Good news if you’re looking to buy land or property in Tamil Nadu! You can now easily find the Guideline Value of Land Tamil Nadu 2025 on the official website tnreginet.gov.in. This is very helpful for anyone living in Tamil Nadu and planning to buy property.

How to Check Guideline Value of Property in Tamil Nadu

Just visit the tnreginet.gov.in portal, the official website that provides all property-related information for Tamil Nadu residents. To find the property’s guideline value, all you need is the street name and survey number of the land or building. This online service saves you both time and effort.

Understanding Guideline Value of Property in Tamil Nadu

The guideline value shows the minimum price the government sets for property in specific areas to prevent undervaluation. The Tamil Nadu state government sets this rate. Checking it online helps buyers make better decisions when buying property.

Apart from property value, tnreginet.gov.in also offers services like applying for marriage certificates, death certificates, and more for residents of Tamil Nadu.

Quick Facts About Guideline Value of Property in Tamil Nadu

| Scheme Name | Guideline Value of Property Tamil Nadu |

| Launched By | Tamil Nadu State Government |

| Purpose | Check guideline value of property |

| Beneficiaries | Citizens of Tamil Nadu |

| Official Website | tnreginet Portal |

Benefits of Using Guideline Value Service Online

- Check your property’s guideline value anytime on the official website.

- Save the time and trouble of going to the sub-registrar office in person.

- Easily access other government certificates and services online.

- Make smarter property buying choices by knowing fair land prices.

Documents Needed to Use the Service

- Aadhar Card

- Email ID

- Mobile Number

- Electricity Bill

- Address Proof

- PAN Card

- Passport Size Photo

Step-by-Step Guide to Check Guideline Value by Street and Survey Number

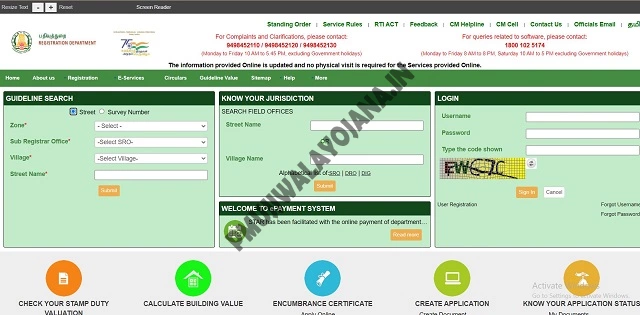

Step 1: Visit the official tnreginet website.

Step 2: Click on the “GUIDELINE SEARCH” option on the homepage.

Step 3: Enter your zone, sub-registrar office, village, and street name as asked.

Step 4: Double-check the details and then click on “Submit” to get the guideline value.

How to Check Your Jurisdiction for Guideline Value

Step 1: Go to the TNREGINET portal.

Step 2: Click on “KNOW YOUR JURISDICTION” on the homepage.

Step 3: Enter your street or village name and press “Submit” to see the jurisdiction details.

How to Calculate Building Value on TNREGINET Portal

Step 1: Visit the TNREGINET portal.

Step 2: Scroll down and click on “Calculation of Building Value.”

Step 3: Select building type, zone, age of building, and period, then submit.

Step 4: The building value will appear on the screen.

Why Guideline Value is Important

- Helps you understand if the property price is fair.

- Used to calculate registration and stamp duty charges correctly.

- Prevents undervaluation of property and fraud.

- Acts as a helpful guide to price properties fairly.

Property Registration Fees in Tamil Nadu

Here are the charges for registration and stamp duty according to TNREGINET:

| Document Type | Stamp Duty | Registration Fee |

|---|---|---|

| Sale or Purchase Document | 7% of market value | 4% of market value |

| Donation Document | 7% of market value | 4% of market value |

| Transaction | 7% of max property value | 4% of max property value |

| Compensation Mortgage | 1% of loan amount (max Rs. 40,000) | 1% of loan amount (max Rs. 10,000) |

| Independent Mortgage | 4% of loan amount | 1% up to max Rs. 2,00,000 |

| Selling Agreement | Rs. 20 | 1% of transaction amount (if independent) |

| Building Contract Agreement | 1% of contract amount | 1% of contract amount |

| Cancellation Document | Rs. 50 | Rs. 50 |

| Partition Between Family Members | 1% of market value per component (max Rs. 25,000) | 1% per component (max Rs. 4,000) |

| Partition Among Non-Family | 4% of market value of component | 1% of market value of component |

| Public Authority Sale Document | Rs. 100 | Rs. 10,000 |

| Public Authority Sale Document (per family member) | Rs. 100 | Rs. 1,000 |

| Other Public Authority Document | Rs. 100 | Rs. 50 |

| Public Authority (with Transfer Amount) | 4% per transaction | 1% of transfer amount or Rs. 10,000 (whichever is higher) |

| Title Document Handing Over | Max Rs. 30,000 (0.5% of loan amount) | Max Rs. 6,000 (1% of loan amount) |

| Release Deed Between Family Members | 1% of market value (max Rs. 25,000) | 1% of market value (max Rs. 4,000) |

| Release Deed Among Non-family | 7% of market value | 1% of market value |

| Leasing Up to 30 Years | 1% for additional lease amount | Max Rs. 20,000 for 1% lease amount |

| Leasing Up to 99 Years | 4% for additional lease amount | Max Rs. 20,000 for 1% lease amount |

| Leasing Over 99 Years | 7% for additional lease amount | Max Rs. 20,000 for 1% lease amount |

| Trust Document (No Property) | Rs. 180 | 1% of Corpus Fund |

Need Help?

If you have any questions or need support, you can email helpdesk[at]tnreginet[dot]net.

Common Questions

Where can I check the Tamil Nadu Guideline Value of Property 2025?

Go to tnreginet.gov.in to check the guideline value online.

What info do I need to check the guideline value?

Just your street name and survey number are enough to check online.

Who can use the tnreginet.gov.in services?

Anyone who is a permanent resident of Tamil Nadu can use this portal and benefit from it.