Overview of a PRAN Card

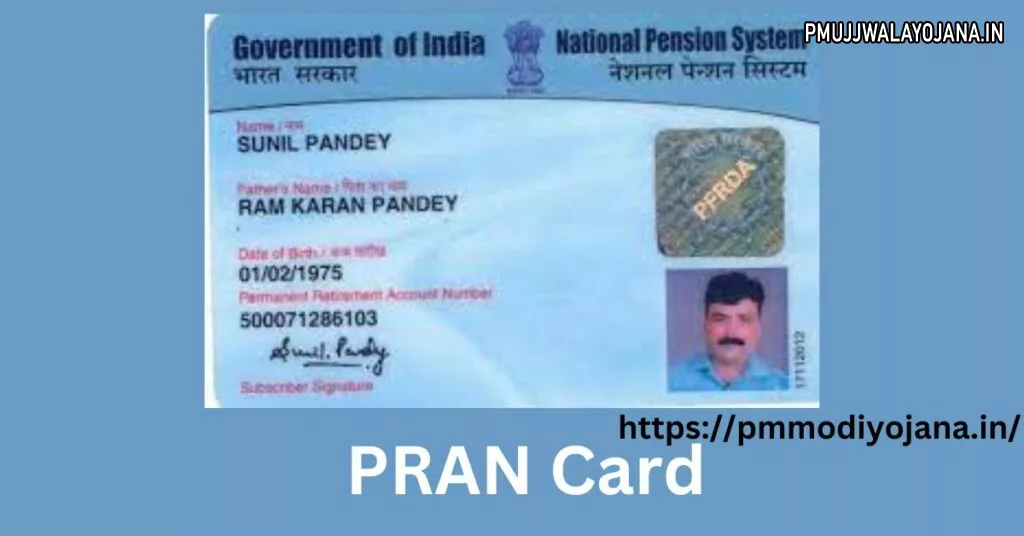

A PRAN Card is an important document linked to the National Pension System (NPS) started by the Indian government in 2004. It stands for Permanent Retirement Account Number and is a unique 12-digit number given to every NPS subscriber. This card helps you save money for your retirement through regular yearly contributions, which earn returns based on market performance.

Initially, NPS was only for government employees, but now, workers from all sectors can join. To take part, you need to have a Permanent Retirement Account, which means applying for a PRAN card.

Main Details About PRAN Card

| Name | PRAN Card |

| Full form | Permanent Retirement Account Number |

| How to Apply | Online and Offline |

| Who Should Get It | State and Central Government Employees (and other sectors) |

| Official Website | https://nsdl.co.in/ |

How to Apply for a PRAN Card in 2025?

You can apply for your PRAN card either online or offline. Both methods are simple and easy to use.

Applying Offline

1. Visit a Point of Presence (PoP) authorized by NPS.

2. Fill out the NPS Application Form (Annexure S1), which works as the PRAN card application.

3. The form asks for your personal and employment details, nominations, scheme choices, and a declaration for the Pension Fund Regulatory and Development Authority (PFRDA).

4. Submit the filled form to the authorized person at the PoP.

Applying Online

The National Securities Depository Limited (NSDL) runs the online platform for NPS. Visit their website to start your application.

You can apply using either your PAN number or Aadhaar number.

Using PAN for PRAN Application

- You must have a bank account with a bank registered for KYC verification.

- The bank will verify your identity during registration.

- Your name and address should match the bank’s records.

- Fill in your details online, upload scans of your PAN card, a cancelled cheque, your photo, and your signature.

- Make your initial contribution through the payment link provided.

- Choose to eSign the form or print it and send it by post to the Central Recordkeeping Agency (CRA).

- Your contributions are credited within two days of payment.

Using Aadhaar for PRAN Application

- Verification happens through an OTP sent to your Aadhaar-linked mobile number.

- Your application form will fill automatically with basic details from your Aadhaar data.

- Fill in the remaining details, upload your signature, and make your payment online.

Documents Needed for PRAN Application

- PAN Card

- Aadhaar Card

- Cancelled cheque copy

- Scanned signature

- Photograph

- Passport (needed only for NRIs)

How to Print Your e-PRAN Card?

Once your PRAN is generated, you can print it yourself or get a physical copy delivered:

- Log in to your NPS account on the NSDL website.

- Select “Print e-PRAN” to download or print your PRAN card.

- You also have the option to request a printed card couriered to your address.

Your PRAN card is needed to manage your pension account and for submitting any claims after retirement.

Checking PRAN Card Dispatch Status

After submitting your complete registration form, your PRAN card is usually sent within 20 days to the relevant nodal office.

You can:

- Contact your nodal office directly for updates.

- Or track your PRAN card status online via the NPS-NSDL website by entering your PRAN number and captcha.

How to Activate Your PRAN Card?

Activation is easy if you choose online e-signing:

- Go to the “eSign / Print and Courier” section on the NSDL website.

- Click the “eSign” option.

- An OTP will be sent to your Aadhaar linked mobile number for verification.

- Enter the OTP to activate your PRAN card.

- After successful verification, you will get a confirmation. A small activation fee may apply.

Start your PRAN card application today and secure your retirement fund easily through the National Pension System.