E-Passbook Facility – The Post Office Savings Bank (POSB) now offers an electronic passbook service to its customers. This new development was introduced by the Government of India (GoI) in 2025. According to a notice from the post office, the e-passbook facility has been established to improve and simplify digital services for account holders of small savings schemes starting from 12.10.2024. With this updated service, customers who have savings accounts in the Post Office will be able to access their passbooks online. In this article, we will explore the details of the e-passbook and guide you on how to use this innovative service.

What Is E-Passbook

Thanks to a new initiative from the government, account holders now have access to an e-passbook. This announcement was made by Devusinh Chauhan, a representative from the Union’s Ministry of State for Communication. Customers registered under the Post Office Small Savings Scheme can access their account details without needing internet banking or mobile access. Key features include checking balances and retrieving mini to full statements. The e-passbook service is available to account holders at no extra charge by logging in with their registered mobile numbers.

The Hon’ble Prime Minister Shri @narendramodi Ji emphasizes that technology should streamline services for citizens. In alignment with this vision, the ‘e-passbook facility’ has been launched for Post Office Savings Bank (POSB) schemes today. pic.twitter.com/vdOfaw7PdA — Devusinh Chauhan (@devusinh) October 12, 2024

Highlights of E-Passbook Facility

| Facility Name | E-Passbook |

| Year Launched | 2025 |

| Initiated By | Government of India |

| Primary Benefits | Online service access |

| Eligible Users | Savings account holders in POSB |

| Official Website | www.indiapost.gov.in |

Objectives Behind the E-Passbook Launch

The e-passbook service was introduced to offer customers a more convenient way to access their banking information. Once the service is fully operational, customers will be able to check their passbooks online through the Post Office Savings Bank. Hence, it is referred to as the e-passbook.

Indira Gandhi National Old Age Pension Scheme

Features of E-Passbook Facility

The e-passbook facility comes with various features:

- Account holders can check the current balances of all their National Savings Scheme accounts using an inquiry function, similar to net banking or mobile applications.

- Mini Statements: Account holders can now access mini statements for their Sukanya Samriddhi Accounts, Post Office Savings Accounts, and Public Provident Fund Accounts. There are plans to expand this service to more public schemes. Users can view the last 10 transactions and download their mini statements in PDF format.

- Full Statements: Comprehensive statements will be made available. Customers will have the ability to generate bank records for specific date ranges.

Benefits of the E-Passbook Facility

- The primary advantage of the electronic passbook is that account holders no longer need to visit the post office to access their passbooks or check their account balances. This can be done conveniently from home.

- Account holders can access their passbooks at any time, from anywhere, and under any circumstances.

- To use the e-passbook, the only requirement is a registered mobile number with the service, making it unnecessary to possess banking credentials for internet or mobile banking applications.

Eligibility and Required Documents for E-Passbook

- To be eligible for the e-passbook, one must simply have a Post Office Savings Bank account.

- A registered mobile number is the only document needed to enjoy the benefits of the e-passbook.

How to Check PPF and SSY Balance Using the E-Passbook Facility

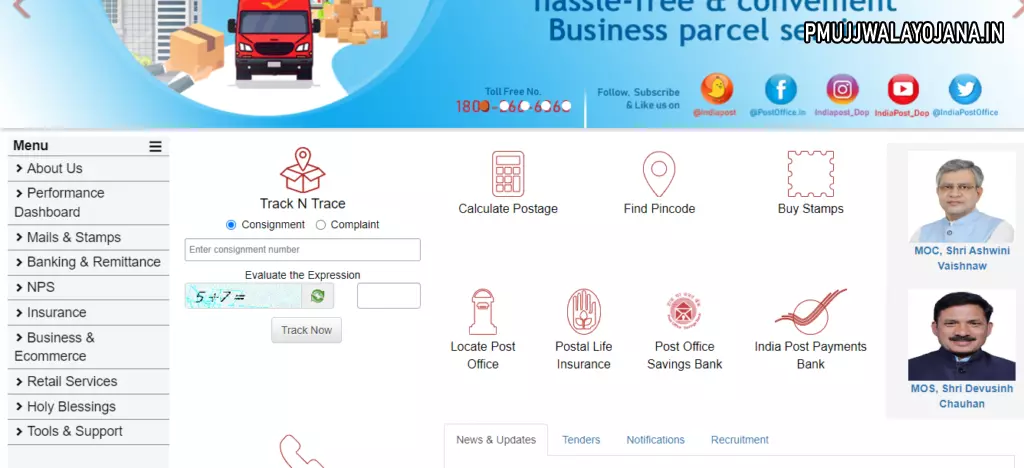

- Visit the India Post website or the IPPB website to find the link to access your electronic passbook.

- Enter your registered mobile number and click on the “Login” button.

- Enter the OTP sent to your mobile and click “Submit.”

- Upon login, a dashboard will be displayed.

- Select the “e-Passbook” option from the menu.

- Choose your scheme, enter your account number and mobile number, then click “Continue.”

- After entering the One-Time Password (OTP) sent to your phone, click the “Verify” button.

- Choose one of the following options:

- Balance inquiry

- Mini statement

- Full statement

- You can view and download the mini or full statement as required.

Note: If your mobile number is not linked to your account, the system will show an error message. To resolve this, visit the relevant department to link your mobile number with your account.