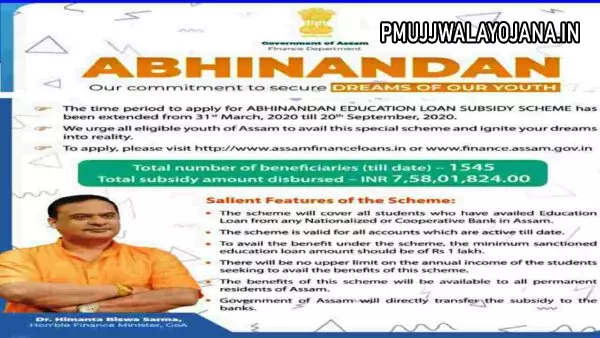

Abhinandan Education Loan Subsidy Scheme 2025 is a helpful program by the Assam Government to support students who want to pursue higher education but face money problems. Through this scheme, the government offers a subsidy of Rs. 50,000 to students taking education loans. This guide explains who can apply, benefits, and simple steps to apply online for the Abhinandan Education Loan Subsidy Scheme 2025.

Overview of the Abhinandan Education Loan Subsidy Scheme

This scheme helps students from Assam who want higher education but find it hard to afford because of money issues. The government gives Rs. 50,000 as a subsidy on education loans taken from banks. It aims to make studying easier by lowering loan burdens. The scheme started on 4th September 2020 and has helped thousands of students so far.

Why was the Abhinandan Scheme started?

The main aim of the Abhinandan Education Loan Subsidy Scheme is to support students who cannot afford expensive college fees. Assam’s Chief Minister has taken steps to offer free or affordable education to bright students from poor backgrounds. This helps many young people get better education and supports Assam’s growth with more skilled people.

Main Details About the Scheme

| Name | Abhinandan Education Loan Subsidy Scheme |

| Launched By | Chief Minister of Assam |

| Who Can Benefit | Students pursuing higher education |

| Main Benefit | Rs. 50,000 subsidy on education loan |

| Official Website | https://www.assamfinanceloans.in/subsidy/welcome |

Benefits of the Abhinandan Education Loan Subsidy

The biggest benefit of this scheme is the Rs. 50,000 subsidy given on the educational loan amount. This helps students reduce the amount they need to pay back to the bank. Many students have already received this help from the Assam government. The scheme was also introduced earlier, in 2016, and continues to support new applicants.

Who Can Apply? Eligibility Criteria

- You must be a permanent resident of Assam.

- You should have taken an education loan from any Scheduled Commercial Bank or Regional Rural Bank in Assam.

- The bank must be approved by the Reserve Bank of India.

- There is no income limit to apply for the scheme.

- The loan must have been approved before 31st March 2019.

- Your education loan amount should be Rs. 1,00,000 or more.

- Your loan account must not be marked as Non-Performing Asset (NPA).

- For loans given since 1 April 2019, you become eligible after disbursing 25% of the approved amount.

- If you have already received benefits from the Bidya Lakshmi Scheme, you cannot apply.

Who Can’t Apply for This Scheme?

- If your loan repayments are overdue beyond a certain time, you won’t qualify.

- Loans declared as NPA (more than 90 days overdue) are not eligible.

- Beneficiaries of the Bidya Lakshmi Scheme (started in 2017) are excluded.

- Government employees who got loans under the Bidya Lakshmi Scheme are not eligible here.

How to Apply Online for the Abhinandan Education Loan Subsidy Scheme

Apply for the subsidy by following these easy steps:

- Go to the official website: https://assam.gov.in/assam-abhinandan-education-loan-subsidy-scheme.

- Click the “Apply” button on the page.

- The online application form for Abhinandan Education Loan Subsidy Scheme 2025 will open.

- Fill in details such as your name, father’s name, date of birth, address, mobile number, PAN card, and bank details.

- Upload required documents like loan proof, address proof, and PAN card photo.

- Submit the form to finish your application.

- After approval, Assam Government will add the Rs. 50,000 subsidy directly to your education loan account.

Stay updated with official news for any new information on the Assam Education Loan Subsidy Scheme. This scheme is a great chance for students from Assam who want to study without worrying much about loan payments.