The IGRS Rajasthan and Epanjiyan Rajasthan portals provide essential services related to real estate, such as property registration, assessment, stamp duty, and various transaction rules. This article explains how to access and effectively use these citizen services available through the IGRS website.

What is IGRS Rajasthan?

The Inspector-General of Registration and Stamps (IGRS Rajasthan) oversees the management of taxes from real estate transactions to support state development. The Ajmer office of IGRS Rajasthan offers an array of services, while the Epanjiyan portal manages property registrations and other related tasks. This article will delve deeper into the citizen services offered through e-Panjiyan, including how to download records related to the Rajasthan Registry.

E Dharti Portal – Apna Khata Rajasthan

Objectives of IGRS Rajasthan

The IGRS Rajasthan platform aims to achieve the following goals:

- Implement the provisions of the Registration Act of 1908.

- Revamp state laws associated with stamp regulations.

- Provide a transparent, efficient, and user-friendly system.

- Boost the state’s revenue via stamp duties and registration fees.

- Access IGRS services through www.epanjiyan.nic.in.

Epanjiyan Rajasthan Services

Services offered on the Epanjiyan platform include:

- Property valuation

- Document-specific fees & rebates

- DLC rate information

- E-Inspection/Search e-Panjiyan

- Online appointment scheduling

- Track CRN/document status

- Details of land disputes

- Guidelines for obtaining a draft sale deed via e-registration

Epanjiyan: How to Check Property Valuation

To find the official value of your property using the Epanjiyan website (epanjiyan.nic.in), follow these steps:

- Select “property value” on the left menu of the Epanjiyan website.

- Enter your phone number and captcha code, then choose “Fresh value” or “Modify valuation.”

- Input necessary information, such as the type of property and document category related to the sale deed.

- Provide details like the Tehsil, district, and SRO.

- Complete additional property details, and the valuation will be displayed. You can save the property details by clicking “save property details.”

- Obtain your Citizen Reference Number (CRN) by entering the challan number along with the OTP sent to your registered mobile.

- If you need to amend a finalized document, use your CRN and request an OTP.

IGRS Rajasthan – Epanjiyan Document Fees and Rebates

For comprehensive details regarding stamp duty and property registration fees in Rajasthan, visit the official Epanjiyan Rajasthan website. The stamp duty rates typically differ for men and women, ranging from 3% to 6%.

IGRS Rajasthan – Epanjiyan DLC Rate Overview

The District Level Committee (DLC) rate establishes the minimum property value for sales including plots, apartments, and land. To check these rates, visit the IGRS Rajasthan website and click on the DLC pricing link. Keep updated on the rates via this link: DLC rates (old). Select your district to view specific rates.

In the recent budget presentation for 2024-2025, Chief Minister Ashok Gehlot announced a 10% reduction in the DLC rates. Additionally, he reduced the registration fee for apartments worth up to Rs. 50 lakhs from 6% to 4%.

Documents Required for Property Registration

- Copy of sale deed as proof of ownership.

- Lease deed for terms exceeding one year.

- Release deed for ancestral property evidence.

- Property map.

- PAN card.

- Form 60.

- Recent photograph.

- Supporting property documents.

IGRS Rajasthan – Steps to Register Property

To register your property through the e-Panjiyan portal, follow these steps:

- Visit the official Epanjiyan Rajasthan website.

- On the homepage, navigate to the ‘Property Valuation’ section.

- Enter the captcha and your mobile number, then choose “Fresh Valuation.”

- Fill in property details like location, district, and document type.

- Provide additional property details such as area and address.

- Select the commission, and the property value will display on your screen. Save the property details for your reference.

- Proceed to calculate stamp duty on the Registration and Stamps Department page.

- Ensure you pay the stamp duty and registration fees, as well as any applicable surcharges or penalties.

- Complete the party information, including details of the parties involved in the transaction.

- Upload all required documents to the e-Panjiyan website and finalise your submission.

- Pay your fees through the e-GRAS portal: eGRAS.

- Designate a time slot for your visit to the Sub Registrar’s office.

- Use your CRN number and the OTP received on your registered mobile for entry.

- On the appointment day, visit the Sub Registrar’s office with your fee receipt and CRN number for verification.

- If manual payment is chosen, make the payment in cash or check to complete the registration process.

Online Appointment Booking with Epanjiyan

- To schedule an appointment for document registration, visit https://epanjiyan.nic.in/stepin/booking.aspx.

- You’ll need to input various details including district, sub-office, preferred date and time for your appointment, along with your CRN and OTP.

IGRS Rajasthan: e-Stamp Verification

- Log on to the E-Panjiyan Rajasthan portal and select the ‘E-citizen’ page to verify e-Stamp services.

- Follow the prompts to proceed with verification.

- Choose state name, certificate number, stamp duty type, issue date, and other relevant information to complete verification.

- Stay informed about the status of your documents through the portal by using CRN or document number.

IGRS Rajasthan: Land Dispute Details

- Check land dispute information on the Epanjiyan website by selecting the Land Dispute Details link on the left menu.

- Choose your district to view the list of disputes available.

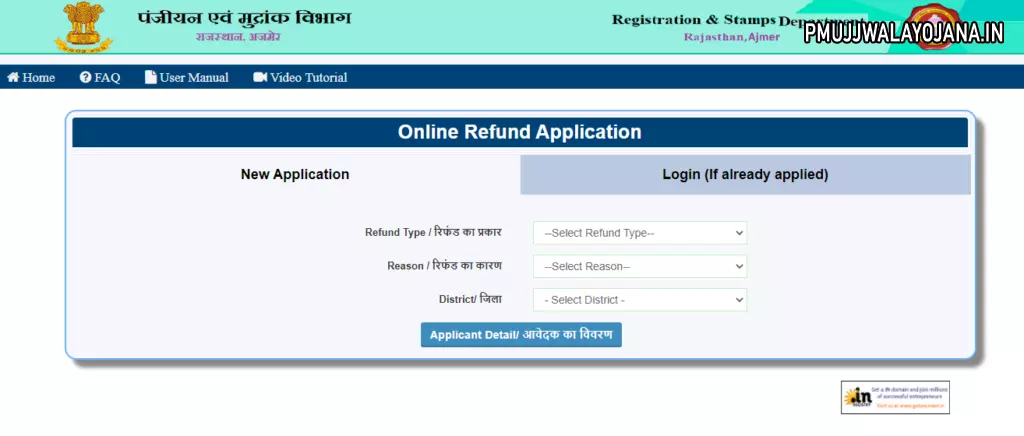

Online Stamp Refund via Epanjiyan Rajasthan

- Navigate to the “Citizen Area” on the primary Epanjiyan Rajasthan website.

- Select the “Online Refund Application” to proceed with your refund details.

- Choose the type of refund: stamp duty, registration fee, or both.

- Specify the reason for the refund from a dropdown menu; reasons can include misused stamps or stamps not executed due to various reasons.

- Fill in your details and submit as required.

- If you’ve previously applied for a refund, log in to check the application status using required credentials.

IGRS Rajasthan: Grievance Filing

- File complaints through IGRS Rajasthan using available tools in the Sampark facility. Follow these steps:

- Visit the official IGRS Rajasthan website.

- Access the E-citizen tab and navigate to “Grievance”.

- Submit your complaint through the “Lodge your Grievance” link, as seen in the interface.

- Maintain accurate records of your complaint for future reference.

Important Points:

- Provide clear information about your complaint; include supporting documents and contact details.

- Prior complaints can also be mentioned.

- Note your grievance number for tracking purposes.

- Complaints regarding RTI will not be entertained.

- For further assistance, contact Rajasthan Sampark at 181 or email at rajsampark@rajasthan.gov.in.

Epanjiyan: PAN and Aadhaar Authentication

- Follow the procedure on e-Panjiyan for verifying PAN and Aadhaar on the appointment day, by presenting the fee receipt and CRN at the SRO.

Benefits of IGRS Rajasthan for Citizens

The IGRS Rajasthan platform significantly enhances convenience, saves time and effort for citizens, and encourages safer real estate transactions. The e-Panjiyan portal also ensures greater transparency by allowing access to crucial property-related information from anywhere.

Benefits of IGRS Rajasthan for Officials

IGRS Rajasthan enables officials to manage grievances more effectively. The streamlined process helps minimize the time spent on disputes and allows them to focus on providing solutions.

Epanjiyan Contact Details

If you need assistance, reach out to the Registration & Stamps Department:

Nodal Officer: Sh. Sunil Bhatia, Joint Director (Computer)

IG, Registration & Stamps Dept, Head Office, Ajmer

Phone: 0145-2971208

Mobile: 8209786099

FAQs

What is e-stamping? E-stamping is a digital method to pay non-judicial stamp duty. Where can I find the list of sub-offices on the IGRS Rajasthan website? After logging in, navigate through the E-Citizen tab to view the sub-registrar list. Can I pay land tax through IGRS Rajasthan? Payments of taxes must go through the e-GRAS portal.