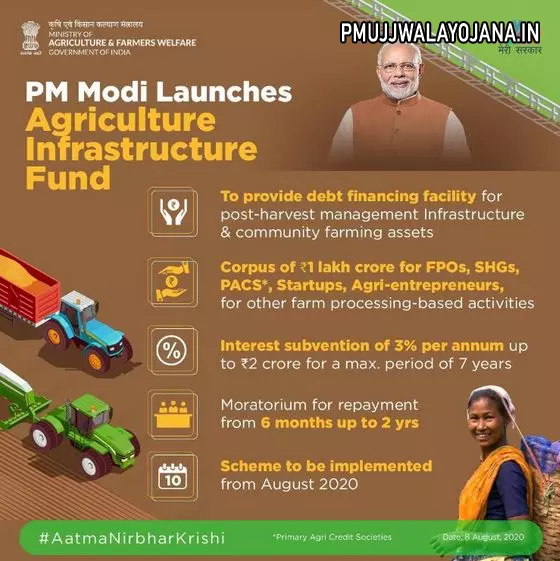

The Agriculture Infrastructure Fund Scheme 2025 is a government scheme aimed at helping farmers, agri-entrepreneurs, startups, and related groups improve agricultural infrastructure across India. This scheme provides financial support and loans to develop post-harvest management facilities and community farming assets. If you’re working in agriculture, this scheme can help you build better storage, processing, and supply chain facilities to increase your income.

Overview of Agriculture Infrastructure Fund Scheme 2025

About 58% of India’s population relies on farming and related activities, but many farmers have small landholdings and low income. To support them, the government offers this scheme, providing long-term loans for projects that improve infrastructure like warehouses, cold storage, processing units, and logistics. The fund aims to strengthen the entire agricultural supply chain and improve farmer earnings.

Goals of the Scheme

This scheme helps farmers and agri-entrepreneurs invest in useful projects for post-harvest management and community farming assets by providing financial support and incentives. It encourages economic growth by raising farmers’ living standards and promoting independence.

Main Details of the Agriculture Infrastructure Fund Scheme

| Scheme Name | Agriculture Infrastructure Fund Scheme 2025 |

| Launched By | Government of India |

| Beneficiaries | Farmers, Agri-entrepreneurs, Startups, Cooperative Societies and others |

| Objective | Support Infrastructure Development for Agriculture |

| Official Website | https://agriinfra.dac.gov.in/ |

Main Features of the Scheme

- Provides a loan amount of Rs 1 lakh crore for agriculture infrastructure projects

- 3% interest subvention per annum up to Rs 2 crore loans

- Credit guarantee coverage up to Rs 2 crore with fees paid by government

- Supports post-harvest management and community farming infrastructure

- Loan repayment period up to 7 years including moratorium of 6 months to 2 years

- Financial assistance extended to various agricultural groups and entrepreneurs

- Loan eligibility includes multiple projects at different locations

- Interest subvention valid for a maximum of 7 years

When Will the Scheme Be Implemented?

- Active from 2024-25 to 2032-33 financial years

- Loan disbursement planned over 6 years

- Rs 4000 crore loans already sanctioned in 2020

- Remaining Rs 96,000 crore will be disbursed in upcoming years

- Rs 16,000 crore planned for disbursement in 2024-25

- Maximum loan repayment duration is about 7 years

Components of the Scheme

- Interest subvention cost: 3% per year for loans up to Rs 2 crore for 7 years

- Credit guarantee cost: Loan coverage up to Rs 2 crore with government paying guarantee fees

- Administrative cost of PMU: Support for building projects through the Project Management Unit

Which Projects Are Eligible?

Post-Harvest Management Projects

- E-marketing and supply chain services

- Warehouses and silos

- Sorting, grading, pack houses, and assaying units

- Cold storage and ripening chambers

- Primary processing centers and logistics facilities

Community Farming Asset Projects

- Organic inputs and biostimulant production

- Smart and precision agriculture infrastructure

- Supply chain for crop clusters including export clusters

- Government promoted PPP projects in farming and post-harvest areas

Who Can Get Loans?

- Primary Agricultural Credit Societies

- Marketing Cooperative Societies

- Farmer Producer Organizations (FPOs) and their federations

- Self-help groups and joint liability groups

- Agri-entrepreneurs, startups, and cooperative federations

- Central, state, and local government agencies running agriculture projects

- Agricultural Produce Market Committees (APMCs) operating markets

Number of Projects Allowed Per Entity

- Loans with interest subvention up to Rs 2 crore allowed per project location

- Entities can apply for multiple projects at different locations, each eligible loan up to Rs 2 crore

- Private entities are limited to 25 projects maximum under the scheme

- No limit for government agencies or cooperative federations

- APMCs may apply for multiple projects within their market area, each with eligible loan

Participating Financial Institutions

- Scheduled Commercial Banks

- Scheduled Cooperative Banks

- Regional Rural Banks

- Small Finance Banks

- Non-Banking Financial Companies (NBFCs)

- National Cooperative Development Corporation

How Is the Scheme Monitored?

- National, state, and district committees check progress and provide feedback

- Geotagging of assets on the online portal for clarity

- Government reviews after Rs 20,000 crore disbursement to make improvements

Who Can Apply for the Agriculture Infrastructure Fund Scheme?

- Farmers and Farmer Producer Organizations

- Marketing Cooperative Societies and Multipurpose Cooperatives

- Agri-entrepreneurs and Startups

- Joint Liability Groups and Self-Help Groups

- Government agencies running agriculture projects

Documents Needed for Application

- Bank loan application or customer request letter for AIF loan, filled and signed

- Passport size photos of promoters or partners

- ID proof (Aadhaar, PAN, Voter ID, Driving License)

- Address proof (electricity bill, property tax, registration certificates)

- Proof of registration (certificate of incorporation or firm registration)

- Income tax returns and audited balance sheets (if available)

- GST certificate if applicable

- Land ownership documents (title deed, lease deed)

- KYC documents of promoters

- Bank statements of last year

- Loan repayment history

- Net worth statement

- Detailed project report and permissions from local authorities

How to Register for the Scheme

- Visit the official agriculture infrastructure fund website

- Click on “Beneficiary” then select “Registration”

- Enter your name, mobile number, Aadhaar number and click on “Send OTP”

- Verify the OTP you receive on your phone

- Fill in the required details and submit the form

- You will get a beneficiary ID via SMS

- Login with beneficiary ID to fill the loan application and upload needed documents

- Submit the application and wait for approval

How to Login to the Scheme Portal

- Go to the official website

- Click on “Login” on the homepage

- Enter your login details and access your account

Check Eligible Projects

- Visit the official website and click on “Eligible Projects” to see supported infrastructure options

Find Fund Allocation Details

- On the homepage, click “Fund Allocation” to see how funds are distributed

Find Lending Institutions and Interest Rates

- Click on “Lending Institutions” on the homepage

- Select “Eligible Institution” or “Interest Rates” to get information

Contact Information

- Use the “Contact Us” page on the official website for support and questions