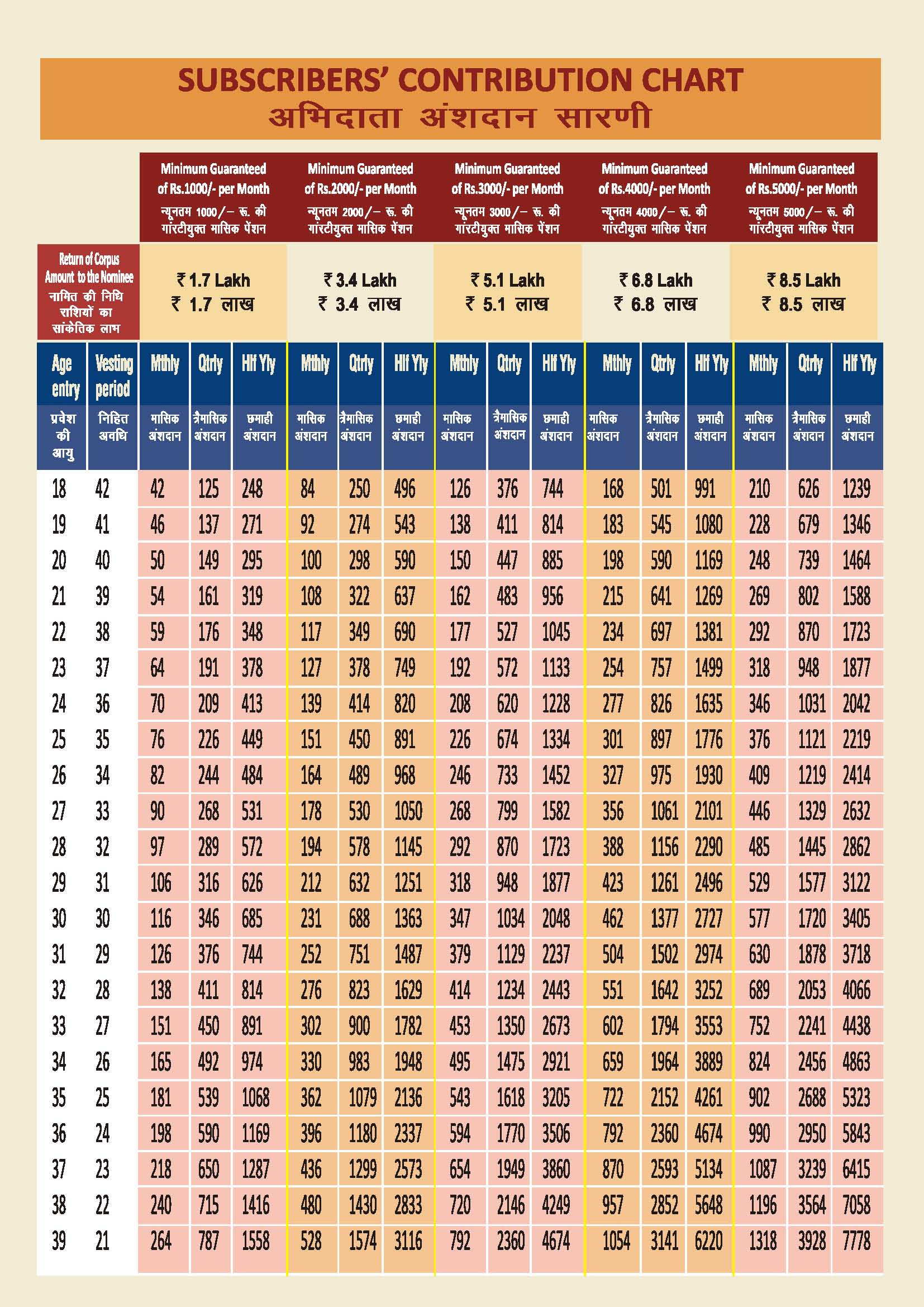

- Offers a fixed pension from ₹1,000 to ₹5,000 per month, depending on your monthly contribution.

- Who can join? Indian citizens aged 18 to 40 years with a savings bank account.

- Must contribute for at least 20 years to receive pension starting at 60 years.

- The government helps by adding 50% of your contribution or ₹1,000 per year (whichever is less) for five years.

- You cannot withdraw money early, except if you pass away or have a serious illness.

- This scheme is made to give financial security to people in jobs without formal pension benefits.

Atal Pension Yojana 2025 Summary

| Scheme Name | Atal Pension Yojana (APY) |

| Launched By | Government of India |

| Managed By | Pension Fund Regulatory and Development Authority (PFRDA) |

| Start Date | May 2015 |

| Target Group | Workers in unorganized sector |

| Objective | Provide pension benefits to unorganized sector workers |

| Age Limit for Joining | 18 to 40 years |

| Required | Savings bank account |

| Guaranteed Pension | ₹1,000 to ₹5,000 per month (based on contributions) |

| Minimum Contribution Period | 20 years |

| Government Contribution | 50% of contribution or ₹1,000 per year, whichever is less, for five years |

| Age to Start Pension | 60 years |

| Withdrawal | Allowed only after 60 years or in case of death/terminal illness |

Atal Pension Yojana Chart 2025

Who Can Join Atal Pension Yojana?

- You must be an Indian citizen between 18 and 40 years old.

- You need a savings bank account to start contributing.

- Contributions happen through auto-debit monthly, quarterly, or half-yearly from your bank account.

- You keep contributing until you turn 60, then you start receiving pension.

Who Cannot Join?

- People who have paid income tax from 1st October 2022 cannot join APY.

Advantages of Atal Pension Yojana

- Fixed pension: You get ₹1,000 to ₹5,000 every month after 60 years.

- Pension for spouse: After your death, your spouse also receives the same pension amount until their death.

- Nominee benefits: After both you and your spouse pass away, your nominee receives your pension savings.

- Tax benefits: Contributions qualify for tax deduction under section 80CCD(1).

How To Apply For Atal Pension Yojana?

Option 1: Online through Net Banking

- Log in to your bank’s internet banking.

- Search for APY on the dashboard.

- Fill in your details and add nominee information.

- Agree to auto-debit contributions from your account and submit.

Option 2: Through Official Website

- Visit https://enps.nsdl.com/eNPS/NationalPensionSystem.html and select “Atal Pension Yojana”.

- Click on “APY Registration”.

- Fill in your basic details and complete KYC using one of these methods: offline XML upload of Aadhaar, OTP on mobile linked to Aadhaar, or virtual ID.

- After filling details, an acknowledgment number will be generated.

- Choose your pension amount and contribution frequency.

- Fill in nominee details and proceed to eSign via Aadhaar OTP.

- After successful OTP verification, your APY registration is complete.

- You can also join digitally through the e-APY portal or bank websites that offer APY.

Need Help? Contact

Helpline Number: 1800-110-069 (Toll Free)

FAQs About Atal Pension Yojana

What is Atal Pension Yojana?

It is a government pension plan for workers in India’s unorganized sectors. It gives a fixed pension based on how much you pay monthly.

Who can join?

Indian citizens aged 18 to 40 years with a savings bank account can join. Income taxpayers are not eligible.

How long must I contribute?

You need to pay for at least 20 years to get pension benefits at 60 years.

How much pension will I get?

Guaranteed from ₹1,000 up to ₹5,000 monthly based on your contributions.

Does government contribute?

Yes, government adds 50% of your contribution or ₹1,000 per year (whichever is less) for five years if you are eligible.

What if I miss paying?

Late payments have penalties:

– ₹1 per month if contribution up to ₹100.

– ₹2 per month if contribution ₹101-₹500.

– ₹5 per month if contribution ₹501-₹1,000.

– ₹10 per month if contribution above ₹1,001.

Accounts freeze after 6 months of missed payment and close after 12 months.

When will pension start?

Once you turn 60 years old.

Can Swavalamban subscribers join?

Yes, eligible Swavalamban subscribers can transfer to APY.

Start securing your future now with Atal Pension Yojana, and enjoy a steady pension after retirement.