Looking for an easy way to calculate your earnings from the Mahila Samman Savings Certificate? The Mahila Samman Savings Certificate Calculator 2025 can help! This calculator is made just for women investors across India who want to see how much interest they can earn from this government-backed savings scheme.

Overview of the Mahila Samman Savings Certificate Scheme

The Mahila Samman Savings Certificate Scheme is a special savings plan started by the Government of India through the Department of Economic Affairs under the Ministry of Finance. The scheme began on April 1, 2023, and runs until March 31, 2025. It encourages women to save money safely while earning a good interest rate.

Right now, the interest rate is 7.5% per year. This means any money you invest will grow steadily over the two-year term, making it a smart option for women looking for safe and profitable investments.

Main Goal of the Mahila Samman Savings Certificate Scheme

The main goal of this scheme is to offer women a risk-free way to save money while earning higher interest than regular savings accounts. It’s open to all women, including married women, widows, and women with disabilities. You can invest any amount starting from INR 1,000 up to INR 2 lakh.

This plan helps women take charge of their finances, encouraging the habit of saving and planning for the future.

Quick Overview of Mahila Samman Savings Certificate Scheme

| Scheme Name | Mahila Samman Savings Certificate Calculator |

| Launched By | Government of India |

| Launch Date | April 1, 2023 |

| Announced By | Prime Minister of India |

| Who Can Apply? | Female citizens of India |

| Minimum Deposit | INR 1,000 |

| Maximum Deposit | INR 2,00,000 |

| Interest Rate | 7.5% per year |

| Term | 2 years |

| Application Process | Online and offline |

Who is Eligible?

- Must be a permanent resident of India.

- Must be a female citizen.

- For minor girls, parents or legal guardians can apply on their behalf.

Main Benefits of the Mahila Samman Savings Certificate Scheme

- Safe investment with no risk of losing the deposited amount.

- Attractive interest rate of 7.5% per annum, higher than many savings accounts.

- Short 2-year maturity period, great for women seeking short-term investment options.

- Encourages women to build a habit of saving money regularly.

Investment Limits

- Minimum investment starts at INR 1,000 and must be in multiples of 100 rupees.

- Maximum investment limit is INR 2,00,000 under the scheme.

Interest Rate Details

- Fixed interest rate of 7.5% per annum for the entire scheme duration.

Maturity and Withdrawal Rules

- The scheme matures after 2 years, and you can withdraw the full balance including interest.

- After completing 1 year, you may withdraw up to 40% of the eligible balance before maturity.

- For minor girls, guardians can apply for withdrawal with the proper documents.

- Any fraction of rupees will be rounded off during withdrawal calculations.

Premature Account Closure

The account can be closed before the 2-year maturity only in certain cases:

- If the account holder passes away.

- When the account holder faces serious hardship like a life-threatening illness or death of guardian, with proper proof.

- Premature closure after six months is allowed for valid reasons, with the interest rate reduced by 2% from the scheme’s rate.

How to Use the Mahila Samman Savings Certificate Calculator

This easy calculator shows you how much money you will have at the end of the term based on your deposit, interest rate, and time period. The scheme uses simple interest to calculate the maturity amount.

Simple Interest Formula

- P = Principal amount (your deposit)

- R = Interest rate per year (%)

- T = Time in years

Maturity Amount Calculation

- Simple Interest (SI) = (P x R x T) / 100

- Maturity Amount (A) = P + SI

Example:

If you deposit ₹2,00,000 for 2 years at 7.5% interest:

- Simple Interest = (2,00,000 x 7.5 x 2) / 100 = ₹30,000

- Maturity Amount = ₹2,00,000 + ₹30,000 = ₹2,30,000

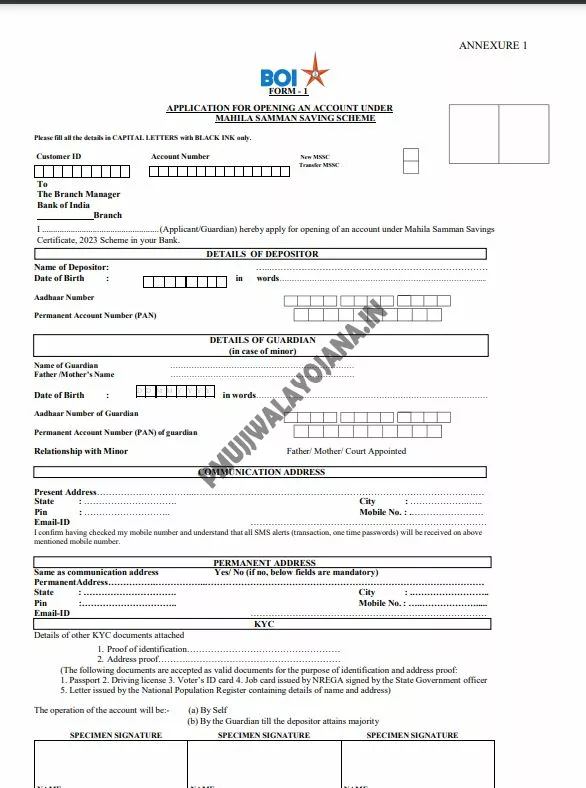

How to Apply for the Mahila Samman Savings Certificate

Step 1: Visit the official website or your nearest bank branch to get the application form.

Step 2: Fill out the form with all required details and attach necessary documents like your Aadhaar card and bank account proof.

Step 3: Submit the form along with your initial deposit to the bank official for processing.

Download Application Form

Step 1: Go to the official website.

Step 2: Click on “Download Forms” on the homepage.

Step 3: Select “Account Open Form” to download your application form.

Contact Information

- Toll-Free Numbers: 1800 103 1906, 1800 220 229

- Landline: (022) 40919191 (Chargeable, available 24×7)

- Email: cgro.boi@bankofindia.co.in

Frequently Asked Questions

Who runs the Mahila Samman Savings Certificate Scheme?

It is managed by the Department of Economic Affairs under the Ministry of Finance, Government of India.

Who can apply for this scheme?

Only women who are Indian citizens can apply.

What is the minimum deposit under this scheme?

The minimum amount you can invest is INR 1,000.

Feel free to use the Mahila Samman Savings Certificate Calculator 2025 to plan your investments and watch your savings grow safely and surely!