Understanding Grahak Seva Kendra and CSP Online Registration – If you’re wondering how to open a Grahak Seva Kendra (Customer Service Center) and want to know the process for CSP online registration, you’re in the right place. In this article, you’ll get to know what a Grahak Seva Kendra is, how to start one, and the steps for online registration. Running a Grahak Seva Kendra can be a great business where you can earn money and gain respect in your community.

Overview of Grahak Seva Kendra

Before we get into the details, let’s explain what CSP stands for. CSP means Customer Service Point. Opening a Grahak Seva Kendra is easy and doesn’t require advanced education. Basic computer skills are enough. CSP works like a small bank, especially in villages where banks are not nearby, so rural people get simple access to banking services. This service was started by Prime Minister Narendra Modi to bring banking to remote rural areas. If you’re interested in the banking field, opening a Customer Service Point is a good option.

How to Start a Grahak Seva Kendra?

You can open a Grahak Seva Kendra by following one of these two simple methods:

Through a Bank

If you want to start a Grahak Seva Kendra, first visit the bank where you want to set up your center. Meet the bank manager and share your plan. The manager will ask about your qualifications and investment. If everything is good, you’ll get permission to open the center. The bank will give you a username and password to manage your CSP. You may also get a loan of ₹1.5 lakh to start your center.

Through a Company

You can also get in touch with companies that help set up Grahak Seva Kendra centers. Many companies like Vyam Tech, FIA Global, Oxigen Online, and Sanjivani offer CSP services. Be sure to research and check these companies to avoid scams.

Income from Grahak Seva Kendra

By running a Grahak Seva Kendra, you can earn around ₹25,000 to ₹30,000 each month. Banks pay commissions for different services you provide. For example, Bank of Baroda offers these commissions:

- ₹25 for opening a bank account using an Aadhaar card

- ₹5 for linking a bank account with an Aadhaar card

- 0.40% commission per transaction for deposits and withdrawals

- ₹30 annually per account for Pradhan Mantri Jeevan Jyoti Bima Yojana

- ₹1 annually for Pradhan Mantri Suraksha Bima Yojana

Popular Grahak Seva Kendras

Some well-known centers include PNB Grahak Seva Kendra, BOB Grahak Seva Kendra, and SBI Grahak Seva Kendra.

Online Steps to Open SBI Grahak Seva Kendra

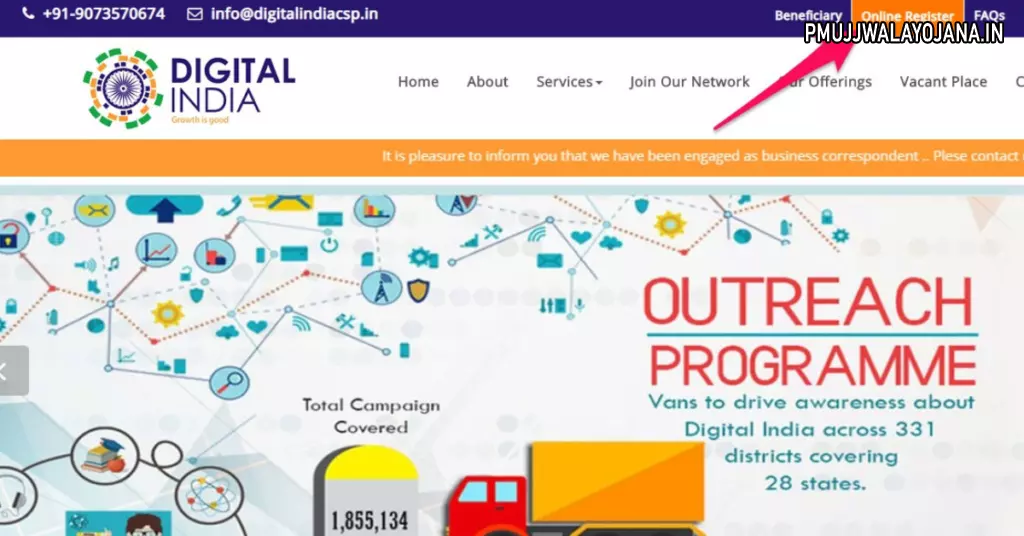

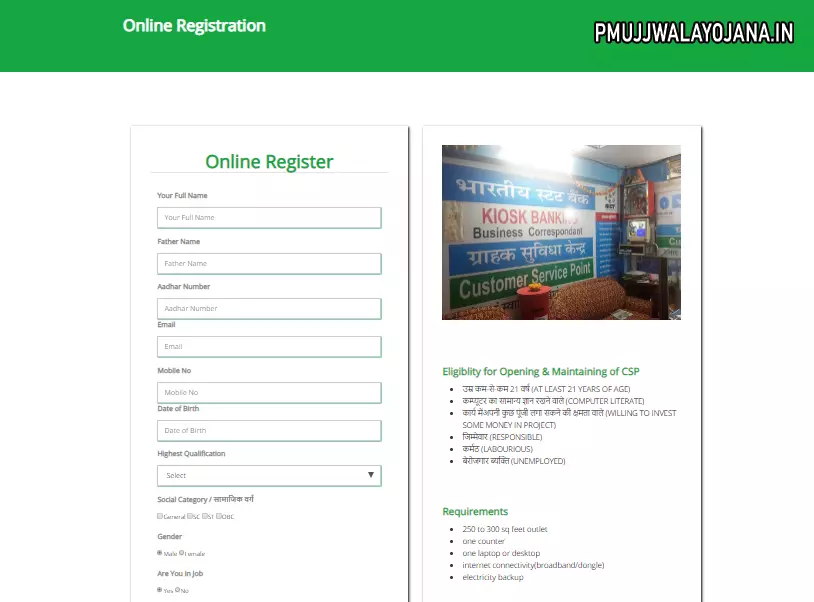

You can open a Grahak Seva Kendra by registering online through the Digital India CSP website. Follow these steps if you want to start an SBI center:

- Go to the Digital India CSP website.

- On the homepage, you’ll find details about eligibility and the qualifications needed for a CSP.

- Find the “Online Registration” option at the top of the page.

- Click on it to open the registration form.

- Fill in your details carefully and submit the form.

After submitting, registration usually takes 15 to 20 days to complete.

Services You Can Offer at Grahak Seva Kendra

Here are the main services you can provide at your Grahak Seva Kendra, similar to bank services:

- Opening new bank accounts

- Linking Aadhaar card with bank accounts

- Linking PAN card with bank accounts

- Depositing money into customers’ accounts

- Withdrawing money from customers’ accounts

- Issuing ATM cards to customers

- Fund transfers

- Providing insurance services

- Fixed Deposit (FD) and Recurring Deposit (RD) services

Contact Information:

Digital India Oxigen Private Limited

1137, R.G. Towers, Above arrow Showroom,

Bangalore-560038, Karnataka, India

Email: Info@digitalindiacsp.in

Phone: +91 9073570674