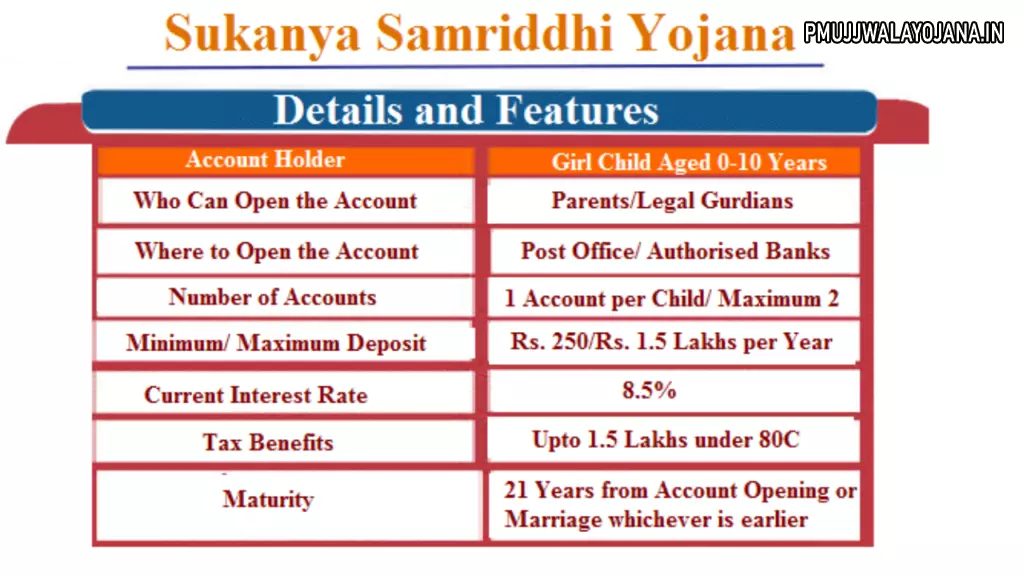

Sukanya Samriddhi Account opening form download and a simple guide on how to open SSY account online with documents required, updated interest rate, and online payment method for 2025. The Indian Government supports the Sukanya Samriddhi Yojana (SSY), a savings scheme made just for girls. You can open this account in your girl child’s name until she turns 10 years old.

Overview of Sukanya Samriddhi Yojana (SSY)

Sukanya Samriddhi Yojana (SSY) encourages parents or guardians to save money for their girl child’s education and marriage. It is part of the government’s Beti Bachao – Beti Padhao campaign which supports girl child empowerment.

You can open SSY accounts at Post Offices or certain banks authorized by the government. Besides helping you save, SSY offers tax benefits under Section 80C up to Rs 1.5 lakh and gives a higher interest rate than many other small saving schemes.

LIC Kanyadan Policy

Who Can Open a Sukanya Samriddhi Account?

- A natural or legal guardian can open an SSY account for their girl child from birth up to 10 years of age.

- Account must be in the girl child’s name only.

- A guardian can open a maximum of two accounts for two girl children.

- For twins or a third girl child in a family, one more account (third) can be opened.

Main Features of Sukanya Samriddhi Account

- Interest rate is 7.6% per annum (effective July 1, 2024 to September 30, 2024).

- Minimum deposit per year is Rs. 250.

- Maximum deposit allowed yearly is Rs. 1.5 lakh.

- Flexible monthly or yearly deposits are allowed with no limit on the number of deposits.

- Tax benefits under Section 80C for deposits up to Rs. 1.5 lakh per year.

- Deposits can be made for 15 years from the date of account opening.

- Account matures after 21 years from the opening date.

- When the account matures, the girl child can withdraw the full accumulated amount with interest by submitting identity and address proofs.

Documents Needed to Open an SSY Account

- Birth certificate of the girl child

- Photo ID of the parent or guardian

- Address proof of the parent or guardian

- Photographs of both the child and parent/guardian

Steps to Open Sukanya Samriddhi Account

- Fill the account opening form completely.

- Submit required documents and photographs.

- Make the initial deposit (minimum Rs 250 or as specified).

- After opening, you can deposit using cash, cheque, or demand draft.

| Maximum Accounts | 2 accounts for two girls; 3 accounts if twins or third girl child |

| Deposit Limits | Minimum Rs 250 initially, Max Rs 1,50,000 per year |

| Account Duration | 21 years from opening date |

| Interest Rate | 7.6% for Q2 FY 2024-25 |

| Tax Benefits | Under Section 80C of Income Tax Act, 1961 |

How to Open a Sukanya Samriddhi Account?

You can open a Sukanya Samriddhi Account at any Post Office or participating bank by following these steps:

- Visit the bank or post office branch.

- Fill the application form with correct details and attach necessary documents.

- Deposit the initial amount between Rs 250 and Rs 1.5 lakh.

- The bank/Post Office will process your application and open your account.

- A passbook will be issued to you to keep track of your SSY account.

How to Fill the Post Office Sukanya Samriddhi Form?

- Write the Post Office branch name clearly.

- Mention your existing Post Office saving account details if any.

- Address the form “To The Postmaster” with branch and postal address.

- Paste the applicant’s (girl child’s) photo on the right side.

- Write applicant’s name after “I/We” and mention Sukanya Samriddhi Yojana.

- Leave specific boxes blank that apply only to new PO savings accounts.

- Choose the account holder type as advised by the Post Office staff.

- Fill the deposit amount both in words and numbers.

- Select payment mode (cash, cheque or demand draft) and write related details if applicable.

- Fill personal details like name, gender, Aadhaar, PAN, address etc.

- Sign on the form confirming correctness after reading.

- Fill nomination details and dates as required.

- If illiterate, get signatures from two witnesses.

Can I Open Sukanya Samriddhi Account Online?

Currently, you cannot open a Sukanya Samriddhi Account online. You need to visit the bank or post office in person to apply.

Where to Register for Sukanya Samriddhi Yojana?

SSY accounts are opened at Post Offices or banks that take part in the scheme, such as:

- State Bank of India

- Allahabad Bank

- Andhra Bank

- Punjab and Sind Bank

- Bank of Baroda

- Canara Bank

- Bank of India

- Bank of Maharashtra

- Corporation Bank

- Central Bank of India

- Indian Overseas Bank

- Dena Bank

- Indian Bank

- UCO Bank

- Syndicate Bank

- United Bank of India

- Punjab National Bank

- Union Bank of India

- Oriental Bank of Commerce

- IDBI Bank

- Vijaya Bank

- Axis Bank

- ICICI Bank

How to Pay for Sukanya Samriddhi Yojana Online?

You can pay your SSY account online using the IPPB (India Post Payments Bank) app:

- Transfer money from your bank account to the IPPB account.

- Open the IPPB app and choose Sukanya Samriddhi Yojana under DOP Products.

- Enter your DOP customer ID and SSY account number.

- Set the duration and amount of payment installments.

- IPPB confirms once your payment plan is set up.

- You get a notification each time a payment is made.

Which Bank is Best for Opening SSY Account?

All the banks listed above let you open an SSY account. Choose the bank where you already have an account for easier access and convenience.

How to Submit Sukanya Samriddhi Yojana Documents?

- Visit the bank or Post Office where you opened the account with original documents.

- Submit a copy of the girl child’s birth certificate.

- Provide identity and address proof of parent or guardian.

- If multiple girls were born at once, provide a medical certificate.

- Any other documents requested by the branch.

Sukanya Samriddhi Yojana Interest Calculator

Interest is calculated monthly on the minimum balance from the 5th to the end of the month but credited once at fiscal year-end.

Formula:

A = P(1 + r/n) ^ nt

Where:

- P = Principal amount deposited

- r = Annual interest rate

- n = Number of times interest is compounded per year

- t = Number of years

- A = Maturity amount

How Often Can You Invest in Sukanya Samriddhi Yojana?

You can deposit money yearly or monthly in installments. A minimum Rs 250 deposit each year is required for 15 years to keep the account active. There is no limit on the number of deposits per year or month.

How Does Sukanya Samriddhi Yojana Work?

To withdraw, submit the withdrawal form and passbook at the bank or Post Office branch where the SSY is held. Premature withdrawal before maturity (21 years) is allowed only for higher education or marriage expenses from age 18 onwards.

The account can be closed early after 5 years if the account holder dies, or if the guardian dies, or for serious illness of the account holder.

How to Open Sukanya Samriddhi Account at Post Office?

- Find the nearest Post Office.

- Fill the application form properly.

- Submit the form with necessary proofs.

- Pay the initial deposit by cash, demand draft, or cheque.

- Get the passbook after setting up the account.

How to Transfer Sukanya Samriddhi Yojana Account?

- Visit the Post Office branch where your SSY account is held.

- Inform them that you want to transfer the account.

- Submit your passbook, account transfer form, and KYC documents.

- After closure at the Post Office, visit the new bank branch to open the transferred SSY account.

What Amount Will You Get from Sukanya Samriddhi Yojana?

The return depends on your yearly deposits and interest rates. After the girl child turns 18, you can withdraw 50% of the deposit for education or marriage. The full amount with interest is payable at maturity.

How to Check Sukanya Samriddhi Account Balance?

You get a passbook after opening your SSY account. Visit your bank or Post Office branch to check the latest balance shown in the passbook.

Can I Download Sukanya Samriddhi Yojana Statement Online?

Not all banks provide online SSY statement access. Check with your bank if online account login is available. Use credentials given by the bank to access balance and statements through online banking.

FAQs on Sukanya Samriddhi Account

What is the minimum deposit to open SSY account? Minimum Rs. 250 to start.

When was Sukanya Samriddhi Yojana launched? Launched on January 22, 2015.

Which department manages SSY? Ministry of Women and Child Development.

Are tax benefits available? Yes, under Section 80C of Income Tax Act, 1961.