Thinking of buying property in Tamil Nadu? It’s important to understand the Tamil Nadu Guideline Value 2025 before you make your purchase. This value tells you the government’s set minimum price for property registration and protects you from paying too much or too little stamp duty. Let’s look into what it is, how it works, and how you can check it easily online.

What is Tamil Nadu Guideline Value in 2025?

The guideline value, also known as the circular rate, is the minimum price fixed by the government for a property. It’s used for registration and calculating stamp duty. Usually, it’s lower than the market price but acts as a base to prevent tax avoidance. The government decides this value based on factors like neighborhood development, past sales data in the area, and the locality.

This value affects your property purchase because the registrar will check if the property is undervalued. If the price declared is below the guideline value, officials will ask for payment based on the higher guideline amount.

In cities and towns, guideline values are often given per square foot for developed land or per acre for agricultural land. In 2025, the Tamil Nadu government has set specific rates for different areas and roads to keep pricing consistent across the state.

Recent Update on Tamil Nadu Guideline Value

On 3rd January, the Tamil Nadu government released the combined guideline values for properties on about three lakh roads and streets across the state. Chennai alone has guideline values for nearly 1.5 lakh streets. For example, the highest rate is ₹28,500 per square foot near the Boat Club area.

- A 1,000 sq ft flat on St Mary’s Road, Mylapore has a guideline value of ₹15,000 per sq ft, so registration fee is ₹13 lakh (7% of the total value).

- In North Chennai’s Muthialpet region, rates are set at ₹16,500 per sq ft.

- Tambaram suburbs have lower rates starting from ₹3,800 up to ₹6,000 per sq ft.

These updates bring clarity and help buyers know the legal minimum amount expected for property sales and registration.

Difference Between Guideline Value and Market Value

- Market value is the price agreed on by buyers and sellers based on demand and supply.

- Guideline value is fixed by the government and is usually lower than the market price.

- Market value can change often; guideline values change only when the government updates them.

- In Tamil Nadu, guideline value is used as a standard to calculate stamp duty and registration fees.

Why Is Tamil Nadu Guideline Value Important Before You Buy?

- It sets a legal minimum price to prevent stamp duty evasion.

- Registration officers check this value to confirm your property’s declared price is fair.

- Knowing the guideline value helps you negotiate better and avoid fraud.

- It decides how much stamp duty and registration fees you need to pay on your property.

If you’re planning to sell property, it also gives you an idea of fair pricing based on government guidelines.

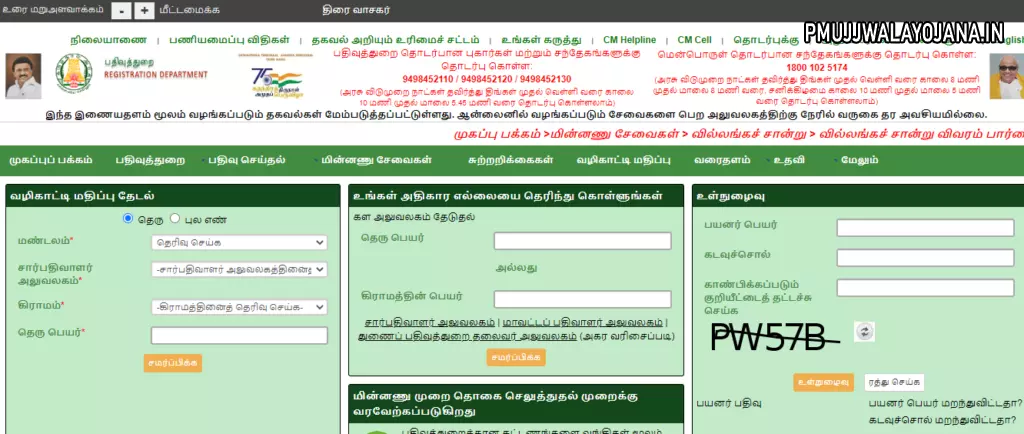

Check Your Property Guideline Value Online Through TNREGINET

You can easily check Tamil Nadu’s guideline value online for free by visiting the TNREGINET official website. There are two easy ways to check:

- By entering the street name or property address

- By entering the survey number, along with village and zone details

Steps to check the guideline value:

- Go to TNREGINET’s official portal.

- Look for the “Guideline Search” box on the homepage.

- Enter the survey number, zone, and village for your property or select the street name and registration office.

- Submit the details and see the guideline per square foot or per acre for your property.

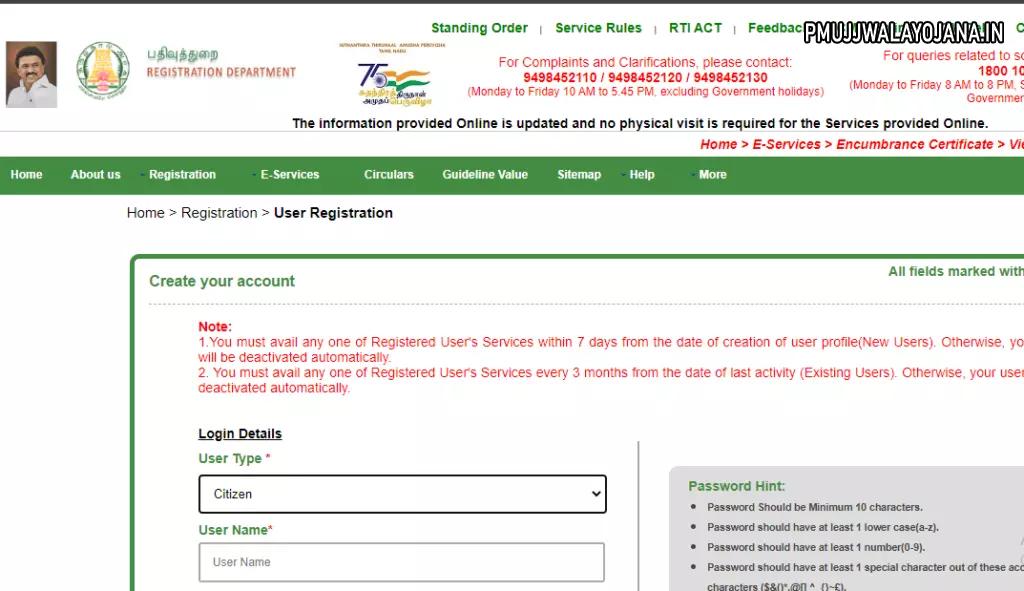

How to Register and Log In on TNREGINET Portal

- Visit the TNREGINET website and click on “User Registration” from the menu.

- Choose your user type: citizen, document writer, or lawyer.

- Create a username and password following the site rules.

- Fill in your personal details like state, district, postal code, address, and mobile number.

- Verify with OTP and complete your registration.

After registering, use your username and password to log in. Enter the captcha code shown to access details related to property records, registrations, and more.

Impact of Tamil Nadu Guideline Value on Real Estate

If the guideline value is much lower than the market price, many buyers might declare prices below market value to avoid higher stamp duty. This causes two problems:

- Illegal money movement: Cash deals happen for the difference between declared and actual market value, which helps launder black money.

- Loss to government revenue: The state loses money in stamp duties and registration fees when values are underreported.

To reduce these risks, the government often updates guideline values to better reflect market prices.

Factors Affecting Tamil Nadu Property Guideline Values

The government sets different guideline values by considering:

- Type of property (commercial, residential, agricultural)

- Neighborhood development and infrastructure

- Past sales data in the area

- Location within the city or town (like Chennai, Coimbatore, etc.)

For example, in Chennai, guideline values range from ₹40 per sq ft in some areas up to ₹23,500 per sq ft in premium locations.

Recent Changes in Tamil Nadu Property Guideline Value (2024-25)

- Since 2017, no major updates were made till 2020.

- On June 12, 2020, the government reduced guideline values by about 33% to boost real estate deals, especially in rural areas where prices were higher than market rates.

- To recover revenue, registration fees for certain deeds involving non-family members were raised from 1% to 4%.

- Buying below the updated guideline value helps you save on stamp duty but could trigger Long Term Capital Gains tax if you sell later.

Knowing these updates will help you make better choices when buying or selling property in Tamil Nadu.